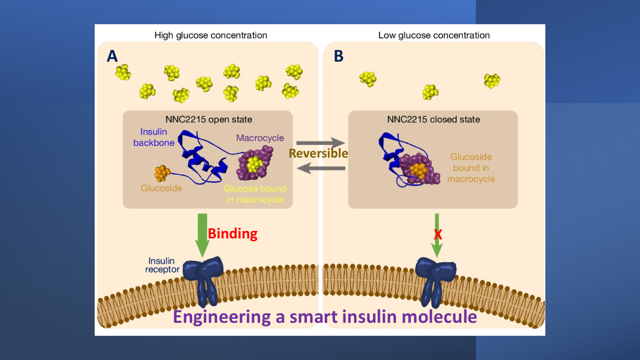

Bank Verification Number (BVN) has become a more reliable method for securing sensitive or personal information in Nigeria’s banking system.

To prevent incidents of compromise on conventional security systems like passwords and PINs, the Central Bank of Nigeria (CBN) mandated banks to enrol their customers on the BVN system as an enhanced form of authentication for real-time security processes.

Join our WhatsApp ChannelAs of 3 July 2023, over 57.96 million BVNs have been registered, according to the Nigeria Inter-Bank Settlement System Plc (NIBSS).

Note that while the BVN is crucial to secure your details in the financial system, the telecommunications company have been incorporated into the BVN system to enable Nigerians to easily check their BVN.

The network providers created an Unstructured Supplementary Service Data (USSD) code and other application-driven procedures to enable Nigerians to check their BVN.

How MTN users can check their BVN

MTN Via USSD Code: MTN Nigeria offers two methods for its 84.66 million telephony customers to check their BVN, one being the USSD code and the other being the network provider’s customer self-app.

On your phone dial pad, inputting and dialling *565*0# will result in the BVN system sending a notification with your BVN number to your phone.

However, note that the USSD code system requires you to have at least N30 on your airtime balance, as MTN will charge you for the USSD session.

Also, ensure that the phone number used to perform the USSD check is the contact linked to the BVN system when you registered.

MyMTN App: Similarly, with MyMTN App, you can perform a BVN check by doing the following;

In case you haven’t registered on the MyMTN app, create an account on the mobile app with your phone number.

At the bottom of the app screen, there’s a “More” option, click it.

A list of options will appear, select “My Bank”.

After the above procedure, your BVN number linked to your contact will be made visible to you.

How Glo customers can check their BVN

The same code applies to Globacom’s 61.33 million telephony customers who want to check their BVN code to perform some transactions that require enhanced security checks.

On your Glo phone number connected to the BVN system, dail *565*0#

You will be required to confirm the BVN inquiry, select ‘1’

The BVN system will request the last four digits of your bank account number

Option ‘1’ will appear, select it to continue, and your BVN will appear

How to Check BVN on 9Mobile

With over 13.57 million telephony subscribers, 9mobile is also crucial to checking your BVN if you are a user in the telco’s customer base.

To check your BVN on 9Mobile, dial *565*0# on your 9Mobile sim

How to Check Your BVN on Airtel

Similar to other networks, Airtel, which has over 60.19 million subscribers, also requires the *565*0# to check your BVN

Follow the prompt requesting information

After inputting the requests, your 11-digit number will appear

BVN Frequently Asked Questions

How to enrol on the BVN system

- Visit any branch of your Bank.

- A BVN Enrolment form will be handed to you, fill and submit it

- Your fingerprint and facial Image will be requested, so make yourself available for data capturing.

- You will be given an acknowledgement slip showing your transaction ID.

- Following the above procedure, an SMS will be sent to you to come pick up BVN, which will be generated within 24 hours.

What you need to know about BVN

- Your account will be linked to a unique ID number, regardless of the bank.

- After opening a bank account, customers are expected to enrol on the BVN platform within a fixed period to avoid losing access to the account

- The information provided during enrollment and your BVN will be among the requirements demanded when performing certain banking transactions like requests for loans for authentification.

Benefits of BVN

- Your information can easily be verified across the Nigerian Banking Industry through your unique BVN identity.

- BVN protects you from unauthorized access to your bank accounts.

- Your exposure to fraud is reduced by the BVN, as it prevents identity theft.

- It also enables the banks to identify blacklisted customers in the entire Nigerian banking industry.

- BVN improves the efficiency of Nigerian banks.

- All Nigerian banks can easily identify you through the BVN data centre.

Follow Us