A grim forecast by Bloomberg L.P. has surfaced, signaling a continued slump of the Naira throughout 2024.

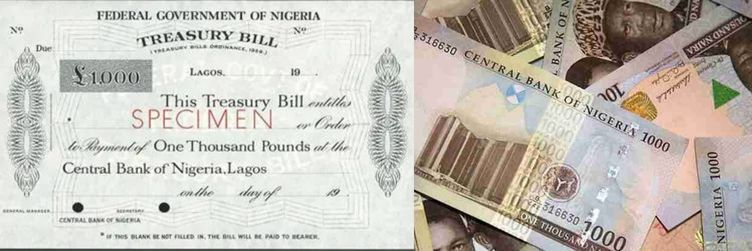

This prediction comes after the currency experienced a 55% decline in the past year, plummeting to approximately N1,043 per dollar, ranking it among the worst-performing currencies globally.

Join our WhatsApp Channel“This downward trend poses grave concerns for Nigeria’s economy,” remarked an analyst at Bloomberg.

The Naira’s slide to a new low against the dollar, crossing the N1,000 per dollar threshold, heightens these worries.

The situation is compounded by the revelation of a six-year low in foreign reserves, partly due to short-term overseas commitments.

“President Bola Tinubu’s reforms, particularly the forex rate unification, have contributed to this devaluation,” noted Vetiva Capital Management Ltd.

They stressed the need to attract international investors or boost oil production to reverse this downward spiral.

Patrick Curran, a senior economist at Tellimer Ltd, emphasized the necessity of further devaluation and tighter monetary policy to restore stability in the FX market.

“The road to recovery might involve increments in external reserves, increased foreign exchange inflows, and a reduction in money supply,” according to a recent market analysis.

With uncertainties looming, experts underscored the urgency for proactive measures to mitigate the Naira’s decline and its potential repercussions on the nation’s economic landscape.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.