The central banks have been warned by the International Monetary Fund (IMF) against constantly bailing out governments in their quest to borrow funds outside the bond market.

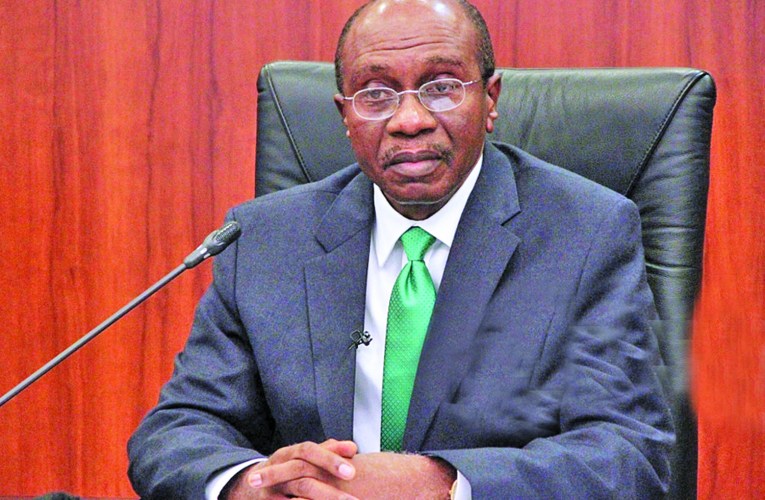

Recall that the N23.7 trillion debt the Nigerian government owes the Central Bank of Nigeria (CBN) has been a topic for debate in 2022.

Join our WhatsApp ChannelPresident Muhammadu Buhari had requested that the National Assembly should restructure the N23.7 trillion loan to bond in order to reduce the interest rate on the debt.

The World Bank previously said the interest rate on the central bank’s loan will gulp over 62 per cent of the Federal Government revenue by 2027.

Prime Business Africa understands that FG obtaining loans from CBN could increase liquidity in the money market, which will fuel inflation.

In the IMF report titled ‘Rethinking monetary policy in a changing world,’ the monetary fund said monetising excessive government debt needs to be halted.

Speaking on the roles of the central banks in the economy, the IMF said, “The low interest rates and less extreme public debt levels that prevailed after the global crisis permitted central banks to ignore what were then relatively inconsequential interactions between monetary and fiscal policy.

“The period following the 2008 crisis was one of monetary dominance—that is, central banks could freely set interest rates and pursue their objectives independent of fiscal policy.

“Central banks proposed that the core problem was not rising prices, but the possibility that weak demand would lead to major deflation.

“As a result, they focused primarily on developing unconventional policy tools to allow them to provide additional stimulus.

“Central banks also felt emboldened to pursue policies that would simultaneously meet the need for further stimulus and achieve social objectives, such as hastening the green transition or promoting economic inclusion.

“During the COVID-19 crisis, circumstances changed dramatically. Government spending rose sharply in most developed economies.”

Follow Us