Agusto & Co. Warns of Economic Reform Risks

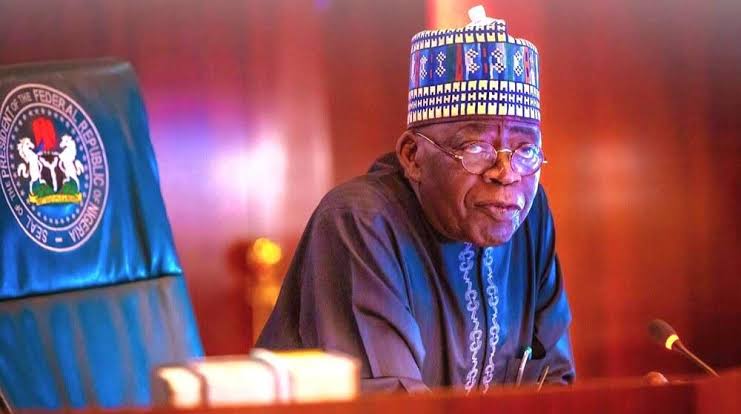

Rating firm Agusto & Co. has raised concerns that the N6.6 trillion supplementary budget and the proposed N70,000 minimum wage might disrupt the economic reforms of the Bola Tinubu administration.

In their latest report, the agency highlighted that these factors could undermine recent efforts to stabilize the economy, particularly in controlling inflation.

Join our WhatsApp Channel“The risk of a renewed inflationary surge is heightened by several factors, including the proposed supplementary budget of N6.6 trillion, increased liquidity from monthly disbursements to the three tiers of government, and the impending implementation of the N70,000 minimum wage,” Agusto & Co. stated in their newsletter published on Friday. “These factors could potentially offset the positive impact of recent policy measures and prolong the disinflationary process.”

Impact on Inflation and Cost of Living

Despite recent reports from the National Bureau of Statistics indicating that inflation had moderated to 33.40% in July, due to a slowdown in food inflation, Agusto & Co. cautioned that this does not mean prices are falling.

Instead, it suggests a slowing pace of price increases, which may not bring immediate relief to citizens.

“The dip in inflation is a welcome respite for Nigerians grappling with a severe cost-of-living crisis,” the report noted.

“However, the relief is tempered by broader economic challenges, including the risk of inflation resurgence due to the supplementary budget and new minimum wage.”

These concerns come amid growing public discontent, as evidenced by recent protests across the country. In early August, hunger protests were held, with citizens demanding the reinstatement of fuel subsidies and reductions in electricity tariffs.

The public’s frustration is seen as a direct response to the rising cost of living, exacerbated by the government’s economic policies.

READ ALSO: Tinubu’s Economic Reforms: A Bold Move Or Reckless Gamble?

Government Measures and Economic Stabilisation

To address the chronic foreign exchange shortage and stabilize the naira, the Central Bank of Nigeria (CBN) has reintroduced the Retail Dutch Auction System (RDAS).

This move allows authorized dealer banks to submit bids on behalf of clients, aiming to create a market-driven mechanism for currency allocation.

“The inaugural auction on August 6th saw $876.6 million allotted to 26 banks at a rate of N1,495 per dollar,” Agusto & Co. reported. “This system is anticipated to facilitate efficient price discovery, aligning the naira’s value more closely with market fundamentals.”

Additionally, the report highlighted Nigeria’s launch of a $500 million domestic dollar bond, expected to boost foreign reserves.

This five-year bond, which offers semi-annual interest payments, is designed to attract both domestic and foreign investors, ultimately strengthening the naira through increased foreign exchange reserves.

Future Projections and Economic Strategy

Looking ahead, Agusto & Co. predicts that the Central Bank may adopt a cautious approach at its next Monetary Policy Committee meeting.

Given the subdued GDP growth in Q1 2024 and rising borrowing costs, the CBN might maintain its current policy rate to observe inflation and exchange rate trends.

“CBN Governor, Olayemi Cardoso, hinted at potential rate cuts in the future if inflationary pressures continue to ease,” the report stated.

“This strategic pause would allow the CBN to assess the impact of recent measures on the economy before making further adjustments to its monetary policy stance.”

In a bid to tackle food inflation, the Federal Government has introduced a new fiscal measure effective from July 15, 2024, to December 31, 2024.

The Nigeria Customs Service will implement zero import duty and VAT exemptions on specific items, including grain sorghum, millet, maize, wheat, beans, and husked brown rice.

These measures are intended to ease the burden on consumers by reducing the cost of essential food items.

Balancing Reforms with Economic Stability

As the Tinubu administration navigates its economic reform agenda, the balance between stimulating growth and controlling inflation remains delicate.

The supplementary budget and minimum wage increase, while aimed at addressing immediate needs, pose significant risks to long-term economic stability. Agusto & Co.’s warning underscores the need for careful management of these reforms to avoid derailing progress toward economic recovery.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

Follow Us