In the wake of a robust job report, the Federal Reserve eyes a “soft landing” for the US economy, navigating inflation challenges.

However, as interest rates hold steady, a housing affordability crisis deepens, prompting Democratic senators to address the Fed. While the central bank’s role is questioned, experts suggest congressional measures like tax credits and regulatory changes may wield more impact.

Despite the Fed’s influence on mortgage rates, housing remains elusive for many, particularly younger and lower-income Americans.

The 2021 surge in home prices, even with near-zero interest rates, emphasizes the complexity of the issue. A potential soft landing hinges on stabilizing the labor market and easing interest rates, but regional nuances in housing supply and local policies add layers to the affordability crisis.

Orphe Divounguy from Zillow notes improved conditions due to higher incomes and slightly lower mortgage rates, but he warns that affordability challenges persist. The average 30-year fixed mortgage rate, which peaked at 7.79%, has gradually declined but might not dip below 6% this year, according to predictions. Meanwhile, home prices nationwide remain elevated, hindering the sustainability of affordability improvements.

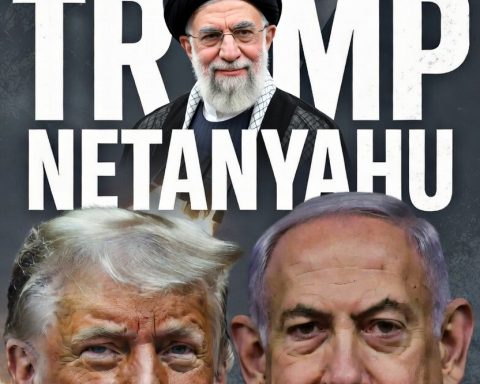

Former President Donald Trump intensifies the discourse, expressing reluctance to reappoint Fed Chair Jerome Powell.

Accusing Powell of political motives for potential rate cuts, Trump’s stance reflects a longstanding clash. Powell, despite facing political pressure, maintains the Fed’s focus on its dual mandate and downplays immediate rate cuts, with the economy adding a surprising 353,000 jobs in January.

The housing dilemma underscores the need for comprehensive solutions beyond monetary policy, urging a focus on long-term sustainability. As the Fed navigates economic intricacies, the housing crisis remains a critical battleground for policymakers and citizens alike, emphasizing the imperative of addressing underlying structural challenges for enduring economic stability.

US Economic Soft Landing In Sight, But Housing Affordability Looms Large