Last week had two contrasting news from two institutions that reflected two highly contrasting tales of resource management. One institution comes within the context of abundance and crass economic profligacy. The other comes within the context of imposed economic depression, but extraordinary prudence in lean resource management.

First, the Nigerian banks, operating in an atmosphere of choking macroeconomic problems, declared huge profits in the first half of 2023. Four Nigerian Banks, namely, United Bank for Africa (UBA), FBN Holdings, Guarantee Trust Bank, and Zenith Bank, declared a profit before tax (PBT) of N1.13 trillion as against the N315.9 billion within the same period in 2022, a 260% increase in profits. UBA, the most profitable, grew its PBT by 371% to N404 billion. The bank raised its interim dividend payout from 20 kobo to 50 kobo within the same period.

Join our WhatsApp ChannelThese are banks that came off two national economic recessions in six years between 2015 and 2021. These are banks that faced the federal government’s wrenchingly disastrous naira redesign project, a stifling brain drain in technology experts, a global pandemic, runaway inflation, government’s debt-driven macroeconomic policies, the world’s most volatile forex market and the accompanying exchange rate and struggling businesses.

NNPCL, the Crude Prodigal Son

On the other disastrous economic end is the country’s oil leviathan, the Nigerian National Petroleum Company Limited (NNPCL), which is now a mammoth manifestation of inefficiency. The NNPCL crumbled all of Nigeria’s four refineries, which have been functionally useless since 1999. In 2015, the NNPCL inherited a crude oil production volume of 2.05 million bpd, and this crashed further in 2016 to 1.4 million bpd, a 30-year low at the time. It fell much further to 998,602 bpd in April 2023 in relation to the country’s OPEC quota of 1.8 Million bpd. This abysmal performance made the NNPCL not to remit a dime to the Federation Account Allocation Committee (FAAC) since January 2022.

The same NNPCL watched over a terrific subsidy regime, one of the most corrupt in the country since the return to democratic rule in 1999. In eight years, the government of Muhammadu Buhari spent N17.5 trillion on fuel subsidy. Out of this, N10.5 trillion was spent in the last 18 months of the administration. Since the turn of democratic rule, the country has spent about $35 billion on fuel subsidy. The National Bureau of Statistics said Nigeria spent N16.9 trillion importing petrol between June 2015 and October 2022.

READ: NNPCL Signs MoU On Gas Supply With Indorama

Nigeria Importing Crude Oil?

For years, Nigerians endured fuel shortages and high costs of petroleum products, while waiting on their leaders to repair and build refineries. Hope came when news filtered in that Dangote’s refinery, begun since 2017, would start local production of about 650,000bpd in August 2023, following President Buhari’s commissioning of the refinery in May 2023 just before he left office. Hopes also rose for an end to huge amounts committed to fuel subsidy due to importation.

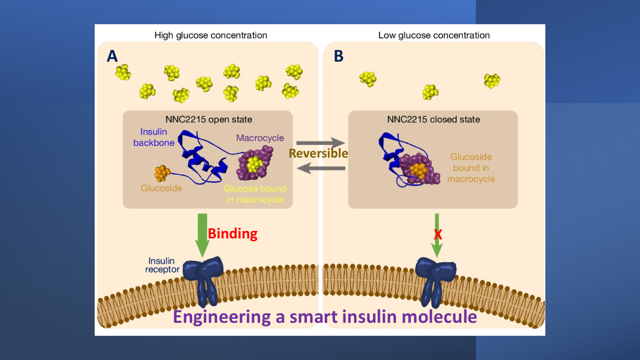

Curiously, after it failed to start production as promised, the Dangote refinery began to import crude oil for refining. The NNPCL explained that it could not supply the refinery with crude because it (NNPCL) has committed its future crude oil to Africa-Export-Import Bank in a $3 billion crude-for-loan deal. The NNPC’s crude swap arrangements for refined products consumed N2.6 trillion in 2021, according to the Nigeria Extractive Industries Initiative (NEITI). The NNPCL is forecasting to meet Dangote Refineries need for local crude in November. The same fate is bedeviling the modular refineries in the country, which are also unable to get crude supplies from NNPCL. As it is, the modular refineries are functional, but incapable of refining the much needed premium motor spirit (PMS).

READ ALSO: Dangote Refinery Has Right Of First Refusal To Nigeria’s Crude Oil – NNPC

An Executive Director of the Dangote Group, Devakumar Edwin, said that the company would import crude from Angola, hoping to start fuel refining by October 2023. This last move tended to break the optimism of many, who are tempted to confirm the hunch that Nigeria has gone beyond a fuel refining jinx to a calculated attempt by some powerful individuals to stop the country from having locally refining capacity. Some people may call this a conspiracy theory or wild guess, but someone is constrained to imagine, if not to think so.

According to the National Security Adviser, Nuhu Ribadu, Nigeria suffers a daily oil theft of 400,000bpd, amounting to about $4 million. NEITI said Nigeria lost N1.96 trillion to oil theft, sabotage, and production adjustment in 2021. The country has suffered this type of loss for over two decades. With a combined daily capacity of 450.000bpd, Nigeria’s four refineries would be okay with the quantity of crude stolen daily.

Borrowing Away Nigeria’s Future

Company income taxes, foreign exchange earnings, local resources and even existing infrastructure are known to have been traded for loans in the past. Under the infrastructure tax credit scheme, major companies are given roads to build over a period. The recent complaints of David Umahi, new works minster, about shoddy road contracts shows that the scheme is flailing. In the midst of it, government’s future Company Income Tax has already been spent. At present, debt servicing alone exceeds government’s revenue, with the stupendous N87 Trillion debt stock achieved by President Buhari, who dug down into the country’s foreign reserves. As a result, Nigeria more than doubled the total naira supply from N21 Trillion to over N55 Trillion between May 2015 and May 2023. No wonder the N1, 000/US$1 exchange may just be a mushrooming financial tornedo.

READ ALSO: State Of Emergency On Southeast Roads…Beyond Umahi’s Tears

Experts have thus forecast a gloomier economic future for Nigeria, which appears to be in the throes of economic pressures by unseen hands. Full privatization of the NNPCL appears to be a way out, barring Nigeria’s omnipresent corruption. The successes of private enterprises such as banks and telecommunication companies in Nigeria are instructive. For now, NNPCL defies imagination in its scale of economic licentiousness.

Dr Marcel Mbamalu is a veteran journalist, Editor and Publisher

Follow on X: @marcelmbamalu

Follow Us