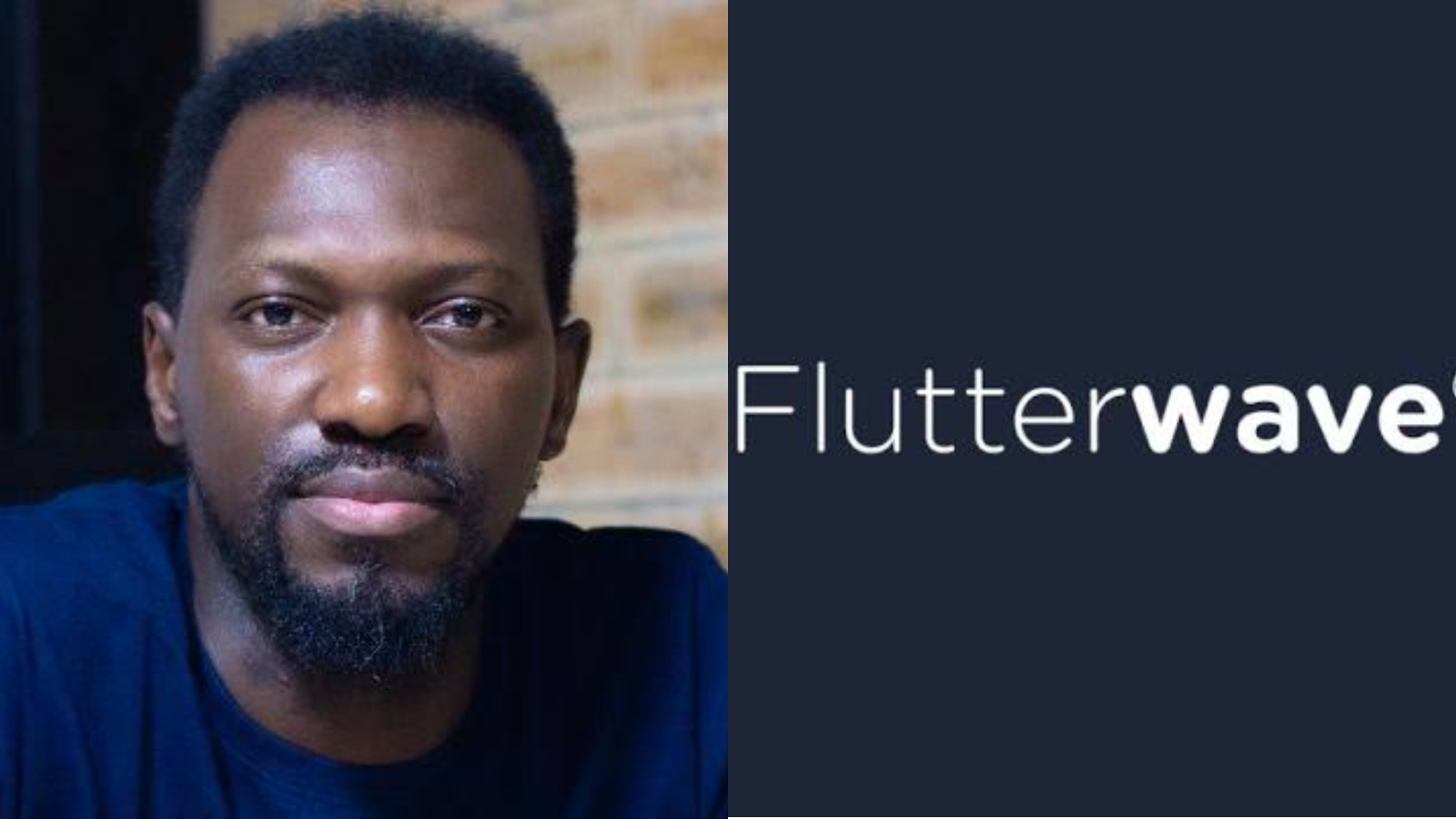

Cross-border payment tech startups, Flutterwave and Chipper Cash, have been operating in Kenya without license from the financial authority, the government has disclosed.

The governor of the Central Bank of Kenya, Patrick Njoroge, said Flutterwave shouldn’t be operating in the country because the Nigerian tech unicorn doesn’t have license to operate remittance or payment service.

Join our WhatsApp ChannelNjoroge said this on Thursday while speaking to Journalists in Kenya. He said the same applies to Chipper Cash, “Flutterwave is not licensed to operate as a remittance provider or, for that matter, as a payments service provider in Kenya.”

The central bank chief affirmed that, “They are not licensed to operate, and therefore they shouldn’t be operating, and Chipper Cash, we could also say the same.”

CBK’s disclosure comes three weeks after the Kenyan authority, Asset Recovery Agency (ARA), accused Flutterwave of money laundering, after 185 bank cards, with similar card numbers made payment to the tech firm.

It was gathered that Flutterwave’s Kenyan operation once received about N43.6 billion between 2020 and 2022, with the purpose concealed.

Kenyan authority said, though Flutterwave claimed to operate its business to facilitate payment between customers and merchants, however, the funds were not remitted to them, instead, they were sent to different accounts.

Although Flutterwave denied the allegations on money laundering and card fraud, stating, “Claims of financial improprieties involving the company in Kenya are entirely false, and we have the records to verify this.

“We are a financial technology company that maintains the highest regulatory standards in our operations.

“Our anti-money laundering practices and operations are regularly audited by one of the Big four firms. We remain proactive in our engagements with regulatory bodies to continue to stay compliant.”

Follow Us