Nigeria’s two main political parties – the All Progressives Congress (APC) and the opposition People’s Democratic Party (PDP) – will rake in more than N60 billion from the ongoing sale of nomination and expression of interest forms, inside sources told Prime Business Africa at the weekend.

There are at least 20 presidential aspirants in both the PDP and the APC who have either publicly declared interest to run for the presidency or preparing to declare their intentions. About 30 percent of them have paid the mandatory fees and collected the forms. Others are in a rat race to beat deadlines in view of the public holiday.

This multimedia newspaper confirmed 11 APC presidential aspirants likely to pick forms, six (five males and a female) of which had already collected as of May 1, 2022; just as 84 governorship forms were also issued out after payments were confirmed, according to impeccable sources. It was also gathered that the number would have significantly increased by close of business on Friday as the Finance Department of the party was yet to confirm many other payments.

Join our WhatsApp ChannelREAD ALSO: Ribadu On Lesser Hajj Sends Aide To Pay N50m For Adamawa Governorship Form

Already, the APC is said to have collected more than N11 billion few days after the exercise began. The amount is expected to be quadrupled across all elective positions in two of the leading political parties – APC and PDP. Those familiar with the processes said the figure is sure to hit about N30 billion at the end of the process in APC.

Each of political parties will conduct primary elections for one presidential ticket, 30 gubernatorial ticket (one in each of the 30 states), 469 federal constituencies across 36 states and the FCT (Senate: 109, Representative: 360), and over 650 State Houses of Assembly in 30 states. Unlimited number aspirants are showing interest and purchasing forms for each of these positions, making payments through Nigerian banks to inject liquidity into the economy. Party Delegates are also to purchase forms to be able to vote for candidates.

Presidential and governorship forms in the ruling party go for as high as N100 million while governorship forms are sold for half the amount at N50 million.

Although at N40 million, the PDP sells its presidential forms for less than half of the amount, source within the party believes that the opposition party would also gather as much as N30 billion or even more, given that it does not offer waiver for women as APC did.

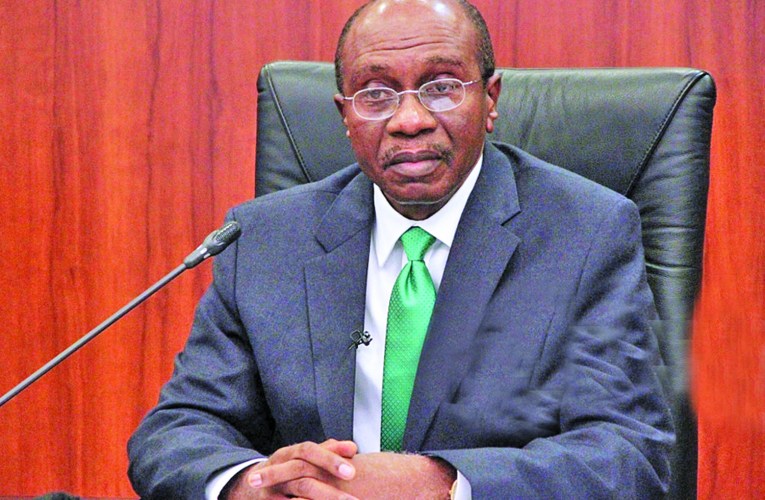

Banks are funding the acquisition process and the volume of transaction which the political activity will generate in the economy is now a concern to experts, with regards to containing the skyrocketing double-digit inflation. The situation will require a strategic action from the central bank to curb the impending worsening of the inflation rate.

Nigeria’s annual inflation rate climbed to 15.92 per cent in March 2022 from 15.70 per cent in the prior month, the fastest rise in consumer prices since November 2021 as election year beckons. The skyrocketing prices, fueled by higher cost of diesel that drives productive activities and the ongoing Russia-Ukraine war, are majorly worsened by political activities as the election year approaches.

At least $50,000, approximately N30 million as officially admitted, was reported to have been stolen in front of the Secretariat of one of the political parties as candidates were purchasing nominations forms worth tens of millions of Naira in Abuja. The rush by aspirants and their supporters which precipitated the loss of the $50, 000 at the entrance of the party’s secretariat reportedly forced the party to move some of the activities to the International Conference Center.

Prime Business Africa reports that both political parties are almost overwhelmed by volume of requests for nomination forms as Nigeria marks Eid-el-Fitr holiday and Workers’ Day, a situation that defies the current economic hardship the country faces.

‘‘I wonder how and where our politicians are getting the money. How can an obscure politician, who does not even have any chance of winning an election in his village, raise N50 million to pay for governorship form,’’ a leading politician told Prime Business Africa at the weekend.

‘’It shows you that there is no productive activity except probably corruption; politics, therefore, becomes the only thriving business.’’

It was gathered that banks were falling over themselves in Abuja late last week to convince APC leaders to designate their branches to receive payments for Presidential, Governorship and National Assembly forms.

Meanwhile, bank credit to the Nigerian private sector, according to a report by the Central Bank of Nigeria (CBN), rose to N36.37 trillion as of March 2022, representing N1.18 trillion net new loans to the real sector in the first quarter of the year.

Also, credit to the government also increased by N2.99 trillion in the review period to stand at N16.32 trillion as of March 2022, while currency in circulation declined slightly by N79.56 billion in Q1 2022.

Speaking on the liquidity in the country’s economy ahead of the party primaries, a development economist, data scientist, and project finance expert, Dr. Bongo Adi, said politicians are always prepared for the period of elections.

Dr. Adi of the Lagos Business School (LBS),who is also the Board Chairman of Newstide Publications Limited, noted that businesses that deal in consumables, branded outfits, print, and digital services, and investment assets are expected to benefit from the increased liquidity.

Speaking on the current state of inflation, he explained that the situation has always been the same in every election year.