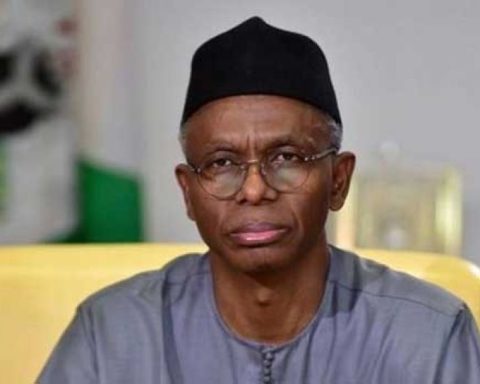

Ex-governor Nasir El-Rufai, who used to be a player in Nigeria’s private sector before emerging as an accidental public servant, is planning to launch a $100 million venture capital (VC) fund early next year for startups in Nigeria, particularly those in the Kaduna tech ecosystem.

Expressing the resolve to stake $2 million of his money to offtake the project, the former Kaduna State chief executive is looking to source the balance from investors “who believe in us but don’t have the capacity or the time to do the analysis and evaluation. But they trust our judgment and they will come with us.”

Join our WhatsApp ChannelPrime Business Africa recalls that there were stories of how the ex-governor who played a significant role in the emergence of President Bola Tinubu was edged out of serving in the federal cabinet as supposed Energy minister. Although nominated by the President, he was not confirmed as minister by the Godswill Akpabio-led Senate over some security clearance issues.

Several months after being off the public radar, El-Rufai spoke to BusinessDay on the sidelines of the Africa Investment Forum in Marrakech, Morocco in November, expressed his desire to set up a venture capital fund or private equity that will invest in young Nigerians with innovative ideas.

He recalled his time as governor of Kaduna State where he met many students in Kaduna who had great ideas and were creating innovations but lacked people who could mentor them and help those ideas grow. El-Rufai and his fund is targeted such persons whether their ideas are in agriculture, ICT or the creative industry

His words, “What young people need is essentially mentoring and financing to get things going. They develop the idea and see whether it is viable. And we will open doors for them because they don’t have contact. They don’t know or have access to ministers, presidents, or regulatory agencies. We do. We know the minefields that they have to navigate.

“We know that they need to give them appointments and we can provide them with the startup funding and in return we take an equity position. We don’t want to take your business; we want to develop it. But if we take the risk on you, we will take a percentage of the business,” El-Rufai said.

He is working with select private sector partners, including Eyo Ekpo, co-founder of Excredite Consulting Limited, and their primary focus is on Nigeria but the ambition is Africa because he projects from a report that Africa will be supplying the world with a significant portion of the workforce it needs by 2050.

Noting that Africa’s population is expected to reach 2.5 billion by 2050, El-Rufai maintained that such projections call for more investments in the younger demographic. However, his fund will not just be focusing on new startups, there is also a plan to engage established companies with management problems that are still viable. The VC fund will invest in such companies, get them sorted out and take them to exit.

“We don’t intend to remain in any business. We want to catalyse growth in these startups,” he said, adding that one of his reasons for being at the African Investment Conference was to seek continental partnerships, and investors and to explore opportunities with climate-focused investors.

“Nigeria has a lot to offer Africa and the world. Our population, entrepreneurial capability, the innovation of our young people and their boldness and courage to find success. We just felt that we have a duty to encourage,” he said.