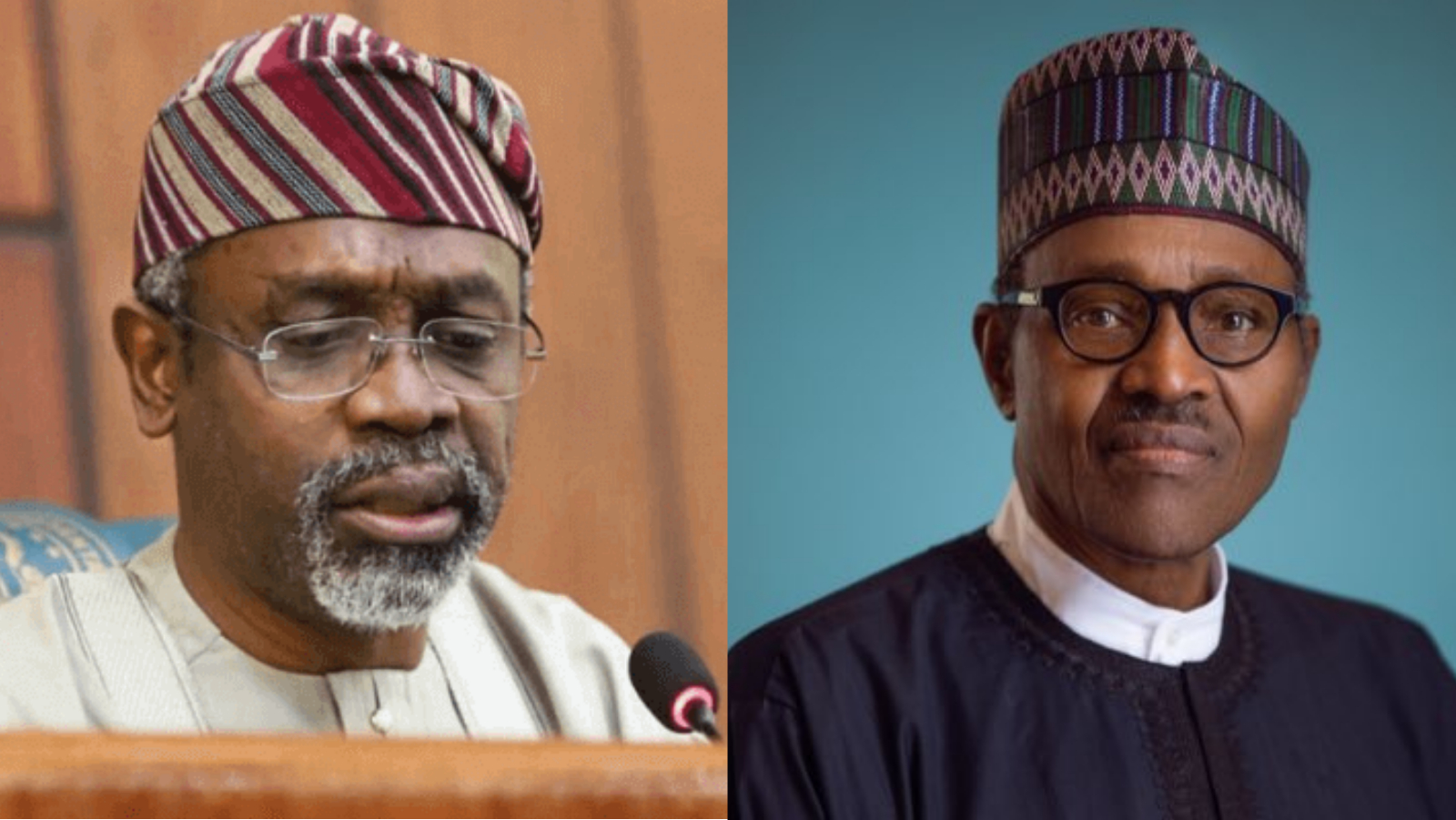

Speaker of the House of Representatives of Nigeria, Femi Gbajabiamila, has raised concerns regarding the rising debt of Nigeria, after the government borrowed N3.28 trillion in the first six months of this year.

Prime Business Africa had reported that debt profile of Nigeria rose to N42.84 trillion at the end of second quarter 2022, as President Muhammadu Buhari’s administration continues to depend largely on loan to finance budget, against the N39.56 trillion level it stood as at December 2021.

Join our WhatsApp ChannelAccording to figures released by the Debt Management Office (DMO), the total debt stock showed external debt was N16.61 trillion as at June 30, and domestic debt accounting for N26.23 trillion.

The state with highest debt is Lagos with N797,305,312,602.53, Delta State came next with N378,878,236,830.75, and Ogun State owes N241,782,021,304.96.

Rivers State’s debt is N225,505,011,356.83, Imo State has N210,394,836,519.93 debt profile, and Akwa Ibom complete the top six list with N203,951,611,822.07.

The least-indebted states are Jigawa, with N45,135,377,621.30, and Ebonyi State, which owes N59,111,939,636.77. In total, both the Federal Government, States, and local governments have a debt profile of N42.84 trillion.

This has raised concerns among the House of Representatives during the resumption of the plenary on Tuesday, where Gbajabiamilia said the long-term effect of the debt burden on Nigeria is worrisome.

The lawmakers were also concerned about the ability to pay in a responsible and sustainable way. According to him, the interactive sessions of the Senate and House Committees on Finance with the Ministries, Departments and Agencies (MDAs) of the government on the Medium Term Expenditure Framework and Fiscal Strategy Paper (MTEF/FSP) had led to questions being raised.

DMO had explained that, “Over 58 percent of the external debt stock are concessional and semi-concessional loans from multilateral lenders such as the World Bank, International Monetary Fund, Afrexim and African Development Bank and bilateral lenders including Germany, China, Japan, India and France.”

Follow Us