Africa’s largest economy and most populous country on the continent continues to lag peers in many ways; one of such is the very low insurance penetration, with gross premium of barely N550billion in 2020, some 0.36% of Nigeria’s gross domestic product.

Worse still, the sector shrunk 15.3% in 2020, even as it contributed barely 0.33% to the Nigerian economy. The statistics is quite alarming when put in the perspective of peer countries like Uganda, Ghana, Kenya, Botswana and South Africa where the insurance sector represents some 0.7%, 0.9%, 2.4%, 3.1% and 13.0% of gross domestic product respectively.

Join our WhatsApp ChannelBeyond the size of the economy and population, rising urbanisation and attendant formalization of the labour force is expected to stimulate insurance penetration.

Interestingly, whilst fintechs are yet to dominate the insurance sector, unlike banking, imminent competition and complementarity of technology-based finance companies may be a catalyst and game changer for the sector. As the fintech competition heats up in the banking sector, agile tech-savvy entrepreneurs will search for insurance opportunities, hence reinforcing the prospect for growing the sector’s pie.

Many of the underwriters have woken up to this emerging reality, as reflected in the increasing investment in digital channels. Whilst the repeal of universal banking license a decade ago partly undermined bancassurance, it is gradually recovering, with strong prospect for a rapid take-off, as Nigerian lenders increasingly seek opportunities to offer lifestyle banking to meet fast changing customer preferences.

More so, the pressure from fintechs, especially in the payment space, is stimulating banks’ appetite for new income lines, with target of being one-stop financial supermarkets. Even so banking penetration is also still relatively low, bancassurance can moderate insurance awareness deficits, lower the cost barriers to route-to-market as well as bridge trust gaps. With perhaps the strongest retail penetration in Nigeria, telecommunication companies can be strong partners in driving insurance, especially as incredible telephone penetration provides a fertile distribution channel for underwriters.

Where will the growth come from?

In Nigeria, general insurance, powered mainly by motor insurance and oil & gas, has been the main growth poles for underwriters, with very limited growth in the life and broader retail segments of the sector.

Interestingly, like the evolution of most peer countries, including Asia, the fastest growth over the next decade may likely come from pensions and individual life insurance offerings, even so the imminent double-digit growth projections are partly reflected of the low base effect.

In the non-life space, it would be exciting to watch out the likelihood of double-digit growth in accident, health and property insurance, especially if underwriters make the right partnerships, some of which may need to be pioneered by the regulator. For instance, IRDA, the insurance regulator in India, appointed repositories to dematerialize insurance policies as a measure to improve operational efficiency of underwriters, mitigate the risk of counterfeit policies whilst also protecting policyholders from the consequences of loss of paper documentation, which are essential, especially for mandatory insurance policies.

Notwithstanding the optimism on retail insurance, the prospect for commercial insurance remains attractive, especially as the insurance density and penetration of SME remains low.Perhaps one of the challenges to insurance penetration in Nigeria is the current fragmented structure and relatively low capitalization, which limits the capacity and appetite of insurers to invest in requite distribution channels, advocacy and technologies.

Notably, the new regulation on minimum capital may generate some vibes for the sector, as influx of new capital may be channelled towards developing distribution networks and digitization whilst also investing in marketing and client servicing, all of which are pertinent to driving sustainable growth of the industry. Possible mergers and acquisition and likely entrance of foreign players may also stimulate new shades of competition, which could help accelerate innovation in the industry. However, the sector may remain fragmented.

How much longer can underwriters remain passive with a one-size-fits-all approach?

One of the challenges to underwriting is the blanket pricing and passive risk management approach. Nigerian insurers rarely price inherent insurable risks, rather use a one-size-fits-all approach in pricing products or offerings. For instance, what role does years of driving experience, location, accident and claims history amongst others play in pricing motor insurance? What role does health records, family history, lifestyle and occupation play in pricing life insurance policies? Sadly, unhealthy competition, fragmented structure of the industry, exacerbated by the broker-inclined route-to-market as well as apathy of underwriters to invest in sustainable long-term campaign and strategies capable of driving sustainable growth of the market continue to undermine the pricing capacity of Nigerian underwriters.

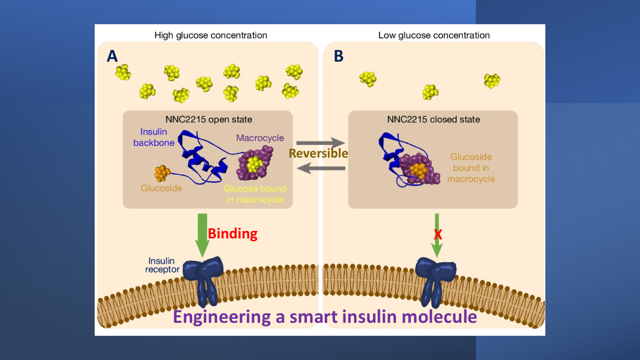

As an industry, players must evolve a mechanism that allows for effective pricing of the true and fair view of inherent risk exposure. This may help to lower the cost of insurance to clients with low risk whilst also encouraging high-risk clients to consciously manage their risk. More importantly, with rising claims ratio and consequent pressure on underwriting margins, insurers need to take more active roles in mitigating risk exposures unlike the current practice of warehousing risks and waiting for claims on exposures.

The investment syndrome; critical issues for innovation

More worrisome is the relatively sub-optimal investment strategy, which has perhaps weakened underwriters to become price-takers in the financial market. With 95% of life insurance portfolios invested in FGN bonds, it is a case of one single source of supply, a phenomenon which exposes long-term insurance carriers to the issuance decisions of the Debt Management Office, especially as the current size of the underwriters undermines their effective participation in secondary market trades. In most peer markets, including African countries like South Africa, Kenya and Morocco, insurance companies, particularly long-term carriers are renowned for championing development of alternative asset markets, with focus on leveraging investment activities to create insurable assets.

Notwithstanding the perceived “risk-free” rating on sovereign instruments, the concentration risk of life insurers’ portfolios need to be addressed for the long-term sustainability of the sector. Beyond the weak pricing influence of insurers in primary market auctions for sovereign papers, the rising debt service burden of the government reinforces the dire need for underwriters to reassess investment strategies.

Whilstthe impact may be marginal, pension funds have partly leveraged their investment philosophies to drive compliance of corporates and sub-nationals to the Pension Reform Act, as PFAs do not invest in instruments of non-complaint entities or state governments. If similar philosophy had been adopted by underwriters, it may have had some impact on compliance to mandatory insurance policies.

In the current interest rate environment, financing long-term investments in the real sector can be beneficial for inter alia to insurance firms, especially life insurers looking to match their long-term liabilities with long duration assets, whilst having a steady investment income stream and the option of secondary market liquidity. More importantly, investments in real sector assets helps to stimulate the velocity of money and create insurable risks, which can help to increase insurance density.

Reversing the weak profitability of Nigeria’s underwriters

Beyond the race to unlock the premium opportunity for insurers, profitability is critical. Except for a few underwriters, most Nigerian insurance firms have very low profitability, as reflected in the single-digit average return on equity of the industry.

Therelatively low profitability partly explains the limiting attraction of the sector to capital providers. The poor pricing of risks, occasioned by competition and the dominant influence of insurance brokers, middlemen who do not take risk but undercut underwriters’ margin, is one of the many reasons for the sector’s low profitability. In addition, most insurance players focused mainly on the underwriting segment of the business, neglecting the equally important role of investment management – insurance is like a scissors and the investment management side of the business is as important as the underwriting segment. This fact is particularly important for long term carriers, whose profitability is mainly driven by the success of the investment management arm of the business.

Quite surprising, Nigerian life insurance companies have been less profitable, a contrast to the impressive performance of peers in other markets. Amongst several factors, which perhaps includes the scale and scope of operation of Nigerian long-term underwriters, a salient factor undermining profitability is the paucity of requisite investment assets and perhaps sub-optimal investment strategies.

Paradoxically, life insurance companies are carriers of long-term risks and associated contingent or real liabilities, but invest in short term assets, an absolute duration mismatch which tend to hunt underwriters, as reinvestment risk crystalizes through the volatile economic cycles.

Anecdotally, annuity offerings are less attractive in current negative real rate environment where inflation rate is well above interest rate, even so previously written annuities at elevated interest rates present key risk to the underwriters, as returns on investments wane in contrast to rising liabilities, a challenge which continue to weigh down the sustainability of some long-term underwriters. More worrisome, product pricing is largely influenced by similar sentiments, with the primary focus on current market trends in taking long term decisions.

Understandably, the paucity of investable assets is a key constraint to life insurers, just as pensions and traditional asset managers, albeit there are increasing opportunities for life insurance companies in alternative assets, including infrastructure assets, mortgage, REIT and direct exposure to real estate assets.

Interestingly, unlike the current practice of offloading premium to the government, through an overweight investment in FGN bonds and treasuries, alternative assets tend to have a feedback effect in the form insurable interest. For instance, an investment in infrastructure asset generates insurable risks, which in turn provides opportunity to grow premium and insurance density. Unlike investment in sovereign instruments which has little or no multiplier effect for the business sector, especially in Nigeria, where public sector borrowing is partly used in funding recurrent expenditure, which has no positive impact on economic growth and development.

Whilst a genuine concern of insurance firms in exposing portfolios to alternative asset classes is the credibility of the project sponsors and viability of assets, the recent initiatives of a number of intermediaries such as credit guarantee companies like InfraCredit have partly demystified the risks and simplified the process of investing in alternative asset classes, in addition to offering opportunities for exposure to quality investment-grade assets. Similarly, non-traditional Funds such as Infrastructure Funds offer the benefit of experience to insurance firms in participating in impact projects that can potentially enhance insurance density.

See also:

Follow Us