…Experts Advocate Roundtable Discussion For Suitable Sharing Formula

FOLLOWING controversy between states and federal government of Nigeria over collection of Value Added Tax (VAT), leading to litigation, professionals have said only a roundtable conference between the parties would solve the problem.

Join our WhatsApp ChannelThis expert submission was made during ICAN On Air programme, organized by Institute of Chartered Accountants of Nigeria (ICAN) on Tuesday.

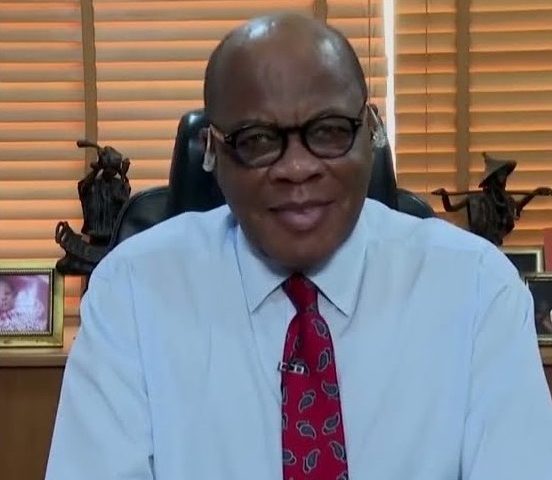

Discussing the topic, “VAT in Nigeria, How it all Started”, former President of ICAN, Dr Emmanuel Ijewere, traced the history of VAT in Nigeria to 1993 when a committee which he was part of, recommended VAT as a replacement for sales tax and was subsequently legalized through enactment of Act No. 102 of 1993.

Federal High Court in Port Harcourt had ruled that Rivers State should be responsible for receiving Value Added Tax and Personal Income Tax (PIT) in the state, not the Federal Inland Revenue Service (FIRS which collects on behalf of the federal government). The case is currently at Suprme Court, where more states from the South and some from the North have indicated interest in joining Rivers State as co-defendants in the suit.

The tax expert said the committee he chaired in the 1990s had said that VAT was suppose to be entirely a state money, but due to complication associated with it in terms of goods moved from state to state (cross-border trade), it recommended a form of compensation between the parties at the end of every month.

Ejewere who stated that VAT cannot work without deploying appropriate technology to drive the exercise, asserted neither was National Assembly the right place to resolve the problem as it is now, without involving experts with technical understanding of the technical issues surrounding it.

He said, “I don’t think NASS can really comprehend what’s on ground now. There is so much technical issues involved here, that you need to put together people with technical understanding of what VAT is.”

He remarked that court judgment will not be a final solution to the VAT controversy, but a system where by states and the central government come to conference table and articulate the format or template for VAT collection to be replicated in all the states as a model.

“Agreed in principle that whatever the judgment of the Supreme court is on this matter, that will not be the end of the problem. The reason is that it is either the federal government wins through FIRS, or the states win.

“If the states win then there’s still the area about imported tax, there is still the area of cross state or interstate tax or VAT.

“Now if FIRS wins, you will not expect those states that are feeling shortchanged, they will find a way and sabotage it. Because if you go into various demonstrations that have been put together by these states, some of them did not see the technical complications involved.”

Another guest speaker at the programme, Taiwo Oyedele, Fiscal Policy partner & Africa Tax Leader at Price Water House Coopers (PWC), said it is not right or wrong for central government to collect VAT depending on whether States have capacity to manage an efficient VAT regime.

Oyedele observed that many states in Nigeria currently do not have capacity to collect sales tax, talk more of VAT that is more complicated to determine.

He cited countries like Brazil, Canada, United States, etc. with different modalities for collection of VAT and asserted that the important thing is what is efficient in terms of collection of taxes, and what is good for businesses and individual consumers.

He said, “our concern and thinking is about the most efficient in terms of collection and what is better for the business community in terms of doing business, especially interstate and across the country and ultimately what is good for the individual consumers should be our priority such that as we allow the court to decide what the constitution should be, we do so in such a way that will not be counterproductive.”

Oyedele also advised coming together by the states and the central government to articulate a revised sharing formula that will assuage the states who feel shortchanged rather than going to court.

On the necessity of the ongoing litigation over the VAT, Oyedele stated that it is necessary for the legal aspects to be resolved, noting that it was the failure of specifying VAT in the constitution that brought about the legal controversy that is currently on.

He however, warned that politicizing issues about VAT will not solve the problem.

He said, “some are siding FIRS, some of the states in the South said they are joining Rivers State. It is not suppose to be a regional issue, because if you look at the bottom three states, in terms of VAT derivation, according to FIRS data, the bottom three are Abia in the Southeast, Osun in the Southwest, Zamfara in the North. There are 32 states that are taking more than they earn in VAT, it cut across the country.

“So let’s have a conversation about the country and what is the best form of VAT collection mechanism given our circumstances, rather than turning it into politics,” Oyedele advised.

On the issue of handling VAT related to interstate or cross border businesses, a participant in the programme, Larry Otaga, suggested that a Joint Tax Commission should be established to address it.

Ayodele aso suggested the deployment of technolgy in handling what is due as tax in terms of derivation by the states.

His words, “This is what we can use technology and accounting to do very easily and whatever that is attributable to every state, give to them 100 percent. Let it be that VAT that we are sharing is the VAT on import, interstate and international services.

“And then we find a basis that correlate with derivation like we do for stamp duties to allocate so that you see the outcome of your effort in the amount that you are able to share.”

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Follow Us