The 18-storey apartment building being developed by the Akwa Ibom State government in Victoria Island, Lagos, will be constructed by Western Legacy Construction Limited. The three major consultants to the project are Tony Ndah, a quantity surveyor; Murray Ekong, a structural engineer, both based in Lagos and Victor Akpan of FOVAK Architects, Uyo-based architect. I am pleased that Akwa Ibom professionals are fully involved in the project. I know Ndah and Ekong very well; they’re my childhood friends and high school classmates. I can vouch for their expertise and professionalism.

But will Ibom Towers be profitable? What are the benefits to the ordinary Akwa Ibom citizens and why was Lagos chosen for this project? I spent the last few days talking to people in the Lagos property market just to understand the economics of this project. I also spoke with Governor Umo Eno on the source of funding for the project and other issues. Legacy Construction is a Lagos-based construction company with a considerable experience in developing luxury apartments and renovation of rundown buildings. Its recent work is the restoration of the dilapidated pre-independence Ibadan-based Premier Hotel into a modern facility.

Join our WhatsApp ChannelIn the high-end luxury property market, the return on investment is generally around 30 per cent, according to those I spoke with. ROI is simply a monetary value of an investment versus its cost. (The formula is profit minus cost divided by cost). For Ibom Towers, the 32 apartments should net at least N80 billion to cover all the associated costs, including documentations, legal, consultancy, approvals as well as the contract sum. Generally, luxury apartments in Lagos are priced in dollars or the Naira equivalent. Developers like the Chagoury Group who are behind the Eko Atlantic project typically ask for payments in dollars, despite the legal implications of transacting in foreign currencies in the country.

The group has a high-rise apartment structure down the road from where Ibom Towers is located and each four-bedroom flat costs between $4 million and $4.5 million; one-bedroom penthouse apartments go for as high as between $2.5 million and $3 million. Zenith Bank Chairman, Jim Ovia, is currently developing luxury apartments about a kilometer from Ibom Towers. It is located next to his iconic event place, the Civic Center. Known as Quantum Towers, Chief Ovia’s apartments are also being priced in dollars.

In terms of facilities, design, aesthetics and the amenities, Ibom Towers is expected to compete favourably with the Chagoury and Quantum projects. Ibom Towers has ten one-bedroom flats; ten two-bedroom; nine three-bedroom and three penthouses. The government is yet to decide on the selling prices of these apartments, but “we shall work with competent estate agents to have the best bargains,’’ according to the governor. At today’s market conditions, the government could generate up to $80 million (N128 billion) from the sale of the 32 apartments, in addition to the rentals from the restaurant and office facilities whose ownership would be held by the government. But how will this project be funded? Is the governor borrowing?

By December 2023, Akwa Ibom State owed N190.7 billion, down from N219.26 billion, according to DMO. The state is paying down on its domestic debt stock, unlike others whose obligations are on the rise. I had this at the back of my mind when I met Pastor Umo Eno in Lagos on Thursday. “I will not borrow a kobo to build Ibom Towers; the government has the money to fund the project and it is in a dedicated account,’’ he told me. Eno spoke of his intentions to pay down on existing debts, including the debts incurred to fund the first set of Ibom Air’s aircraft.

His words: “Ibom Air will soon break even. They are doing very well, but their only problem is the bank charges on the initial loans they took to acquire the first set of planes. As you know, the state government recently acquired two Boeing planes and on Friday (November 1), we are unveiling another two planes. The government paid cash for these four planes. I have no intention of borrowing as I will continue to use the people’s money as prudently as I can.’’

READ ALSO: Ibom Towers In Lagos: Searching For Alternative To Crude Oil

In between interruptions from other visitors, I tried hard to squeeze as many questions as possible into the 30 minutes I spent with Governor Eno. I asked him why the government has opted to outright sale of the apartments instead of leasing them. He reasoned that putting tenants in a building entails a lot of maintenance costs which offset whatever profits could be made. “You will be dealing with huge maintenance costs and tenement rates and other unforeseen problems if you do leasing’’, he said, but noted that in future the government will rebuild another property in Victoria Island located near Zenith Bank Head Office into a modern office complex for lease.

The whole intent of the government is to diversify the state’s income profile and enhance its IGR. “By the time Ibom Air breaks even and posts profits, and the MRO is functioning and all these investments in real estate are matured, our IGR will improve considerably,’’ he said, drawing my attention to a report released by BudgIT which puts Akwa Ibom among states that cannot survive without FAAC. His plan is to create viable businesses with AKICORP as the holding company.

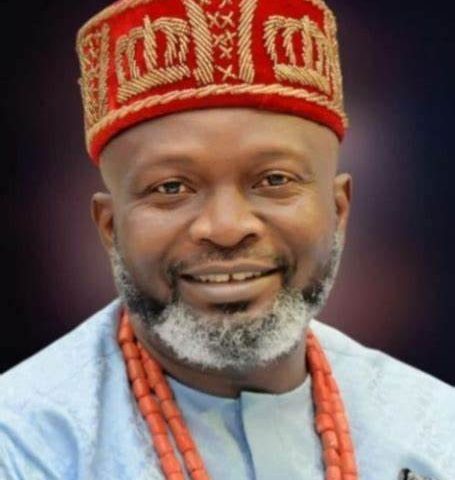

Etim Etim

ETIM ETIM is a journalist, banker and author. He has been a member of the Editorial Board of The Guardian, a Regional Manager in Access Bank and is currently a Columnist in Prime Business Africa, The Cable and Businessday newspapers.

He is also the Chief Executive of Stein Meyer Communications, a major media consultancy and the author of the best-selling book, "Akwa Ibom Heroes: Inside Story of the Fight for Abrogation of Onshore-Offshore Oil Dichotomy" and co-author of another book, "Osinbajo Strides: Defining Moments of an Innovative Leader".

Follow Us