Prime Business Africa reports that the new trend in Iran- Saudi Arabia relations could affect the near-term outlook for oil prices, as US watches closer the emerging relations between China and its allies and foes.

Saudi Arabia’s Finance Minister Mohammed Al-Jadaan says the middle East country is set to invest in Iran after both countries signed an agreement.

Join our WhatsApp ChannelREAD ALSO: Iran Executes ex-Defense Minister For Allegedly Spying For UK

Al-Jadaan, on Wednesday, said that Saudi investments into Iran could happen “very quickly” after they agreed to restore diplomatic ties.

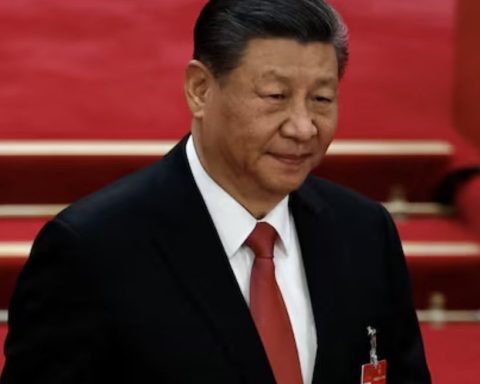

China brokered the new relationship. Considering the Unites States relations with Saudi Arabia, this move has real implications for existing US-Saudi Arabia ties as well oil pricing outlook.

Saudi, as a long-standing ally of the US, relies on it for defence support in the form of arms and training and in turn sells most of its oil to US. Iran being a Chinese ally and presumed enemy to the US, suffers from myriads of sanctions from the US. It has been a and a long-time rival to Saudi Arabia.

The United States and Israel may be concerned that now that the two countries (Iran and Saudi) may be working together, there could be a threat from China forging a global strong alliance and force with its allies and foes.

This may have implications for oil market going forward, depending on the response from US and likely possibility of some part of oil market gradually being redenominated in new currency outside of the US Dollar.

“Pricing oil in USD is a one of the major fundamentals of the Dollar and gradually losing that anchor may be negative for the greenback and overall fundamentals of the US, hence the US is expected to respond,” Lagos-based Economic Analyst Abiola Razaq told PBA on Thursday night.

Al-Jadaan had, during Financial Sector Conference in Riyadh, said: “There are a lot of opportunities for Saudi investments in Iran. We don’t see impediments as long as the terms of any agreement would be respected.”

After many years of hostilities, Iran and Saudi Arabia had, barely one week ago, resolved to re-establish relations and re-open embassies within two months. This followed the talks both countries had in China. The China connection makes it even more precarious for the Saudi-U.S relations, considering that U.S has been having diplomatic issues with China over the latter’s alleged espionage moves.

“Stability in the region is very important, for the world and for the countries in the region, and we have always said that Iran is our neighbour and we have no interest to have a conflict with our neighbours, if they are willing to cooperate,” Al-Jadaan told Reuters in an exclusive interview.

Reuters reported that the “hostility between the two Middle Eastern powers had endangered the stability and security of the Middle East and helped fuel regional conflicts including in Yemen, Syria and Lebanon.”

Al-Jadaan was quoted as saying: “We have no reason not to invest in Iran, and we have no reason not to allow them to invest in Saudi Arabia. It is in our interest to make sure that both nations benefit from each other’s resources and competitive advantage.”

“If they (Iran) are willing to go through this process, then we are more than willing to go through this process and show them they are welcome and we would be more than happy to participate in their development,” he said.

Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama