The ease, swiftness and assuredness of contemporary online money transfers no longer allow us to remember the dark and fearful days of cash-only transactions. How time flies. Just move back in time a little – 13 years ago. A great majority of individuals and firms looked to be foolhardy to send and receive payments online.

Many individuals swore never to engage in airborne transfer of their hard-earned money. As recently as 2019, just before the COVID-19 pandemic, many small businesses and ordinary individuals still marveled at the sheer risk of online payments. Some still found it difficult to obtain automated teller machine (ATM) cards, let alone use their phones and other electronic means to wire money to unseen, known and unknown business dealers.

Join our WhatsApp ChannelREAD ALSO: CBN Is Forgetful In Its Lagos Relocation Plan

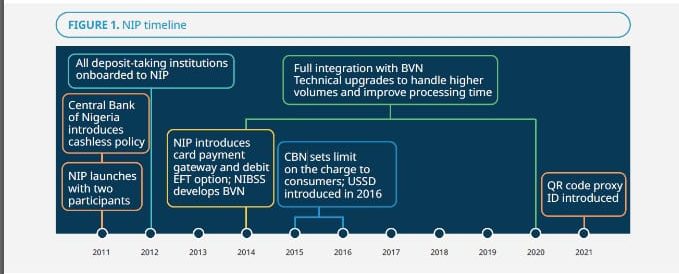

And then the instant cash revolution. In 2011, Nigeria joined the rest of the world to launch electronic systems to enable banks, businesses and ordinary people to undertake e-payments. Since then, the Central Bank of Nigeria (CBN) has kept updates on the State of Inclusive and Instant Payments Systems (SIIPS), with strong support from AfricaNenda, the United Nations European Commission for Africa and the World Bank. AfricaNenda actually releases the yearly report on SIIPS in Nigeria and Africa.

The Beginnings

We begin a journey of a series of article servings on the trail of instant payment systems in Nigeria, beginning with its very beginning. Rising global populations, business volume and the attendant risks of moving cash around raised a lot of concerns for governments and businesses alike. The reliance on cash was proving to be brittle. Much of the world was moving to electronic cash, and Nigeria had to wake up.

The Central Bank of Nigeria launched the ‘cashless policy’ in 2011 to remove the dependence on physical cash, which was both costly to print, cumbersome to move around and risky to keep for long. Economically, the preponderance of cash had untoward monetary implications in terms of corruption, tendency to hoarding and inflation. These denied money of its economic meaning as a medium of exchange that should be immediate, universal, and readily available.

More than Cash

Any system other than physical money has to do more than physical cash. In the Nigerian situation, physical cash was the known means of exchange, yet it proved ineffective and non-inclusive. These were the disadvantages the CBN foresaw as the basis to launch its Nigeria Inter-bank Settlement System (NIBSS), which powered the NIBSS Instant Payment System (IPS), a form of instant and inclusive online payment platform. IPS had the huge promise of boosting economic growth through fast payment services, reduction of the costs of using cash and grafting the urban and rural dwellers into an inclusive, formal financial system.

The aforementioned advantages would face some hurdles, which caused even banks to drag their feet in the beginning. Poor and non-pervasive internet services, distrust, internet fraud, and media illiteracy combined to pose stiff challenges to IPS. At the close of 2011, only two banks had the nerve to join the system.

Quickly, however, NIBSS proved its mettle by assuring the security, instantaneity, and cost-effectiveness of IPS. Boom. By 2012, the scheme had attracted the participation of all 22 commercial banks, all 20 microfinance banks and all six mobile money operators (MMOs) in Nigeria as the following timeline shows.

Source: NIBSS, 2022

How it was achieved

To achieve this instant wide attraction, NIBSS ensured customer convenience by making the IPS credit-only electronic fund transfers (EFT) to become interoperable with mobile wallets and card networks, with links to proxy identities. NIBSS ensured that banks did not overcharge customers for using the IPS.

In 2014, NIBSS also added the Bank Verification Number to link different accounts owned by the same entities and to checkmate fraud. This was after it introduced debit EFT in the same year. Between 2015 and 2018, NIBSS made it possible for customers to use their cards on any payment outlet as well as achieved USSD functionality. The integration of mobile wallets happened in 2018, in addition to the 2021 introduction of the Quick Response (QR) codes for fast and secure data encoding and retrieval on computers. NIBSS produces yearly reports as updates on its efforts and also leverages its control over banks to ensure the latter’s upgrade to the current payment standards.

The NIBSS Governance System

At present, NIBSS has a central processing hub to enable cross-bank operations by all customers though available payment platforms. The hub is the Nigerian Central Switch, which connects directly to all commercial banks (the direct participants), microfinance banks (indirect participants), and mobile money operators (MMOs) in Nigeria.

The CBN is the ultimate player and the federal government’s agent in the cashless policy implementation. It owns the NIBSS, which runs the IPS. NIBSS is therefore the managing institution or agent for the IPS in terms of ownership, operations (rules and technical standards), management and regulation.

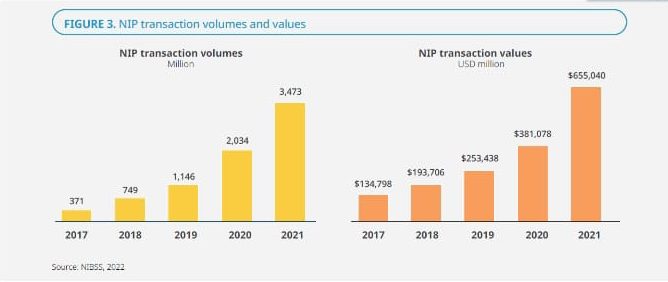

The NIBSS has a Board of Directors, made up of eight people (four managing directors from the major banks in Nigeria, and four from other banks, which are rotated). The Board is chaired by the CBN Deputy Governor of Fiscal and Monetary Policy, who is the final point of decision-making. In its efforts to develop the IPS, the NIBSS Board consults with the Committee of e-Banking Industry Heads (CeBIH) and industry players (e.g., banks, MMOs, and MFBs). The advancements in these areas account for the increased volume of use of the NIP as shown in Figure 2 (our next article series will present a digest of research and experiences on SIIPS).

Figure 2: NIP Transaction Volumes and Values

Source: NIBSS, 2022.

Dr Mbamalu, a Jefferson Fellow, is an Editor, Publisher and Communications Consultant. Follow on X: @marcelmbamalu

Dr. Marcel Mbamalu is a distinguished communication scholar, journalist, and entrepreneur with three decades of experience in the media industry. He holds a Ph.D. in Mass Communication from the University of Nigeria, Nsukka, and serves as the publisher of Prime Business Africa, a renowned multimedia news platform catering to Nigeria and Africa's socio-economic needs.

Dr. Mbamalu's journalism career spans over two decades, during which he honed his skills at The Guardian Newspaper, rising to the position of senior editor. Notably, between 2018 and 2023, he collaborated with the World Health Organization (WHO) in Northeast Nigeria, training senior journalists on conflict reporting and health journalism.

Dr. Mbamalu's expertise has earned him international recognition. He was the sole African representative at the 2023 Jefferson Fellowship program, participating in a study tour of the United States and Asia (Japan and Hong Kong) on inclusion, income gaps, and migration issues.

In 2020, he was part of a global media team that covered the United States presidential election.

Dr. Mbamalu has attended prestigious media trainings, including the Bloomberg Financial Journalism Training and the Reuters/AfDB Training on "Effective Coverage of Infrastructural Development in Africa."

As a columnist for The Punch Newspaper, with insightful articles published in other prominent Nigerian dailies, including ThisDay, Leadership, The Sun, and The Guardian, Dr. Mbamalu regularly provides in-depth analysis on socio-political and economic issues.