Opay, a leading fintech company in Nigeria, will begin charging customers a N50 levy on electronic transfers of N10,000 or more from September 9, 2024.

This move complies with the Federal Inland Revenue Service (FIRS) regulations. The company shared this update with customers in a message titled “FGN Electronic Money Transfer Levy,” which was sent out over the weekend.

Join our WhatsApp Channel“Please be informed that starting September 9th 2024, a one-time fee of N50 will be applied to electronic transfers of N10,000 and above paid into your personal or business account, in compliance with the Federal Inland Revenue Service (FIRS) regulations,” Opay stated in the message.

Why Is Opay Charging the Levy?

Opay clarified that the N50 fee is a government-mandated charge and not a source of revenue for the company.

The fintech explained that the levy would be directed entirely to the Federal Government as part of its electronic money transfer levy (EMTL), introduced in the Finance Act 2020.

The EMTL applies a N50 charge on electronic transfers of N10,000 or more made to any bank or financial institution. According to the law, this fee is a one-time charge on deposits and transfers across all types of accounts.

“This is not a fee that benefits Opay,” the company said. “It is a Federal Government levy, and all funds will be directed to the government.”

READ ALSO: Nigerians Panic As CBN Ban Opay, Moniepoint, Others Over KYC Concerns

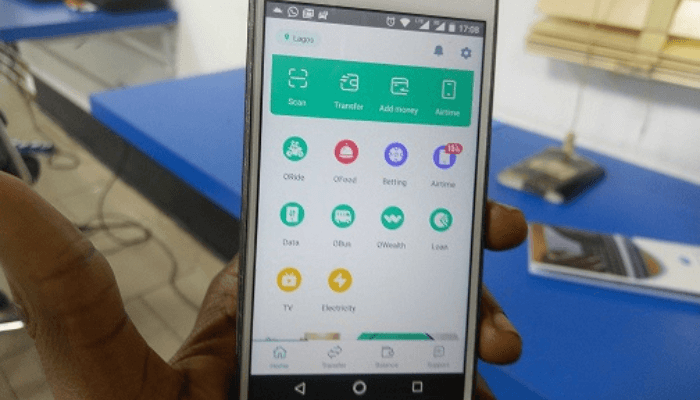

Opay’s Current Charges and Its Growing User Base

Opay, which currently charges N10 for transfers after the third transaction in a day, will continue to apply this fee alongside the new EMTL.

With over 30 million users, Opay has been a significant player in Nigeria’s digital payment space. Its ability to handle massive transaction volumes helped it thrive during the naira cash shortage in 2023.

Adedeji Olowe, the founder of Lendsqr, praised Opay’s role in Nigeria’s growing cashless economy. “Payment methods have become easier, faster, and better, and people are using them for everyday things,” Olowe commented. He added that platforms like Opay have made it simpler for Nigerians to make everyday transactions.

Impact on Nigeria’s Cashless Economy

The Federal Government introduced the EMTL to take advantage of the rapid increase in electronic transfers, which have grown exponentially in recent years.

In 2023, the government generated N180.31 billion from the levy, a 29.45% increase from its N136.35 billion target.

As more Nigerians turn to cashless payment options, revenues from the EMTL are expected to rise. In the first quarter of 2024 alone, cashless transactions hit N237 trillion, an 88.09% increase from the previous year.

Despite this surge in digital transactions, experts have pointed out that the levy mainly applies to transfers over N10,000, leaving out a significant portion of micro-transactions that occur through platforms like Opay and Palmpay. These smaller transfers, often under N10,000, are driving Nigeria’s e-payment boom but are not subject to the levy.

The Future of Cashless Transactions in Nigeria

Opay’s new levy is part of a broader government strategy to increase revenues from electronic transactions. The Central Bank of Nigeria has projected a continued decline in cash usage by 2025, which would further drive the growth of digital payments.

The government hopes that the increasing use of platforms like Opay will fuel future revenue growth from the EMTL. With millions of users relying on these platforms, the N50 levy could contribute significantly to government coffers in the coming years.

As cashless transactions become more common, the role of fintechs like Opay will only grow. However, for users, the new N50 levy may mean adjusting their payment habits, particularly for larger transfers.

Starting September 9, Opay users making transfers above N10,000 will face a N50 levy in compliance with FIRS regulations.

The fintech giant continues to play a significant role in Nigeria’s digital economy, driving growth in cashless transactions.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

Follow Us