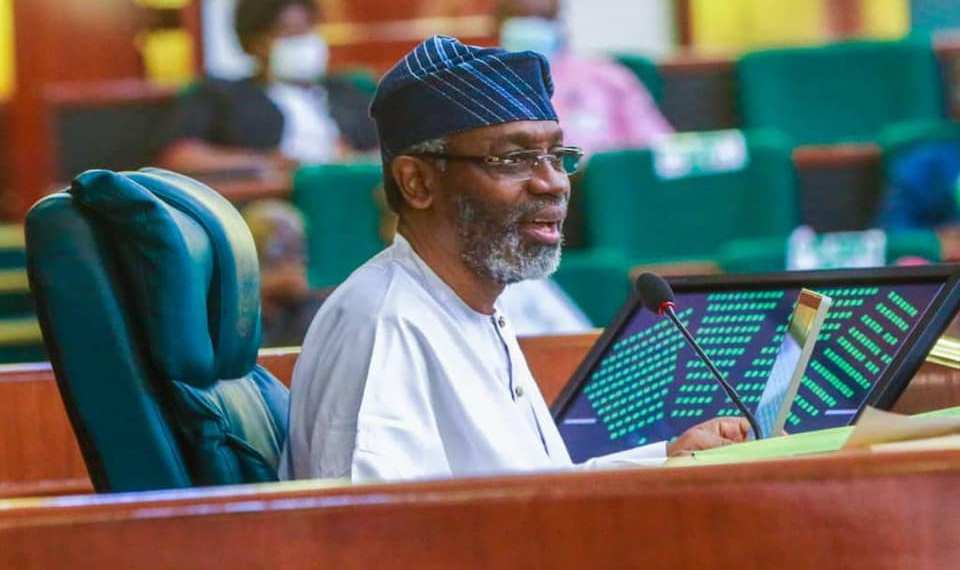

The Nigerian Students loan scheme’s implementation is set to commence within the coming three weeks, as indicated by Femi Gbajabiamila, the Chief of Staff to the President of Nigeria.

He affirmed the administration’s unwavering dedication to its successful execution during his reception of a delegation from the National Association of Nigerian Students at the State House in Abuja, led by Lucky Emonefe, its President.

Join our WhatsApp ChannelGbajabiamila urged Nigerian students to lend their support to the Student Loan Funds policy, stressing its objective to ensure equitable access to quality education for all Nigerian students, irrespective of their socioeconomic status.

He reiterated the President’s resolve to see the initiative to fruition, urging Nigerian students to unite behind it to ensure that no deserving but financially challenged student is overlooked in availing the loan.

READ ALSO:8 Key Facts About The Student Loan Law In Nigeria

Gbajabiamila emphasized, “Mr. President is resolutely committed to its success. We anticipate its launch within the next two to three weeks, as we finalize the necessary details to ensure seamless implementation. Your involvement is crucial for its success as it has been widely endorsed. It aims to rectify the unconstitutional deprivation of education based on birth circumstances.”

Furthermore, he assured the students that the government is prepared to forestall any potential industrial action by members of the Academic Staff Union of Universities (ASUU), asserting ongoing efforts to address the union’s grievances.

Gbajabiamila highlighted President Tinubu’s directives aimed at resolving disputes with academic unions, stating, “We are determined to leave the era of strikes behind us. President Tinubu has issued directives to that effect, and we are striving to prevent future disruptions.”

Somto is an Entertainment Reporter with a passion for uncovering the latest stories in the world of entertainment. As a dedicated journalist, Somto delivers in-depth reporting, exclusive interviews, and breaking news coverage.

She covers a wide range of topics, from celebrity interviews to industry trends and film reviews.

As an Entertainment Reporter for Prime Business Africa, She continues to provide comprehensive and insightful coverage of the entertainment industry, offering readers an insider's perspective on the latest developments and trends. She is a trusted source for breaking news, exclusive interviews, and thought-provoking analyses.

Somto is dedicated to providing valuable information and entertainment to her audience while upholding the highest standards of journalistic integrity.

Follow Somto on social media:

LinkedIn: Somtochukwu Bisina

#EntertainmentReporter #MediaProfessional #Journalism

Follow Us