This is the concluding part of the series on having a balanced investment portfolio, you can read part 1 here.

READ ALSO: Top Secrets For Balanced Investment Portfolio (Part 1)

I would be using myself as an example for the practical application of the guide I wrote in part 1 on how you combine the following parameters in building an effective balanced investment portfolio:

Risk Profile

Age

Needs/Wealth ratio

Accessible Investments

I am a 34 (this) year old man with a young family (wife and one daughter) living in a fairly expensive 3 bedroom apartment in Lagos. So let’s see how I built my balanced investment portfolio.

Risk Profile

If you have a friend who is always calculating and comes across as very meticulous, self-absorbed and risk-averse; your friend is very much like me. Growing up I was the calm and quiet child who became the teacher’s favourite in school and the hostel-class-church robot at university. When people are looking for who to join them on an adventure or business venture, I am a clear wrong choice. By now you should have a good idea of my risk profile – I call it 4 on a scale of 1 to 10. You can be forgiven if you think 4 is too high, but there’s another part of me that surprises people and reflects a risk taking side that makes 4 a good representative score. Once I understand something and decide to go for it, the whole world can fall apart around me and as long as my reason is still intact, I do not budge.

That’s why I run my own business and I ride a high power motorcycle (commonly referred to as a power bike). But you’ll still see the low risk person shining through even when I’m on the bike, I am the go-at-my-pace no-stunt guy.

So with this risk profile, how do I structure my investments?

The number one thing I did was to spend months reading up about stocks, real estate, money market and all the different investment types that were accessible to me. I bought college books and practitioners books. I took online courses. I, effectively, tried to find my own solid reasons for making my investment moves based on sound knowledge. And the amazing thing is that I found stocks to be within my risk tolerance level. My knowledge of how the stock market works and that it’s very normal for it to go up and down make me feel no worries when I see my stocks go up and down.

I also have interests in real estate even though I found the Nigerian real estate market to be full of hidden charges and grey areas. I felt okay going in without a clear path to exit as I could chart for the stock market.

I actively avoid crowdfunding platforms, agritech investment platforms and any investment I do not understand their end to end value creation/growth chain. No amount of high return on investment and close friends’ testimonials sway me. If I can’t see their financial books, products and value chain, then, I can’t stomach the risk involved.

In all, I am what most wealth managers will classify as a medium risk profile investor – someone willing to take on a small amount of risk but not the type to go all in on any high risk high reward opportunity.

Age

As I earlier mentioned, I am 34 (this) year old. It’s easier and more financially natural to count from January to December as a year rather than looking at your actual day and month of birth, this helps align your investment analysis, the market cycle, your planned actions (like portfolio rebalancing) with your age. For instance, it makes better sense to take January as the year start if you are on an investment strategy of putting a percentage equal to your age in fixed income and the remainder in the stock market and real estate.

However, what is most important about the age is how shows one’s particular spending and earning profile:

20 – 30 years old – Low spending and low earning regime as the average person in this age bracket is just getting his career set up and has very few dependents.

31 – 49 years old – High spending and high earning regime as most people have the most number of dependents at the peak of their financial needs at this stage, and are taking up new expenses each year as they support a growing family and growing responsibilities. But it is the age bracket most people are able to generate the most income as they have the advantage of high energy and an established career.

50 – 65 years old – Medium spending and medium earning regime as most people are having more independent children and wards requiring less financial support but also are less energetic to make as much money as they made in their younger age.

66 years and above – medium spending and low earning regime as most people are largely living off pensions and passive incomes while also no longer needing to spend on many things.

I fall within the high spending and high earning age bracket, so that means I can’t afford to have a portfolio that does not account for my high spending needs. As much as I look for growth of my capital, it must not be at the high level of volatility that can cause me to lock in losses as family and other spending needs arise. Overall, the best strategy for people in this regime is to pay much more attention to their spending habits, ensure they cut down on their expenses as much as possible, so that they can have more to invest and leave alone to grow well during this 19 years period. If this period is very well managed, it can be the most wealth generating period of one’s life. So personally, I keep peer pressure at bay and I work more on increasing the gap between my income and expenses.

Needs/Wealth Ratio

This is often the hardest part for most people. Some people consider building a palatial house and sending their children to the most expensive school they can afford as an indisputable need while others are okay with staying in a modest rented house and sending their children to modestly priced schools. Unfortunately, most people are set in one category ahead and find it hard to logically justify switching. Try convincing a friend who is bent on building his own house even though it will drain his finances and he won’t get rental income, you’ll be surprised by how set he is in that path regardless of whatever sound explanations you give. So what I advise people to do is go to the low end of their acceptable range of needs spend. If you feel like living in Victoria Island but Yaba is also good, then go for Yaba.

Find ways to be on the low needs budget and that will free up more cash to put to long term wealth building investing. Use an affordable and easy to maintain car, pay yourself first (put money aside for investing first and spend what’s left rather than spending first and investing what is left).

Accessible Investments

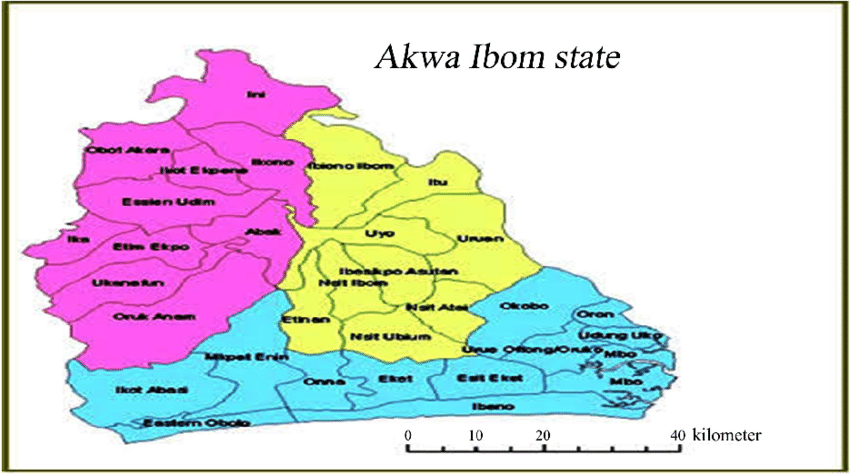

Being a Nigerian living in Nigeria, I have access to the following investment vehicles:

Nigerian stock market

Nigerian fixed income market (bonds)

Nigerian real estate market

US stocks market

Cryptocurrencies

Again, I deliberately avoid agritech and crowdfunding investments as they are too risky for me.

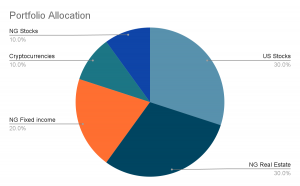

Tying it all together

I decided to put 10% of my investment in Nigerian stock market, 20% in Nigerian fixed income market (specifically money market), 30% in Nigerian real estate market, 30% in US stock market and 10% in Cryptocurrencies.

This allows me to stay within my risk tolerance, maxing out my preference for stocks while keeping me liquid in fixed income to cover my spending needs, and letting me scratch my real estate and cryptocurrencies exposure itch.

Ultimately, it is an investment portfolio that is well aligned with my risk profile, stage in life, spending pattern and accessible opportunities. That is what makes it balanced and yours too should be set up in that very personalised way.

Any investment portfolio that is copied from online or prescribed to you by someone who doesn’t know you very well is going to be an unbalanced one; it will give you anxieties at best and losses at worst.