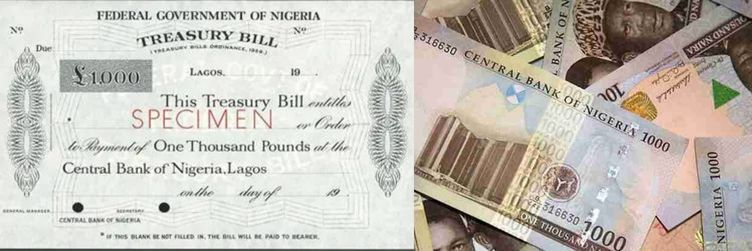

Issuance of the final Nigerian Treasury Bills for 2023 has enabled the Federal Government to raise N6.658 trillion this year, marking a notable 40.4% increase from 2022.

“This surge in Treasury Bill earnings amidst heightened inflation is puzzling,” remarked a banking expert, highlighting the complexity of Nigeria’s economic landscape. “Our inflation rate is caused by the exchange rate, so no amount of monetary policy can affect inflation.”

Join our WhatsApp ChannelDr. Muda Yusuf, Director General of the Centre for the Promotion of Private Enterprises, echoed this sentiment, emphasizing the minimal impact of monetary policy on inflation.

“Theoretically, Treasury Bills mop up excess liquidity to curb inflation, but in reality, their effect is marginal,” Dr Yusuf stated.

Examining the correlation between Treasury Bill earnings, inflation rates, and exchange rates, Yusuf asserted that the overwhelming liquidity injection from Ways and Means financing outweighs the impact of NT bills.

Despite economic disparities, there’s a positive outlook with an influx of foreign portfolio investors in Nigerian securities.

Foreign portfolio participation surged to 23.74% in November, reflecting increased confidence in Naira-denominated securities due to efforts by the Yemi Cardoso-led CBN to stabilize the exchange rate and address FX backlogs.

The interplay between Treasury Bills, inflation, and foreign investments suggests a nuanced economic narrative in Nigeria, challenging conventional economic theories amidst the country’s economic realities.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

Follow Us