Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has unveiled it vision to recalibrate the apex bank’s direction, citing how it strayed away from it core mandate during the previous administration.

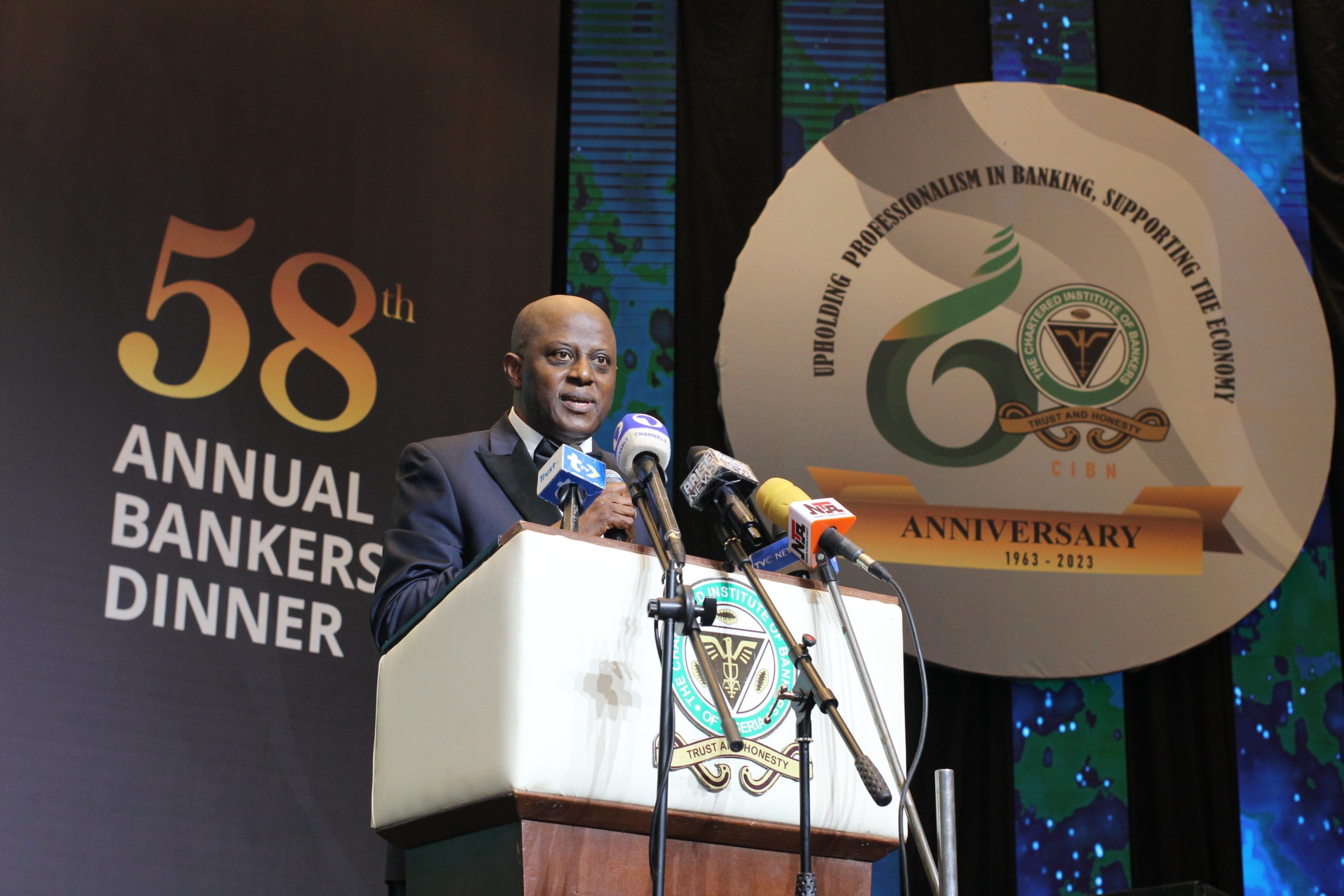

Highlighting a departure from past practices at the annual bankers’ dinner in Lagos State , Cardoso stated, “Under my leadership, the Central Bank of Nigeria will vigorously address these issues.”

Join our WhatsApp ChannelCardoso’s address centered on the redirection of the CBN from its prior course under the tenure of Godwin Emefiele, citing a divergence from the institution’s core mandate.

He shed light on N10 trillion pumped into non-traditional ventures, expressing concern that these activities hindered the bank’s primary objectives and proficiency.

READ ALSO: Depreciating Naira To Dollar Exchange Rate Exposes Nigerian Banks To Great Risk – CBN

“We’ve strayed from our core mandate,” Cardoso proclaimed, acknowledging the apex bank’s involvement in quasi-fiscal activities across sectors like agriculture and power. He emphasized the imperative need for a return to orthodox monetary policy tools, signaling an end to direct quasi-interventionist activities.

“Hitherto, the CBN has strayed from its core mandate and engaged in quasi-fiscal activities that pumped over N10trn in the economy through different initiatives in sectors ranging from agriculture, power, and many others. These clearly, distracted the bank from achieving its own objectives and took it to areas where it had limited expertise.” he said

Underscoring the urgency for the banking sector’s recalibration, Cardoso outlined plans for mandatory bank recapitalization, asserting that Nigerian banks must bolster their capital base to meet the demands of $1 trillion economy. This directive mirrors the step taken in 2005, spearheaded by former apex bank chief Charles Soludo.

Moreover, Cardoso unveiled his intention to usher in a new regulatory framework for digital services. With a focus on tightening compliance and preventing licensees from operating beyond their approved activities, he assured stakeholders of stringent measures against intentional or unintended non-compliance.

The Governor also addressed the inefficacy of Monetary Policy Committee (MPC) meetings in recent years, vowing to ensure that these gatherings become more purposeful and impactful, aligning with the CBN Act’s stipulations.

Despite acknowledging prevalent macroeconomic and social challenges, Cardoso exuded optimism, assuring the audience that with corrective measures and strategic policies, the Nigerian economy can overcome its current hurdles.

Cardoso’s stance and blueprint signal a paradigm shift at the CBN, marking a moment in steering the apex bank back to its fundamental mandate while addressing contemporary economic challenges head-on.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

Follow Us