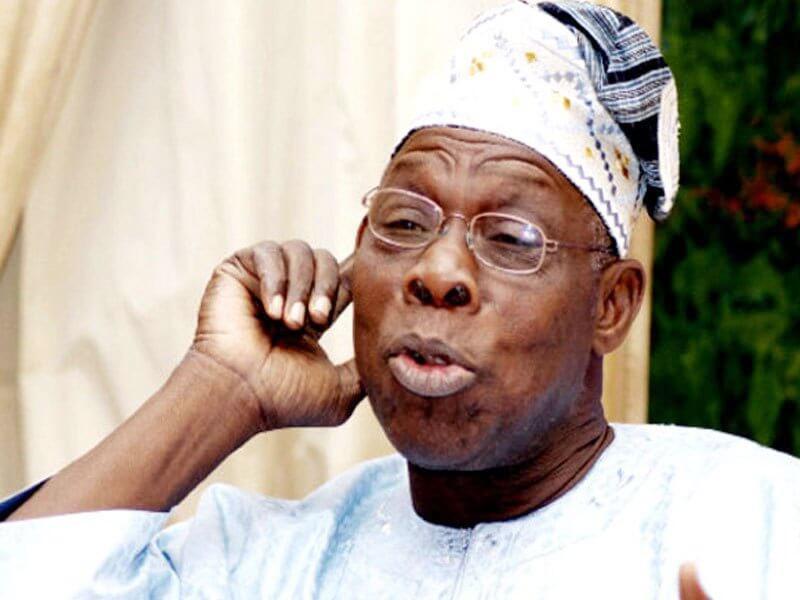

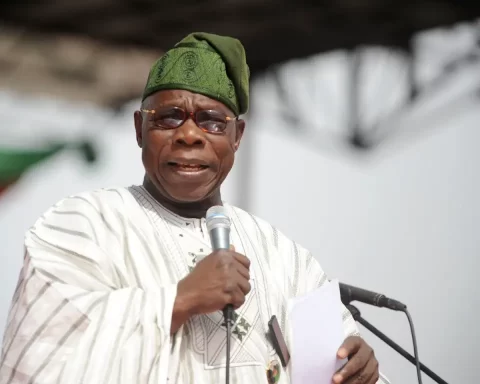

Former President, Olusegun Obasanjo, has cried out over the rising price of diesel that has made cost of doing business in Nigeria skyrocket, and also threaten his fishery enterprise.

Obasanjo said his fishery business could go bankrupt due to the price of diesel rising to N800 per litre, and has made it necessary for fishery business to raise a kilogram of fish to N1,400.

Join our WhatsApp ChannelHe explained to South-West fish farmers’ congress, on Tuesday, that selling below the price could result to loss on the part of fishery business owners within the country, and in turn, cut down availability of fish in the market.

The former president stressed that the cost of diesel is making him sweat, and if care is not taken, Nigerians will have to start importing fish from other countries, resulting to job loss in Nigeria.

Obasanjo said something must be done, and the association of fishery business must take a stand on the price in order to survive the current economic situation, as the management of the country is not what it should be.

“If we don’t come together as an association, nationally, we will sink individually. If we come together, we will swim and survive together,” he said, adding, “And while we are working on coming together, I thought that the situation has arisen whereby we have to do something urgently.

“The price of diesel has gone sky high because the management of this country is not what it should be. And it is as simple as that.

“Then, what will happen is that particularly those of us who have to use a bit of diesel in producing fish, we will completely go bankrupt, and when that happens, Nigerians will still have to eat fish.”

Obasanjo warned that, “people will be producing fish outside Nigeria and dump it here” and “you will go jobless, poor and indigent.

“So, what do we have to do? To come together… we want to sustain fish production, and we must be able to take care of those who are going to eat and those of us who are producing.” The former President said.