The Central Bank of Nigeria has continued its march towards erasing the effects of years of murky image. Online payment systems are proving a good chance for the apex bank to clean up. The CBN and its partners are creating more and more opportunities to make online payments more secure, inclusive and instant.

As noted in the recently released 2023 report on the State of Inclusive Instant Payment Systems (SIIPs), the bank has strengthened its efforts in protecting end-users, boosting consumer confidence in digital retail payments, and promoting service provider value propositions. AfricaNenda, in collaboration with the CBN, the United Nations Economic Commission for Africa, and the World Bank, produced the annual report on SIIPS.

Join our WhatsApp ChannelREAD ALSO:

- Digital Transactions Expand In Africa As Regional Payment Systems Widen

- Talk To CBN Through Your Bank: What Do You Feel About Nigeria’s Online Payment Systems?

- Talk To CBN Through Your Bank: What Do You Feel About Nigeria’s Online Payment Systems? (Part 2)

As we have explained in the previous digital payment series, Inclusive Instant Payment Systems (IIPS) facilitate retail transactions through digital payments within and across a network of licensed payment providers, primarily banks. These systems aim to offer equal opportunities for all end-users, promoting inclusivity in retail payments. Utilizing open-loop and multilateral interoperability, users have access to a wide range of payment options across various channels.

The system operates 24 hours a day in near real-time, allowing for instant transactions. It is based on the concept of digital public infrastructure (DPI), which aims to facilitate inclusive and secure payments globally. DPI often involves collaboration between governments and the private sector to provide front-end and back-end systems. These systems serve as the ‘rails’ for digital transactions, connecting people, businesses, and governments throughout the economy. As the World Bank has assured: “DPI comprises front-end and back-end systems, provided by the government or in partnership with the private sector, which together serve as ‘rails’ that enable digital transactions and connections for people, businesses, and governments throughout the economy.”

The 2021 report had reported an initial lull in the uptake of digital payments by both operators and end-users in 2011. The report showed how fast that situation changed in 2012 when most banks in Africa signed into the system, especially in Nigeria. At the close of 2011, only two banks had the nerve to join the system. Just a year later, the scheme had attracted the participation of all 22 commercial banks, all 20 microfinance banks and all six mobile money operators (MMOs) in Nigeria.

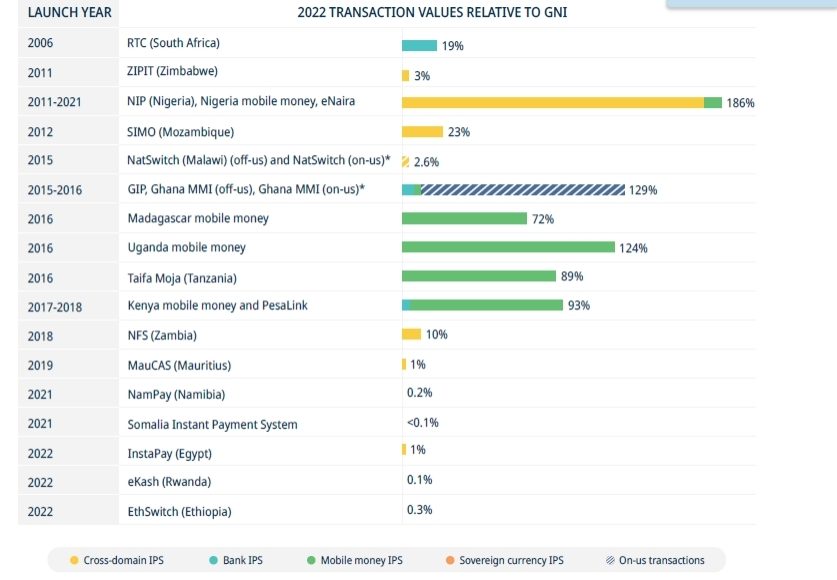

A decade later, the digital payment footprint remains ineffaceably etched in the sands of retail payments in at least 10 countries of Africa. According to the 2023 report: “the instant payment systems are crucial to deepen financial and digital inclusion. In 2022, 32 IPS systems in Africa processed nearly 32 billion transactions worth close to $1.2 trillion. The number of transactions processed has increased rapidly over the past five years, with an average annual growth rate of 47% in transaction volume and 39% in total transaction value. IPS increasingly processes a significant dollar amount as a percentage of gross national income (GNI; Figure 0.2). Nine countries processed IPS values at 10% of GNI or above; three of these processed IPS values in excess of 100% of GNI in 2022: Ghana, Nigeria, and Uganda. Nine countries had IPS values below 10% of GNI.”

Therefore, having not taken security, inclusivity and speed for granted, the SIIPs 2023 report indicates a significant growth in the uptake of digital retail payments by banks and end-users as shown in Figure 1.

Figure 1: 2022 domestic IPS transaction values relative to GNI (n=21)

It is noteworthy, however, that Africa is yet on a march to making IPS on the continent to rival developed countries in becoming a fully operational digital public infrastructure. This is because of the quantum of work needed to assure system sustainability, value for customers, higher promise of value for payment providers, and a strong, operational policy framework.

Work remains in the area of transparency, ease of system use for customers, assurance to the payment service providers of an inclusive system in terms of involvement in rules design, and overall profitability of the system. The service providers also want to be assured of a social support system and values, including “centralized fraud and cyber security facilities, as well as centralized electronic know your customer (eKYC) and customer due diligence (CDD) facilities”.

Government policy implementation must guarantee competitiveness in the industry, open banking, and “continued improvement of the supporting ecosystem: risk-based and harmonized licensing of payment service providers; network upgrades; sustained roll-out of agent networks; increased penetration of smartphones, broadened coverage areas for mobile data, and more affordable data access.”

The report also particularly harped on “building out a principles-based regulatory framework for consumer protection and data privacy, and moving towards risk-based supervision. Emphasis on regional harmonization of policy and regulation for cross-border payments and transfers to enable IPS to catalyze digital.”

Our next article will explore these needs in a bit to highlight the SIPPs landscape in Africa and the journey ahead in the coming years.

Dr Mbamalu, a Jefferson Fellow and Member of the Nigerian Guild of Editors (NGE), is a Publisher and Communications/Media Consultant. His extensive research works on Renewable Energy and Health Communication are published in several international journals, including SAGE.

SMS/WhatsApp: 08094000017

Follow on X: @marcelmbamalu

Dr. Marcel Mbamalu is a communication scholar, journalist and entrepreneur. He holds a Ph.D in Mass Communication from the University of Nigeria, Nsukka and is the Chief Executive Officer Newstide Publications, the publishers of Prime Business Africa.

A seasoned journalist, he horned his journalism skills at The Guardian Newspaper, rising to the position of News Editor at the flagship of the Nigerian press. He has garnered multidisciplinary experience in marketing communication, public relations and media research, helping clients to deliver bespoke campaigns within Nigeria and across Africa.

He has built an expansive network in the media and has served as a media trainer for World Health Organisation (WHO) at various times in Northeast Nigeria. He has attended numerous media trainings, including the Bloomberg Financial Journalism Training and Reuters/AfDB training on Effective Coverage of Infrastructural Development of Africa.

A versatile media expert, he won the Jefferson Fellowship in 2023 as the sole Africa representative on the program. Dr Mbamalu was part of a global media team that covered the 2020 United State’s Presidential election. As Africa's sole representative in the 2023 Jefferson Fellowships, Dr Mbamalu was selected to tour the United States and Asia (Japan and Hong Kong) as part of a 12-man global team of journalists on a travel grant to report on inclusion, income gaps and migration issues between the US and Asia.

Follow Us