As the Nigerian government takes steps to curb activities of exchange rate manipulators and dollar racketeers, the Securities and Exchange Commission (SEC) has finalized plans to delist the naira from all peer-to-peer cryptocurrency trading platforms.

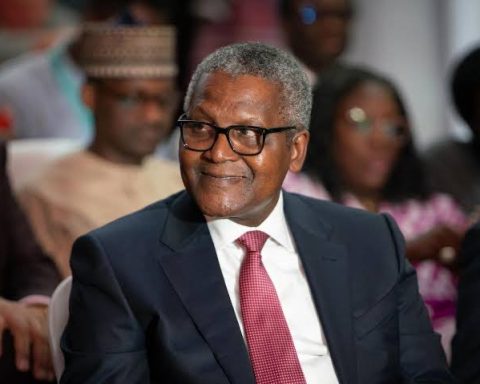

This was made known by the newly-appointed Director-General of SEC, Emomotimi Agama, during a meeting with members of the Nigerian blockchain industry on Monday.

Join our WhatsApp ChannelThe meeting was organised by the Blockchain Industry Coordinating Committee of Nigeria.

Agama, who confirmed that the Federal Government was currently drafting a new set of regulations to govern the crypto sector, said it was geared towards stopping every activity in P2P platforms that manipulates the value of the naira.

READ ALSO:

Since the value of the naira in the foreign exchange market started nosediving, the Federal Government through its agencies, spearheaded by the Central Bank of Nigeria (CBN) has been persistently making efforts to stablise it. This also involves curbing activities of currency speculators in every segment of the economy.

The SEC DG called on the stakeholders in the local crypto community to give the Commission maximum cooperation as the government rolls out the regulations, assuring that all is for the good of the country’s economy.

Speaking to the blockchain industry stakeholders, Agama said:

“We will delist the naira from the P2P platforms to avoid the level of manipulation that is currently happening. I want your cooperation in dealing with this as we roll out regulations in the coming days.”

While emphasising that the meeting was organised to address the concerns regarding activities of crypto P2P traders and their effect on the naira, Agama called on the operators to demonstrate patriotism by “naming and shaming” those involved in sharp practices.

He assured that SEC would continue to work towards providing an enabling environment for fintech to thrive, and urged the operators to reciprocate by doing the right thing.

“We ask with all sense of sincerity that those involved in sharp practices cease. We encourage you to reach out to us by naming and shaming those involved.

“This nation has a future, and this future is dependent on this community. For us at the SEC, our interest is to provide an enabling environment for fintech to thrive, and by so doing; we expect the fintech community to reciprocate by doing the right thing,” Agama said.

While underscoring the need to support innovation in the digital space, especially for fintech, to drive wealth, Agama stressed that they need to explore ways of safeguarding national economic interest.

“We must explore innovative solutions to this problem and strike the right balance between encouraging innovation and safeguarding our national economic interests. This we will do in a friendly and firm manner to enable us to achieve the desired result,” he said.

Prime Business Africa reports that the country’s financial authorities have been taking steps to regulate activities in crypto platforms to ensure that they do not affect the naira negatively.

Recently, the CBN charged Fintech platforms to take steps in ensuring that their customers do not engage in crypto transactions.

Two months ago, Binance, an exchange platform, announced that it will stop naira services. Also, other local exchanges in the country, including OKX, Bitbarter and some platforms under the membership of Stakeholders in the Blockchain Technology Association of Nigeria had stopped naira services in compliance with the government directive.

Also, the CBN last week stopped major fintech firms from onboarding new customers amid an ongoing audit of their Know-Your-Customer process. The level of compliance with KYC process by fintech has been a source of worry by the regulatory authority as there are concerns that improperly documented customers could be involved in money laundering, terrorism financing and other forms of illicit financial transactions.

This directive made major fintech platforms like Opay, Palm Pay, and moniepoint among others to start sending emails to their customers, warning them against trading in cryptocurrency or any virtual currency on their apps. They also threatened to block any accounts found engaging in such activities.

A report released by the Nigeria Inter-Bank Settlement System revealed that fraud losses increased by 496.96 per cent over the past five years, and financial institution customers lost N59.33 billion between 2019 and 2023.

CBN Regulation of Crypto

The CBN prohibited banks and other financial institutions from managing cryptocurrency service provider accounts in 2021. Nevertheless, the banking regulator lifted the prohibition in December 2023. However, new worries about Binance, the biggest cryptocurrency exchange globally, and its peer-to-peer platform operations surfaced in February. These concerns centered around Binance’s price cap on USDT trading. According to the authorities, their actions aided in the naira’s decline in value.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.