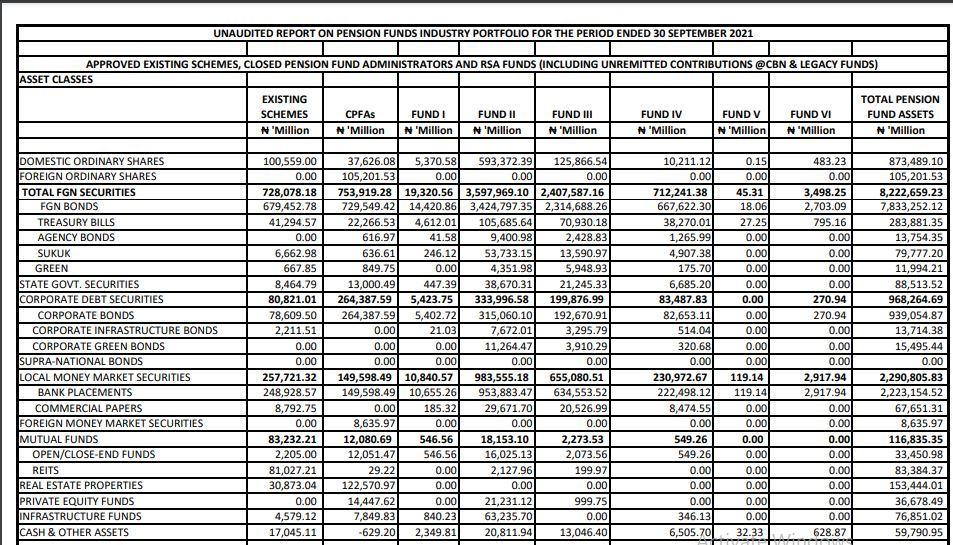

Nigeria’s federal and subnational governments have, so far, borrowed N8.311trillion, representing 63.93% of the N13.001 trillion total pension assets in the country and raising serious concerns among pensioners as well as Nigerian economists and business lawyers.

The borrowed amount represents National Pension Commission’s investments in federal and state governments’ Bonds and far exceeds the public sector’s own contributions to the scheme, according to PenCom’s monthly data as at September 30, 2021.

Join our WhatsApp Channel

Indeed, this is far beyond the total contribution to the pension funds by the public sector, reinforcing the fact that funds belonging to private sector workers are now being borrowed by government, exposing them to risk of fiscal constraints, as elevated debt servicing burden of national government reinforces concerns of pension subscribers regarding availability of their funds at retirement.

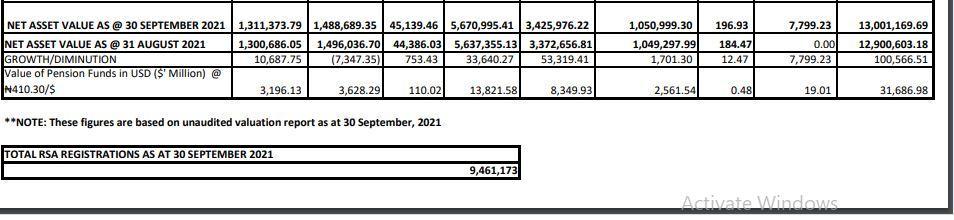

Total pension funds assets stood at N13.001 trillion, a growth of N100.566billion or 0.78% from the N12.900 trillion funds under management as at 31 August 2021.

The total funds, which spread across six different funds, namely Funds I to Funds VI as well as the funds under management of Closed Pension Fund Administrators (CPFA).

Notably, about N5.671trillion, or 43.6% of the total pension funds, is classified under Fund II, which is the default fund for contributors aged 49 years and below. Second in size is Fund III, which accounts for N3.426trillion or 26.4% of the total pension funds in the country and which is also the designated funds for contributors aged 50 and above.

Interestingly, whilst there are restrictions on investment of pension funds in variable assets like equities and alternative assets, there are no limits on what pension funds can invest in Sovereign Instruments such as Federal Government Bonds (FGN Bonds), FGN Sukuk Bonds, and Treasury Bills, hence, tilting the investment of pension assets largely in favour of government-backed instruments.

Interestingly, as at 30 September 2021, a total of N8.223 trillion or 63.24% of pension funds had been invested in FGN securities, ranging from FGN Bonds to Sukuk, Treasury Bills and Green Bonds.

The funds, however, invested in real estate properties as a fraction of the total pension fund assets decreased to 1.18 per cent or N153.44 billion from 1.24 per cent or N156.88 billion in the period under review.

Business Lawyer and investment analyst, Mazi Okechukwu Unegbu, in an interview with Prime Business Africa on Monday, said: “Part of the rule is that the investment should be in diverse areas, not in government bonds alone, even though the government bond appears to be safe but the return may not be as expected. What is important is the safety and yield of an investment.

“To be very candid, I don’t think they are allowed to invest in government bonds because the government appears to be cornering every fund available to the system.

“They force you to buy their assets when the law does not allow it; this is the problem, but I expect that Pension Commission should revolt against and if possible go to court and obtain a rule that their funds cannot be invested in government bond.

He, however, noted that PenCom investing in government bonds deprives the private sector of needed funds for investments.

According to him, “That is one negative implication of PenCom investing in government bonds. Another negative factor is that, although there is no doubt that government will be able to pay, the problem is that, with what is happening now, PenCom might not be assured, because if at the time they want the money they don’t get it, then the investor is shortchanged and there is no way you can tell the PenCom investor to hold on because these are the retired people who probably are old.

“There is no way you can do it if they decide not to pay people because government has not paid them. But I know that government can always pay. Sovereign debt is often very secure, but in Nigeria, we are no longer sure that sovereign debt is as secure as it used to be.

“The beauty of PenCom money is that people keep contributing every month, with that, it will be difficult to have a liability that cannot pay. That is the beauty of PenCom; every month, a lot of funds go into PenCom.

On his part, another business lawyer, Chuks Nwachukwu, said that ordinarily there would be no worry about government borrowing pension funds, but the idea of government feeling distressed and pouncing on the pension fund raises concern on how the economy is designed.

Nwachukwu told Prime Business Africa that government ought to make legal provisions for the kinds of investments that pension funds can be put into in order to ensure they are not lost, adding that investing the fund plays a role in stimulating the economy, but for government to borrow the funds is not a good practice.

His words, “I feel that it is an untidy situation. Pension funds should be made to run as designed and if, for any reason, it is perceived that some funds are still lying idle, it is to make an additional position as to how the funds should be deployed so that they do not stay idle.

“Really, I am uncomfortable with the government saying they need money and would be going to borrow pension funds.”

He advised the government to make provisions for how the funds could be profitably utilized by the investing public, not by government itself.

“If it takes away investible funds, then what are business firms going to fall back on. Pension funds are part of the sources of long-term funds.

“If it takes away the long-term funds, what is left for the private sector? This is where I have concerns. I think that this is a panicky measure from the government and nothing comes out of panicky measures.”

On the Pension Act, Nwachukwu said, there is the need for reform of some aspects of the Act to accommodate the real needs of pensioners.

Follow Us