The Federal Government has announced the launch of a 10-year Ijarah Sukuk at a competitive 15.75% interest rate, In a move to finance critical road infrastructure across Nigeria

The Debt Management Office (DMO) unveiled this opportunity in an official statement today, emphasizing its commitment to transforming the nation’s infrastructure landscape.

Join our WhatsApp ChannelSpeaking about the offering, the DMO stated, “Under the local loans (Registered Stock and Securities) Act, CAP. L17, on the authority of the Federal Government of Nigeria, FGN Road Sukuk Company (FGN RSC 1) offers subscriptions through Greenwich Merchant Bank Limited, Stanbic IBTC Capital Limited, and Vetiva Capital Management Limited, are authorized to receive applications for N150,000,000,000.00 10-year Ijarah Sukuk due October 2033. Rental rate 15.75% per annum.”

This Sukuk issuance is a testament to Nigeria’s commitment to leveraging innovative financial instruments to fund critical infrastructure projects. It comes as part of a broader strategy to revamp and expand the nation’s road network, spurring economic growth and job creation.

READ ALSO: N10 Trillion Spent On Refineries, But They Refuse To Work, Says Taiwo Oyedele

The subscription period for the Sukuk, which began on October 3rd, will continue until October 11th, with the settlement date scheduled for October 13th. The Sukuk will mature in October 2033, providing investors with a decade-long investment opportunity.

As part of its effort to make this investment accessible to a wide range of investors, the DMO has set the unit of subscription at N1000 per unit, with a minimum subscription of N10,000 and subsequent multiples of N1000.

This approach ensures that both retail and institutional investors can participate in building Nigeria’s future.

Speaking about the purpose of the funds raised, the DMO confirmed that the proceeds from the Sukuk offering will be exclusively dedicated to road construction projects across all six geopolitical zones of the country.

This demonstrates the government’s unwavering commitment to addressing infrastructure deficits and enhancing connectivity throughout Nigeria.

In a direct appeal to potential investors, the DMO encouraged interested parties to contact their designated issuing houses for additional information and expert guidance on this unique investment opportunity.

Sukuk has emerged as a vital tool for financing infrastructure projects in Nigeria, and this latest issuance underscores the government’s dedication to promoting economic development through innovative financial instruments.

With an attractive interest rate and a clear commitment to road infrastructure development, the 10-year Ijarah Sukuk presents an exciting opportunity for investors to participate in Nigeria’s journey towards a brighter future.

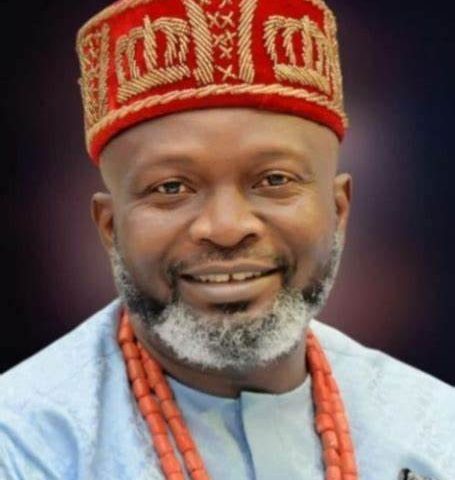

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

Follow Us