MTN Nigeria and Airtel Africa Plc have received approval in principle to operate a Payment Service Bank (PSB) in the country.

The two leading telcos disclosed in regulatory filings on the Nigerian Exchange Limited (NGX) on Friday, November 5.

PSB operators provide financial services through digital means to low-income earners and people that do not use banks or banking institutions for transactions.

Join our WhatsApp ChannelAirtel will operate PSB via its Smartcash Payment Service Bank Limited while MoMo Payment Service Bank Limited will be MTN’s PSB. The essence is to bring more people into the financial inclusion space.

It was learnt that about 36 percent of the adult population, representing 38 million citizens, do not have access to financial services in Nigeria.

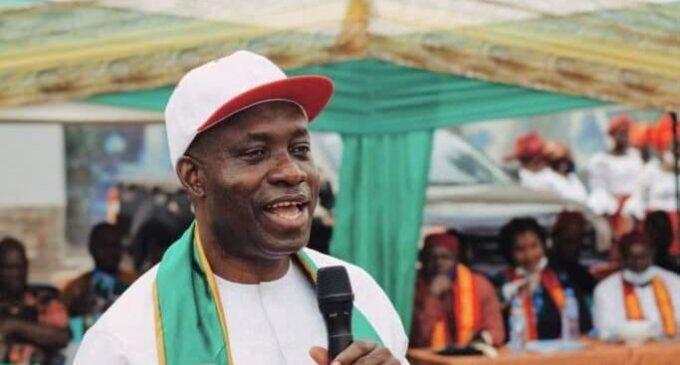

Segun Ogunsanya, CEO, Airtel Africa, said: “I am very pleased that Smartcash has been granted an approval in principle to operate a service bank business in Nigeria. We will now work closely with the Central Bank to meet all its conditions to receive the operating licence and commence operations.

“The final operating licence will enable us to expand our digital financial products and reach the millions of Nigerians that do not have access to traditional financial services.

“I am looking forward to working closely with the Government, the Central Bank and traditional financial institutions to expand financial inclusion and meet the evolving needs of our customers and the economy.”

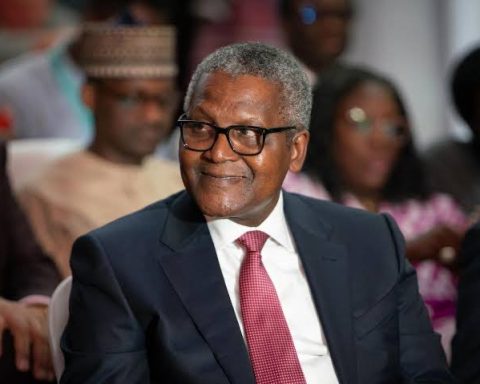

On his part, Uto Ukpanah, company secretary at MTN Nigeria, said, MTN Nigeria remained optimistic that it would eventually get the PSB licence.

“This is the first step in a long process that would lead to eventual approval. In other words, MTN Nigeria would be required to fulfil a number of conditions, even as ‘the decision to issue a final approval is firmly within the regulatory purview of the CBN’.”

“MTN Nigeria expressed optimism that it would eventually get the PSB license, and reaffirmed its commitment to the financial inclusion agenda of the CBN in Nigeria.”

This medium gathered that the two firms would be required to fulfil some conditions before CBN will grant an operating license.