In a bid to curb illegal currency trading and stabilize the Nigerian currency, the Economic and Financial Crimes Commission (EFCC) intensified its efforts, conducting raids on Bureau De Change (BDC) operators across major cities including Abuja, Lagos, Kano, and Port Harcourt.

The move follows the Federal Government’s renewed determination to address the recent depreciation of the naira against the United States dollar.

Join our WhatsApp ChannelAccording to reports, the raids disrupted market activities and instilled fear among traders. Malam Yahu, a trader in Abuja, recounted how the operations in other cities influenced market sentiments, leading to cautious trading and contributing to the hike in exchange rates. “The EFCC guys scattered the market…traders in Abuja were very cautious,” he remarked.

Abubakar Taura corroborated these accounts, highlighting the apprehensions among traders amidst the ongoing crackdown. “Yes, we heard today that EFCC operatives have started arresting people in other states,” he said.

While the President of the Association of Bureau De Change Operators, Aminu Gwadabe, confirmed the raids, he noted that the focus was primarily on street traders, although some registered BDC operators were also affected.

“Yes, the EFCC operatives raided street traders although some of our members were also affected. The government is trying to deal with illegal practices. We believe the currency will appreciate with time,” he said.

READ ALSO: Charge In Naira: EFCC Stops Embassies From Dollar Transactions

The impact of these operations was evident in the parallel market where the naira closed at N1,540 per dollar, marking a 4.05% depreciation compared to the previous day. Similarly, at the Nigerian Autonomous Foreign Exchange Market, the official rate witnessed a 3.04% decline, closing at N1,520 per dollar, the lowest in over six weeks.

The depreciation in the naira’s value has been attributed to various factors, including increased pressure from currency speculators and digital cryptocurrency activities. Faith Iyoha, an economist, emphasized the need for fundamental FX liquidity policies to stabilize the currency, stressing the importance of exports and foreign capital inflow.

Amidst these developments, the Organised Private Sector expressed concerns over the continuous fluctuation of the exchange rate. Francis Meshioye, President of the Manufacturers Association of Nigeria, highlighted the challenges faced by manufacturers in maintaining predictable business models, which may necessitate price reviews.

Gabriel Idahosa of the Lagos Chamber of Commerce and Industry attributed the recent depreciation to a shortfall in dollar supply and predicted continued fluctuations. However, he warned of potential price hikes if the trend persists, impacting consumer purchasing power and overall business operations.

He said, “The market is struggling to stabilize that is why we are seeing this level of volatility. The CBN is managing a very difficult situation because we don’t have established trade flows from our non-oil exports.

Asked if manufacturers have implemented price hikes if the depreciation continues, Idahosa said, “Yes, of course. It will happen. We are hoping that the exchange rate does not get to that precipice of N1,800 or N1,900.”

Dele Kelvin Oye, National President of the Nigerian Association of Chambers of Commerce, Industry, Mines, and Agriculture, underscored the broader implications of currency depreciation on import costs, inflation, and foreign debt servicing. He advocated for government intervention to stabilize the naira and mitigate adverse economic effects.

He said, “The significant depreciation of the naira, now at 1500 to the dollar, poses multiple challenges for Nigeria. The weakening currency increases import costs, affecting prices of everything from food to electronics, thereby fueling inflation and reducing the purchasing power of Nigerians, especially those on fixed incomes. Higher import costs also escalate production expenses in sectors reliant on foreign materials, impacting overall business operations.

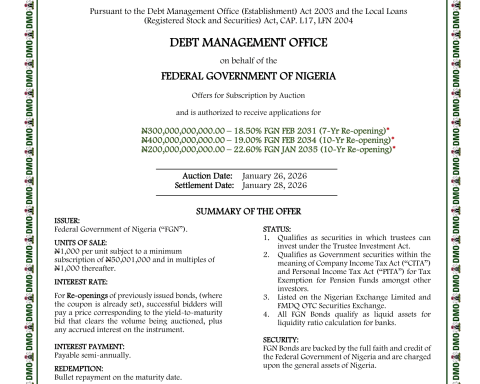

In the financial markets, foreign portfolio investment data revealed a significant increase in foreign outflows from the Nigerian Exchange Limited, underscoring the need for measures to attract and retain foreign investment amidst prevailing economic uncertainties.

As stakeholders assess the implications of EFCC’s crackdown and the broader economic challenges, there is a growing consensus on the imperative for coordinated efforts to address underlying structural issues and restore confidence in Nigeria’s currency and economy.