In line with its quest to ensure adequate circulation of the newly redesigned naira banknotes, the Central of Nigeria (CBN), has launched a cash-swap programme to serve people in rural and underserved areas across the country.

This was confirmed in a circular released on Friday, jointly signed by the CBN’s Director of Banking Supervision Department, Haruna Mustafa, and Director of Payments System Department, Musa Jimoh.

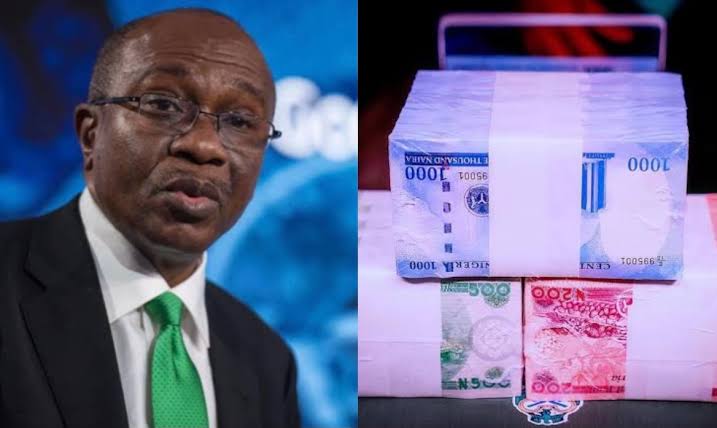

Join our WhatsApp ChannelPrime Business Africa reports that this initiative is to fasten the circulation of the newly redesigned ₦1,000, ₦500, and ₦200 notes as the CBN has insisted on the January 31 deadline for phasing out the old currency notes.

The apex bank has despite pressures to extend the deadline, maintained that the three currency notes will cease to be a legal tender by January 31, 2023.

The cash swap programme which is between CBN, Deposits Money Banks (DMBs), and Super Agents would begin on January 23 2023, to exchange the new naira notes with old notes.

The apex said the programme will focus on rural and underserved areas in the 36 states across the federation.

According to the circular, the cash exchange shall be a maximum of 10,000 per person.

It said: “In recognition of the need to maximise the channels through which underserved and rural communities can exchange their Naira, the Bank is launching a cash swap programme in parthership with Super Agents & DMBs. The programme enables citizens in rural areas or those with limited access to formal financial services to exchange old Naira notes for redesigned notes.

“The old ₦1000, ₦500, and ₦200 notes can be exchanged for the newly redesigned notes and/or the existing lower denominations (₦100, ₦50 and ₦20, etc.), which remain legal tender.

“The agent shall exchange a maximum of N10,000 per person. Amounts above N10,000 may be treated as a cash-in deposit into wallets or bank accounts in line with the cashless policy. Should capture customer’s BVN, NIN, or Voter’s card details as much as possible.”

It further stated that to promote financial inclusion, the service is also available to anybody without a bank account.

“Agents may, on request instantly open a wallet or account, leveraging the CBN Tiered KYC (Know Your Customer) Framework. This will ensure that this category of the populace are able to exchange or deposit their cash seamlessly without taking unnecessary risk or incurring undue cost.

“Agents shall sensitize customers on opening wallets/ bank accounts and the various channels for conducting electronic transactions.

“Designated agents are eligible to collect the redesigned notes from DMBs in line with the Revised Cash Withdrawal Limit policy. Agents are also permitted to charge cash out fees for the cash swap transactions but prohibited from charging any further commissions to customers for this service,” CBN circular indicated.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Follow Us