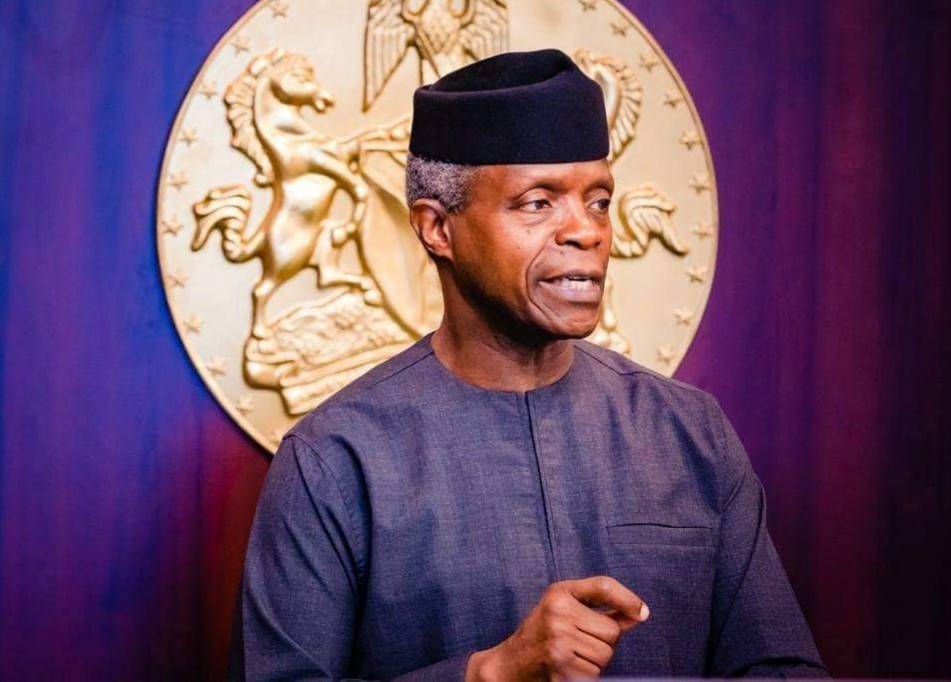

VICE President, Prof Yemi Osinbajo calls for a foreign exchange policy that reflects market realities not devaluation of the currency.

Spokesman to the Vice President, Laolu Akande, in a State House press release, explained that why the VP called for a market reflective exchange rate was to curb arbitrage and corrupt system that offers cheap dollars to some Nigerians, while others obtain it at a higher rate in the parallel market.

Join our WhatsApp ChannelOsinbajo had on Monday during the opening of a two-day Mid-Term Ministerial Performance Review Retreat, called on the Central Bank of Nigeria to review its current strategy of demand management on foreign exchange system and ensure that the Naira value reflects the market reality, in order to attract investors.

The statement reads, “Prof. Osinbajo is not calling for the devaluation of the Naira. He has at all times argued against a willy-nilly devaluation of the Naira.

“For context, the Vice President’s point was that currently the Naira exchange rate benefits only those who are able to obtain the dollar at N410, some of who simply turn round and sell to the parallel market at N570. It is stopping this huge arbitrage of over N160 per dollar that the Vice President was talking about. Such a massive difference discourages doing proper business, when selling the dollar can bring in 40% profit.”

Akande said “this was why the Vice President called for measures that would increase the supply of foreign exchange in the market rather than simply managing demand, which opens up irresistible opportunities for arbitrage and corruption.

“It is a well known fact that foreign investors and exporters have been complaining that they could not bring foreign exchange in at N410 and then have to purchase foreign exchange in the parallel market at N570 to meet their various needs on account of unavailability of foreign exchange. Only a more market reflective exchange rate would ameliorate this. With an increase in the supply of dollars the rates will drop and the value of the Naira will improve.

“The real issue confronting the economy on this matter is how to improve the supply of foreign exchange, but this will not happen if we do not allow mechanisms like the Importers and Exporters window to work. If we allow this market mechanism to work as intended, we will find that the Naira will appreciate against the dollar as we restore confidence in the system. “

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Follow Us