US stocks closed 2024 with remarkable gains, with the S&P 500 rising 23.3%—marking its best two-year performance in over 20 years. The rally was largely driven by investor enthusiasm for artificial intelligence, which boosted major technology stocks. Despite some setbacks in December, the US market outperformed European and Asia-Pacific markets.

“The US market has rarely been so exceptional,” said Michael Metcalfe, head of macro strategy at State Street Global Markets.

Join our WhatsApp ChannelTechnology Leads the Charge in US Stocks

Megacap tech stocks were at the forefront of the S&P 500’s rally. Dubbed the “Magnificent Seven,” Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia, and Tesla delivered substantial returns in 2024. Nvidia’s stock surged by an astounding 172%, while Meta recorded a 65% increase.

These gains highlight the market’s focus on the potential of AI to revolutionise productivity and earnings. “Barring a collapse of revenue, these companies will continue to dominate in 2025,” said Mike Zigmont, co-head of trading at Visdom Investment Group.

READ ALSO: US Stocks Struggle Despite Intraday Rebound

Federal Reserve Policies Boost US Stocks

Interest rate cuts by the Federal Reserve also played a significant role in bolstering US stocks. These were the first rate cuts since the COVID-19 pandemic, supporting investor confidence in a “soft landing” for the economy. Expectations of tax cuts and deregulation during Donald Trump’s second term further fueled optimism.

Benjamin Bowler, a strategist at Bank of America, called the year “a turning point,” emphasizing that AI and favorable economic policies could sustain the rally into 2025.

Challenges and Caution in US Stocks

Despite the strong performance, analysts urge caution. December saw the S&P 500 drop 2.5%, the worst monthly decline in four months. Analysts attributed this to concerns about inflation and lower-than-expected interest rate cuts in 2025.

Chris Jeffery of Legal & General Investment Management pointed out potential risks: “The gap in valuation between US and European stocks is significant, but whether this is sustainable remains uncertain.”

Other Sectors See Mixed Results

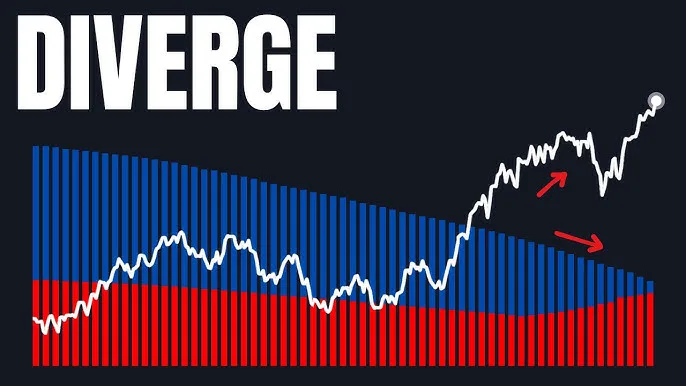

Not all sectors shared the tech-driven success. Industrial materials companies in the S&P 500 were among the worst performers in 2024, hindered by concerns over China’s slowing economy and a potential US recession. Meanwhile, the equal-weighted S&P 500 index, which provides equal weight to all constituents, shed 6.6% in the last month of the year.

Retail and small-cap stocks, represented by the Russell 2000, also underperformed, signaling a divergence in market sentiment.

Looking Ahead for US Stocks

The concentration of gains in tech stocks has led to challenges for investment funds with limits on single-stock holdings. However, investor sentiment remains bullish. A Bank of America survey showed asset managers’ net long exposure to the S&P 500 at a 20-year high.

Despite this optimism, economic indicators like Citi’s US economic surprise index suggest slowing momentum. High Treasury yields, a strong dollar, and tightening liquidity are potential risks for 2025.

As the market enters the new year, analysts remain divided on whether the rally can continue. Still, 2024 has solidified the US stock market’s position as a global leader, driven by technological innovation and robust economic policies.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

Follow Us