Many people have a fearful and esoteric view of the stock market, regarding it as a market more complex than the food markets and shopping malls they shop at every month.

The truth, however, is that the stock market is just like other markets we participate in on daily basis. In fact, I think it’s not more complex than the local food markets we readily patronise.

Imagine going to Balogun market in Lagos and not having a clear idea of what you want to buy and what a fair price is, you’ll most likely buy things you don’t need which will end up being worthless to you and also buying things you need at a price that is higher than you should have paid. That is exactly what people do when they go to the stock market: they buy shares that will soon become worthless and pay exorbitant prices for the good ones.

Join our WhatsApp Channel

Let’s throw out all the confusing and complex perceptions we have regarding the stock market and start from the simple and indisputable truth; that stock market is a market. Yes, the stock market is a market, and like all markets there are buyers and there are sellers.

As much as we like to think there is something advanced and mathematical about the price of shares of companies and tradable securities on the stock market, the truth is that it is just as erratic as the price of food items in the local food market. The price is simply what the last set of buyers were comfortable paying to willing sellers, very much like how the price of onions and beans and plantain and eggs are set.

If there are fewer willing sellers (which you can liken to what happens when filling stations hoard petrol) and lots of people are outbidding one another to be the preferred buyer to the few willing sellers, then the share price shoots up. And similar to the new yam season with farmers harvesting and selling at the same time leading to supply of yam exceeding current market demand, the price falls so as to make it more enticing for buyers to make larger than usual purchases. And that is how the share prices are set, purely a balancing of the supply and demand.

Most of times, you don’t see prices shooting up or falling drastically because on most days the price yesterday is very much the price people feel more comfortable trading at unless they sense a big change coming that will make the company either more valuable or less valuable.

Take Longman Nigeria PLC, one of the oldest publishing houses in Nigeria that started in 1961. Today, they have rebranded as Learn Africa PLC but it’s the same company so I will keep using the more familiar name. If you went to the stock market in 2008 and bought Longman shares, you could be likened to someone buying maize just a few days before the harvest season. The same logic that is clear to us that a harvest season is a big market moving event and prices generally fall as there is a flood of maize and sellers will have to drop prices if they want to entice enough buyers to take up all their quantities on offer for sale.

Similarly, as at 2008 the future was heading straight for online books and online reading culture, which meant less relevance for businesses like Longman that specialised in hard copy books publishing. That effectively represented a big incoming change that was bad for the price/value of Longman shares. And just as we know our mothers to be very market savvy and able to come home with double what most of us come home with from the market at same money spent, a stock market participant should also be aware of the price impacting events that are happening and likely to happen before making any move on a company’s shares.

Sadly, most people don’t want to do any reading and research on a company before buying its shares.

In fact, people do more due diligence when buying a suit or party gown than they do when dealing with the stock market. I am yet to see someone who bought a size 56 suit because his friend bought that same size last month, yet that’s what people do when buying shares – oh, my friend who is a banker bought MTN shares last month, I must also buy some.

READ ALSO: World’s Tech Business Trends

Doing your own thinking and due diligence starts with knowing what really makes up the stock market. To make things a lot easier to grasp, I will focus on just the company shares (excluding commodities, ETFs and bonds) listed on the stock exchange.

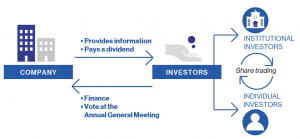

At the core of it all, there is an actual company with staff and revenue that has put it’s shares on the stock market to allow anyone buy and sell their shares. Every year this company reports their business performance showing how much money they made that year and how much they plan to give back to investors as dividends. They also set up investors meetings – annual general meeting – where you get to hear from the company’s management what they are doing and how well the business is doing.

As an individual, you are classified differently from institutional investors like pension fund managers and wealth managers. Ultimately, all classes of investors are selling and buying the company shares. This buying and selling is called share trading.

How then do you purchase from the stock market? Very easy, Just think of an organised market – where sellers and buyers are registered, price of products are centrally displayed for all to see, only goods that meet some base level of quality requirements are allowed to be sold, and everyone pays a small fee to use the market. And you are already very close to what the stock market operates like, only add this one more feature – buyers can also be sellers, you can turn around and sell the very goods you bought in the same market without doing any extra registration or process.

Steps to Profitable Participation in the Stock Market:

1. You research what companies on the stock market are doing very well and very likely to see big positive changes that will make their share price go up.

2. You contact a stockbroking firm to open a brokerage account for you so that you can participate in that modern stock market.

3. Using the brokerage account and the stockbroking firm’s online platform you then buy those shares you have identified as very good and likely to keep rising in value.

4. Whenever you want to sell and take profits you use same online brokerage platform to sell your shares and receive the money in your bank account.

5. You keep doing this again and again, and you become a stock market guru and millionaire.

Follow Us