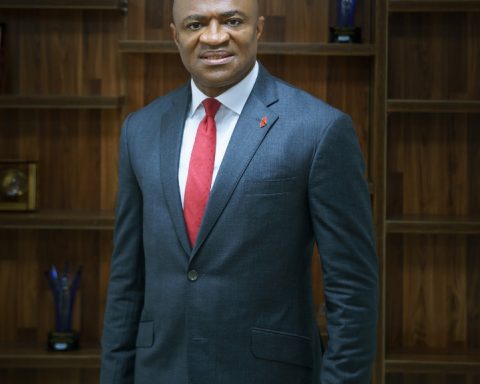

The Group Managing Director of the United Bank for Africa (UBA), Oliver Alawuba, has increased his investment in the financial institution.

Alawuba is now the second highest shareholder in UBA after acquiring 35.53 million shares of the bank in the Nigerian stock market on Friday, 23 June 2023.

Join our WhatsApp ChannelThis was disclosed on Monday in a corporate document obtained from the Nigerian Exchange Limited (NGX), the capital market authority.

Prime Business Africa gathered that the acquisition costs Alawuba N405.10 million and increased his stake in UBA to 0.10 per cent, from a mere 0.004 per cent.

Alawuba’s total UBA shares rose to 37.12 million, from 1.59 million shares, while his investment in the company is valued at N434.40 million as of Monday, up from N18 million prior to the acquisition on Friday.

He sits behind Tony Elumelu, the chairman of UBA, who holds a stake of 7.18 per cent as at the end of 25 May, when he last disclosed an acquisition.

Recall that Alawuba was appointed 11 months ago to replace Kennedy Uzoka as the Group Managing Director and the Chief Executive officer.

Before his exit, Uzoka was the second highest shareholder with 37.17 million shares, which also represented a 0.10 per cent stake in UBA.

Meanwhile, the Group Company Secretary, Bili Odum, also acquired shares of UBA on the same day Alawuba did, to join top shots with shares in the bank.

Odum acquired 2.33 million shares at the cost of N26.63 million, another document released on Monday and obtained by this publication showed.

Their acquisition comes amid gains in UBA share, which has appreciated by N3.4 kobo year-to-date. The share rose from N8.30 kobo at the start of the year to N11.70 kobo as of Monday.

Prime Business Africa understands that the hike in the share value increased the investments of UBA’s shareholders by 40.9 per cent.

This means UBA shareholders made N116.27 billion gain within six months, while the market valuation of UBA rose to N400.13 billion, from N283.85 billion between January to June.