Value Added Tax (VAT) collection in Nigeria has continued to record significant improvement over the years.

VAT is a consumption tax levied on value added to goods and services at each stage of production and distribution. It is applied to most goods and services in Nigeria. However, there are some exemptions, including basic food items, medical and pharmaceutical products, educational materials, and services rendered by microfinance banks. The Federal Inland Revenue Service (FIRS) has stepped up its drive towards collection of VAT and other taxes in recent years as non oil revenue continues to dwindle.

Join our WhatsApp ChannelAccording to data published by the National Bureau of Statistics (NBS) during the weekend, VAT increased on a quarter-on-quarter basis by 19.21 per cent from N1.20 trillion in the fourth quarter (Q4) of 2023 to N1.43 trillion in Q1 2024.

Out of this sum, the report said N663.18 billion was record as local payments, N435.73 billion was from foreign VAT payments, while import VAT contributed N332.01 billion in Q1 2024.

READ ALSO: Top 5 Nigeria’s Sectors that Paid Highest VAT In 2023

“On a quarter-on-quarter basis, accommodation and food service activities recorded the highest growth rate with 59.15 per cent, followed by the activities of administrative and support with 47.79 per cent. On the other hand, activities of extraterritorial organisations and bodies had the lowest growth rate with –57.01 per cent, followed by Human health and social work activities with –27.73 per cent,” the NBS report added.

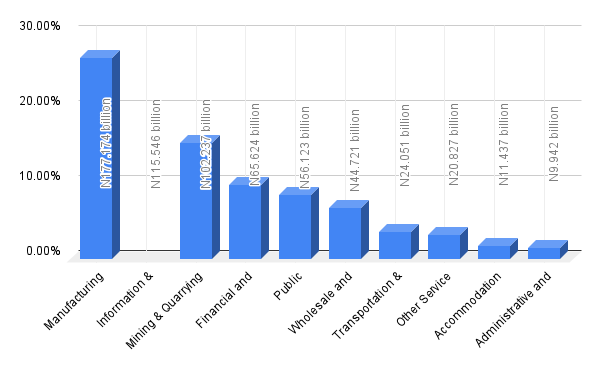

In terms of sectoral contributions, while some emerged top contributors, others scored very low reflecting challenges in the business environment in the country. Here are the top 10 performing sectors in terms of the size of VAT in Q1 2024:

1. Manufacturing

The manufacturing sector contribution to VAT was N177.174 billion in Q1 2024. This represents 26.72 per cent. The manufacturing sector has retained its status of highest contributor to VAT in the country. The outcome reflects an increase of 11.50 per cent from the previous quarter which was N158.902 billion. This feat in VAT was recorded despite challenges in the manufacturing sector such as energy costs, infrastructure, access to raw materials and general cost of production among others. Over the years, there have been calls for concerted efforts to address challenges in the environment and boost local production both to serve domestic demands and have excess for export that would attract foreign exchange earnings.

2. Information and Communication

Information and Communication came second in terms of sector contribution to VAT in Q1 2024 with 17.42 per cent. The sector recorded N115.546 billion in Q1 2024 against N120.290 billion in Q3 2023. This reflects a decrease of -3.94 per cent from the previous quarter. The sector has shown rapid progress in recent years largely driven by activities in the telecommunications sub-sector.

3. Mining & Quarrying

Mining & Quarrying activities contributed N102.237 billion (15.42 per cent) to VAT in Q1 2024. This was an increase of 7.73 per cent from N94.903 billion recorded in Q4 2023. In the last one year, there has been increasing attention to the Mining sector by the President Tinubu administration which has been harping on scaling up activities in the sector in line with the country’s quest for economic diversification. There are, however, challenges in the mining sector that have hindered it from achieving the potential of being a major hub for revenue earner to the country which need to be addressed.

4. Financial and Insurance Activities

The data showed that VAT paid under the Financial and Insurance activities sector amounted to N65.624 billion therefore contributing 9.9 per cent. When compare to Q4 2023 figure of N58,837.50, it increased by 11.54 per cent. The sector is also experiencing some challenges such as integration of fintech, cyber security threats, and regulatory compliance. The banks are faced with challenge of raising their capital base within next two years or take the option of downgrading to a lower category or merge with another bank when they cannot meet the capital requirement 31 March 2026. The recapitalisation requirement is to strengthen the banks capacity to support the Nigerian economy but some banks may find it difficult at the end of the day in meeting the target.

5. Public Administration and Defence, Compulsory Social Security

The VAT contribution for this sector in Q1 2024 was 8.5 per cent. On a quarter-on-quarter basis, it decreased by -3.53 per cent from N58.178 billion in Q4 22023 to N56.123 billion in Q1 2024. This suggests a slight drop in government expenditure in the first quarter of 2024. However, there are still concerns about cutting cost of governance and addressing bureaucratic inefficiency to allow room for improvement that comes with greater benefits.

6. Wholesale and retail trade, repair of motor vehicles and motorcycles

VAT contribution for this sector in Q1 2024 was 6.74 per cent. On a quarter-on-quarter basis, it rose by 7.10 per cent from N41.756 billion in Q4 2023 to N44.721 billion.

7. Transportation & Storage

Transportation & Storage sector came seventh with 3.63 per cent contribution to VAT. It recorded an increase of 7.16 per cent from N22.443 billion in Q4 2023 to 24.051 billion in Q1 2024.

The sector which is at the epicentre of driving socioeconomic activities in the country has been at the receiving of the sharp spike in the costs of petrol, diesel and spare parts. This consequently led to hike in fares to different destinations thereby contributing to high inflation in the economy.

8. Other Service Activities

This sector recorded N20.827 billion in Q1 2024 which is 3.14 per cent contribution to VAT. It however decreased by -4.75 per cent from N21.867 in Q4 2023.

9. Accommodation and Food Service Activities

The contribution of this sector to VAT in Q1 2024 was 1.72 per cent. The data show that there was a significant 59.15 per cent increase from N7.186 billion in Q4 2023 to N11.437 billion in Q1 2024.

10. Administrative and Support Service Activities

This sector came tenth with 1.5 per cent contribution to VAT in Q1 2024. Like Accommodation and Food service activities, this sector also witnessed a significant rise from N6.727 billion in Q4 2023 to N9.942 billion in Q1 2024.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Follow Us