United Bank for Africa (UBA) Plc has taken the spotlight, revealing remarkable growth figures in its audited financial report for the first half of 2023.

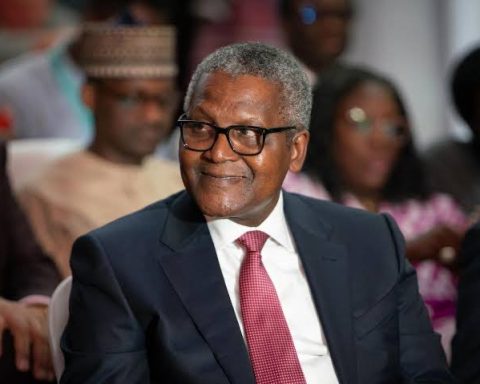

Breaking away from the conventional narrative, the bank’s CEO, Mr. Oliver Alawuba, delivered a statement that resonated with confidence and optimism.

Join our WhatsApp ChannelUBA Group reported a profit before tax of N404 billion, representing an extraordinary increase of 371% when compared to N85.75 billion recorded in the first half of 2022. This translated to an annual Return on Average Equity of 57.7% as against 17.1% a year earlier.

READ ALSO: What To Expect As Apple Set To Unveil The iPhone 15

UBA’s remarkable profit surge is not only a testament to its astute financial strategies but also highlights the resilience of the African banking sector amid challenging global conditions.

The bank’s diversified portfolio, both within Africa and global stage, positions it as a vital financial bridge connecting people and businesses across the continent.

In addition:

• The results also showed as of June 30, 2023, a profit after tax (PAT) of N378.24 billion, representing a leap of 437.8 percent over H1 2022.

• Operating Income grew by 206.6 percent to N783.96 billion in June 2023; higher than N255.67 billion reported a year earlier.

• The Group delivered a 164 per cent growth in its Gross Earnings which rose to N981.78 billion as of June 2023, up from N372.36 billion recorded last year in June 2022.

• Total Assets continued a strong upward trajectory, rising above the N15 trillion mark, as it hit N15.38 trillion, representing a 41.7 percent leap up from N10.86 trillion recorded at the end of last year.

• Customer Deposits also rose by a sharp 42.4 percent to N11.14 trillion in the period under consideration; as against N7.8 trillion recorded at the end of 2022.

• Shareholders’ Funds increased to N1.712 trillion reflecting the Group’s strong capacity for internal capital generation.

Mr. Oliver Alawuba, UBA’s Group Managing Director/Chief Executive Officer, stated, “The Group recorded strong double-digit growth in revenues and profits from its operations, the result also reflects the effect of sizeable revaluation gains, arising from the harmonization of currency exchange rates in Nigeria. Our reporting currency found a new exchange level at about N756 to 1US$ as of 30 June 2023, compared to N465 at the beginning of the year.”

“The results again demonstrate the benefits of our long-held diversification strategy across Africa and globally. The growth of our international business, most recently in the UAE, only reinforces this earnings quality,” he added.

Continuing, Alawuba said: “Our business is on a steady growth trajectory, as we further strengthen our risk management traditions and practices necessary technology investments to deliver premium service to our customers.”

“We have also continued to finance landmark projects in critical sectors of the economies across Africa, facilitating intra-Africa trade with our valuable offerings and providing a versatile last-mile distribution network for Africa-bound donor and multilateral agency funds.”

Commenting on the regional contributions to UBA’s success, Alawuba said: “The three core geographical pillars of our business (Nigeria, the Rest of Africa, and the Rest of the World) are making strong contributions to the Group profit, further justifying our global strategy and business positioning across Africa, UAE, France, UK, and the USA, and demonstrating the benefits of positioning UBA as the financial intermediary for Africa and the rest of the world.”

As the year approaches its final quarter, Alawuba reaffirmed the bank’s commitment to sustaining its impressive performance, promising superior returns to shareholders.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.