Pan-Africa housing development financier, Shelter Afrique has received USD7.15 million in additional capital subscription from the Federal Government of Nigeria.

The additional stake now takes Nigeria’s shareholding to 15.8 per cent, one-percentage point behind top shareholder Kenya, which currently stands at 16.85 per cent.

Join our WhatsApp ChannelThe other top three shareholders of Shelter Afrique whose shareholdings now change include African Development Bank (AfDB), which now stands at 12.16 per cent down from 12.71 per cent; Mali at 5.3 per cent down from 5.54 per cent; and Ghana at 5.05 per cent down from 5.28 per cent.

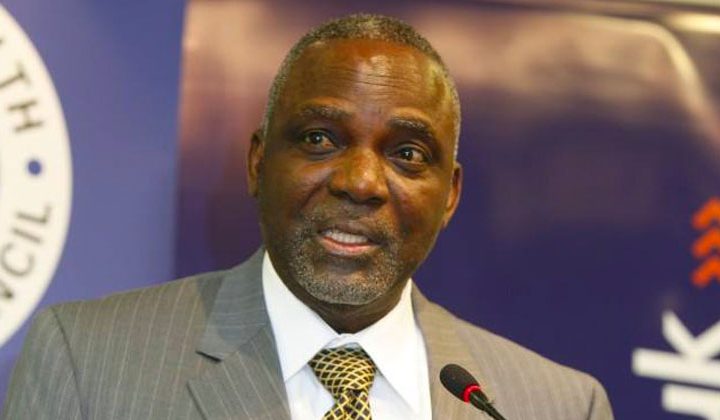

Shelter Afrique Ag. Managing Director & Chief Finance Officer, Kingsley Muwowo while applauding the government of Nigeria for its show of confidence in the institution, said the move now places the country in a good position to become the largest shareholder in Shelter-Afrique when the country fully meets its capital commitment.

“We are grateful to the government of Nigeria for their continued support and the importance they have placed on affordable housing. We are especially grateful to the Honourable Minister for Works and Housing, Babatunde Fashola, Honorable Minister for State, Engineer Abubakar Aliyu, and Honorable Minister for Finance, Dr. Zainab Shamsuna Ahmed, for their long term support and for honouring this significant payment. Additionally, we appreciate Nigeria’s active shareholder and board participation,” Mr. Muwowo said.

The relationship between Nigeria and Shelter Afrique has been growing in recent years. In September 2020, the institution received US$9.4 million additional capital subscription from Nigeria.

Fund-raising Efforts

Other countries that have so far ramped up capital subscription in the Pan-African housing development financier in 2022 are Swaziland and Burkina Faso which paid USD317,854.54 and USD34,610.00 respectively, for additional stakes.

“So far, we have received $7,504,295.45 in additional capital from member States within the last six months of 2022. We are grateful to our shareholders for this much needed capital injection which will go a long way in strengthening the capital structure of the Company to support the ongoing fund-raising efforts to raise additional debt capital required to support project pipeline which now stands at US$1 billion across 44 member countries,” Mr. Muwowo said.

Shelter Afrique recently completed a debut ₦46 billion (US$110.7 million) Series 1 Fixed Rate Senior Unsecured Bond Issuance in Nigeria’s capital market under its ₦200 billion (US$481.3 million) bond issuance programme for housing and urban development in Nigeria.

The Company plans similar bond issuance in East African markets including Kenya, Uganda, Tanzania and Rwanda.

Victor Ezeja is a passionate journalist with six years of experience writing on economy, politics and energy. He holds a Masters degree in Mass Communication.

Follow Us