Nigeria’s equity market again experienced a decline on Tuesday as Nestle Nigeria, United Capital, Africa Prudential, Academy Press, and Thomas Wyatt emerged top 5 losers.

Nestle Nigeria had a decline of N90, or 9.78 per cent, from N920 to N830. United Capital’s share price fell from N37.80 to N34.05, meaning it lost N3.75, or 9.92 per cent, and Africa Prudential’s share price fell from N10.45 to N9.45, meaning it lost N1, or 9.57 per cent. Thomas Wyatt dropped by 9.72 per cent from N 2.16 to N 1.95; Academy Press Plc dropped by 9.60 per cent from N1.98 to N 1.79.

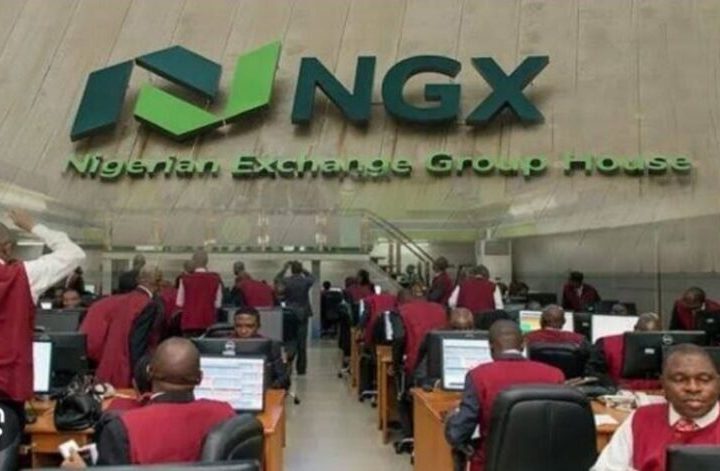

Join our WhatsApp ChannelThe stock market decreased by 0.31 per cent or N171 billion on Tuesday, 30 July 2024. It dropped by 0.07 per cent at close of trading on Monday, 29 July 2024.

The Nigerian Exchange Limited (NGX) All-Share Index (ASI) and Market Capitalisation decreased further from Monday’s trading of 98,132.15 points and N55.716 trillion respectively to 97,830.65 points and N55.545 trillion.

The stock market’s year-to-date (YtD) return decreased to 30.84 per cent.

Investors traded 399,385,857 shares valued at N8 billion in 10,447 transactions. Actively traded stocks on Tuesday were Zenith Bank, Prestige Assurance, UBA, Veritas Kapital Assurance, and United Capital.

Prime Business Africa reports that the Nigerian stock market dropped below 100,000 points at the close of trading last week. Analysts attributed this to profit-taking in some blue-chip stocks by investors who grapple with macroeconomic policy changes, including the monetary policy rate hike by the CBN on Tuesday last week and a 70 per cent windfall tax on foreign exchange revaluation gains of banks.

The ASI fell by 2.33 per cent to close at 98,201.49 points, while the market capitalisation closed at N55.6 1 trillion with 31.33 per cent YTD on Friday, 26 July, 2024.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Excellent piece! Your analysis is insightful, and I found it easy to follow up with the data you provided. I value the time and energy you invested in gathering information and composing this. If you want to learn more about the subject, this is a great book to read.

Temp Mail very informative articles or reviews at this time.