Who remembers the last time he or she held, had and used the coin as a means of exchange in Nigeria? It is a very interesting and serious question. How many of our youths today can tell a story about the Nigerian coin?

But many of our elders reminisce on the good days of the coin? But I can tell you that I have been transacting with the coin. It’s so beautiful and cool. You are filled with fond memories. Yes, in Cotonou, the Republic of Benin fond memories of the coins rush through me. They come in denominations of 25, 50, 100 and 200 Francs.

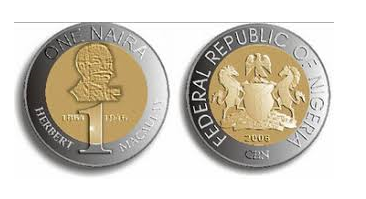

Join our WhatsApp ChannelIn Nigeria, attempt to use the coin began again in 1991 with the introduction of the ₦1, 50k, 25k, 10k and 1k.

However, the 1/2k and 5k were phased out at the time. The coin was last issued in 2007, with the ₦2 as the highest coin denomination. That year ₦1 coin and 50k were reissued in new designs while the 1k, 10k and 25k were withdrawn from circulation. But since 2007 till date the issuance and use of the coin would seem to have died without anybody wondering why or worried at all. But generally speaking have our lives been better economically in the circumstance of absence of the coin?

The last time one remembers any official concern and interest in use of the coin was on March 22, 2022 when the House of Representatives urged the Central Bank to reinforce the use of coins on Nigerians. During a motion brought in plenary by Muda Umar of Toro Federal Constituency of Bauchi State, the lawmakers said they “want the use of coins as legal tender and CBN should ensure the banks comply with the use of coins to the fullest”. How this ended at the CBN end cannot be told.

The Central Bank of Nigeria has the inalienable rght to issue coins as legal tender alongside the currency notes. This is found in Section 2b and Section 17 of the CBN Act. This also means the apex bank can determine the use of coins or discontinuation as the case may be. In the circumstance therefore can we say it is the CBN that has made it a policy that there should be no transaction in coins in Nigeria? What is the reason behind this? Are the benefits not more than the disadvantages? And what are those disadvantages? Are Nigerians averse to the use of coins?

There had been arguments to advance the discontinuation of coins such as the one that criminals melt them into jewelry, leading to scarcity. And so the CBN thought that the best way was to put a final stop to use of coins.

But this is contradictory when it was also advanced that the reason for the light weight of the last issuance was to stop those criminal activities and which also addressed the fact that Nigerians complained much about the difficulty of carrying large amount in coin. It is just funny how criminals or the mere taste preference of Nigerians can just force government off the lane. Yet in many countries coins are fully in use.

READ ALSO:CBN Act Prevents Banks From Rejecting Old Naira After Deadline, Emefiele Meets Reps

How true is the association of coin with inflation trend in the economy? This can only be true because of people’s taste preference such that in certain instances they complain of the inconveniences involved with the weight and collecting of their change during a transaction. The other one is associated with those on the high society rung who like to flaunt by spraying money at parties. But these can be legislated against thereby encouraging the use of coins. The major association would seem to be that when people approximate to the nearest number which comes to a currency note the consumer who ordinarily doesn’t want to collect his change in coin just pay and walk away. This taste behaviour is to the benefit of the seller who now rounds up prices leading to increase in prices of goods and sidelining the coin. In a matter of time the use of coins becomes discouraged through consumer behaviour which the seller capitalises on.

READ ALSO: Bitcoin Struggles To Climb Above $30k In Weak Trade

However, the advantage of coin is mainly the breaking down of high currency denominations into bits. The reduction to bits impact positively on inflation as it is forced down by making transactions possible through use of bits of money symbolised by coins. In this instance the seller cannot add to the cost because consumer is used to collecting his balance also in the bits of coin currency.

At the backdrop of the recent currency redesign policy of the CBN which has created a huge economic dislocation owing to lack of the new notes, it becomes very tempting to suggest to the CBN to include massive deployment of the coins to circulation. It seems very reasonable to hold the opinion that the coin would reinforce the quantity of money in circulation in a less attractive and disturbing or disruptive category. Instead of disruption the coin would tend to align the economy in its most appropriate trajectory. This will indeed make money in different categories available for spending thereby bringing an end to the hardship occasioned by the policy.

It is equally believed that the reintroduction and massive deployment of the coins at this time would reinvent consumer behaviour as he would be forced to get used to use of the coin. By enforcing behaviour change in both consumer and producer/seller the culture of use of coin in the economy would be a big success in the long run. This is one way the CBN which also identified inflation as one of the reasons for the currency redesign would have found an additional means of curtailing the economic challenge.

It is indeed disturbing that lawmakers have not been able to think in the direction of the reintroduction of the coin in Nigeria under the difficult circumstance of the currency redesign policy. They have been more concerned with their political ambitions, thereby failing to give cognisance to the importance of the coin in driving a simple economy. A simple economy is one in which the overall interest of the economy in the long-term is concerned, taking note of the fluidity of basic transactional needs, especially of the largest number which is the common people in their ability to survive under certain novel economic policies. A simple economy is not a status-symbol display which is driven by high denomination currency notes alongside its cashless adjunct or derivative.

Lawmakers must pay total attention to the needs of the simple. The poor inhabit the simple economy class. Instead of crying and wailing over the impact of the policy on their political fortunes, the lawmakers should have asked the CBN to flood the economy with coins to address the cash crunch. The same for the governor that made a counter address in his state and all the 12 States and their governors that went to court to stop the implementation of the policy.

jmjElections are already holding amidst the implementation of the CBN policy while the poor now buy the naira notes before buying food to eat. The coin would have been able to salvage the situation since it would have given more value to the fluidity of the economy under the circumstance. The argument of vote buying wouldn’t have any association with the availability of coins to spend because politicians wouldn’t have deployed it to carry out their nefarious activity.

In the circumstance the nation has found itself, the CBN should take appropriate measures to return the coins into circulation. The advantages are myriad such as fluidity in transportation fare and other purchases that would have their prices forced down. The time is now or never for CBN to wean Nigerians of the culture of big spending in currency notes which are undertaken as status symbol. The coin will be in great partnership with the cashless policy which the CBN has set in total motion. Whereas some big spendings would go cashless the coins would smoothen and complement other transactions that need to be done with cash. It would make life bearable, meaningful and amazing again for the people. It is now or never.

Ifeanyi Ibe is a Media Consultant and can be reached on 08038945092/ifeanyibe1969@gmail.com

Follow Us