Group Chief Executive Officer of Guaranty Trust Holding Company Plc (GTCo), Segun Agbaje, has asserted that looking at the economic situation in Nigeria, it is the perfect time to make investments in the country.

He said the Central Bank of Nigeria’s monetary policy approach and the overall economic reforms by the present adminstration, especially in the area of foreign exchange are all on the right direction.

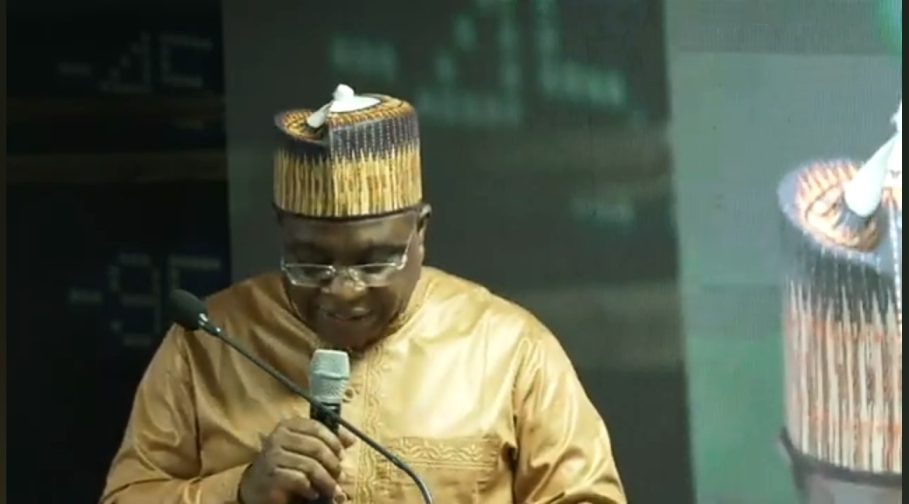

Join our WhatsApp ChannelAgbaje stated this while addressing capital market stakeholders with Fact Behind the Offer Presentation” held at the Nigerian Exchange Limited headquarters in Lagos on Monday, 8 July, 2024.

Prime Business Africa reports that GTCo had earlier notified the Securities and Exchange Commission (SEC) of its plans to raise N500 billion through a public offer of its shares starting from July.

This decision followed the directive by the CBN in March this year, mandating banks to increase their capital base in order to strengthen the financial system in the country.

Banks with international banking licences like GTCO will have to increase their minimum capital to N500 billion, while those with national operations were required to raise their capital base to N200 billion.

The move is part of the broad plan to help grow Nigeria into a $1 trillion GDP economy by 2030.

Speaking on the current macroeconomic environment as it relates to the Nigerian system, Agbaje said the country has for years been operating a foreign exchange market system that did not truly reflect what the country’s real currency value was.

Agbaje said: “It is a great time to be in Nigeria. Forget what people think. This is a perfect time to invest in Nigeria. The country has moved into what I call an orthodox monetary policy situation. We live for years in an abnormal amount, and the exchange rate is completely overvalued and did not move.”

He said what has happened in the last few months is that things are normalising.

He acknowledged that it is a “painful process” but it was necessary for the country to achieve sustainable growth in future.

The GTCo GCEO argued that the CBN’s monetary policy approach which involved increasing the interest rate to tackle high inflation in the country has helped in increasing people’s savings.

On the high exchange rate that came with the devaluation of the local currency, Agbaje said the most important thing is achieving stability in the system.

Speaking on why banks need to raise their capital, Agbaje said it was due to the devaluation of the naira by over 200 per cent, which according to him, has affected the ability of banks to do business.

Agbaje claimed that GTCO will be the first Nigerian bank to post $1 billion profit despite hash economic condition.

He said: “We’re not thinking of the next couple of years as baby step growths, we’re thinking of the next few years where we separate this bank and this organisation, this financial services group forever away from everybody.

“We want a market capitalisation that Nigeria will be proud of. There is no Nigerian company that has ever made $1 billion in profit and we’re going to be the first one so we’re going to give you that bill.”

Countering the notion that banks do not need equity, he said: “We’ve just gone through about a 200 per cent devaluation. For those who understand the impact of that, the balance sheets have shrunk, the ability to do business has reduced.

“The government is also saying it wants a $1 trillion economy, you are not going to achieve a $1 trillion economy at this size of banks if you do not raise capital. So first of all, banks need capital.”

Earlier in his opening address, Group Chairman of NGX Group, Alhaji (Dr) Umaru Kwairanga, said ordinarily, he would say that GTCo does not need to “broadcast why its offer is a good buy given the ample rewards that astute investors who invested in its earlier offers have enjoyed over the years in the form of regular dividends and capital appreciation.”

Kwairanga said the essence of the “Fact Behind the Offer Presentation” is to adhere to due process as a company, and demonstrate to shareholders that the future is brighter for the group and that wise shareholders who decide to investment in the company’s shares would rejoyce later.

He said on the part of NGX, they are committed to doing all that is necessary to ensure that both the bank, shareholders and other parties involved in shares acquisition have a seamless interface during this recapitalisation period.

He emphasised that it was to ensure an efficient interface between shareholders and banks that the Nigerian Exchange established the digital primary market platform which connects shareholders who wish to subscribe to offers using their phones and other digital devices.

“The era of paper application is over. Shareholders can subscribe to these offers from the comfort of their offices and homes and receive acknowledgement immediately. We believe this platform will enhance Investors’ experience and ensure greater participation in this offer,” Kwairanga stated.

READ ALSO: Chad: World Bank launches an Economic report

NGX Board Chairman, Mr. Ahonsi Unuigbe said the story of GTCo is one characterised by resilience and longstanding performance.

Mr. Unuigbe commended GTCo for utilising the NGX platform to enhance their engagement in the capital market community.

He explained that with the “Facts Behind the Offer” presentation, NGX encourages all issuers to interact with market participants, thereby promoting transparency and building investors confidence, “thus contributing to the overall health of our financial market.”

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Follow Us