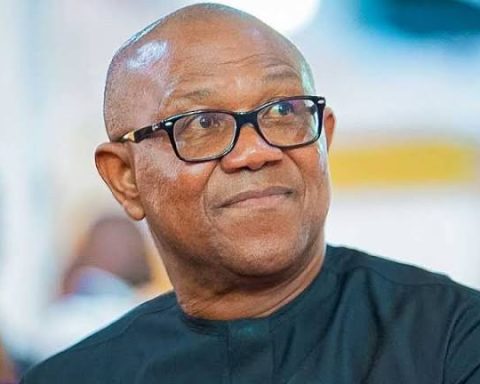

Presidential candidate of the Labour Party in the 2023 general elections, Mr Peter Obi has warned about the danger of increasing debt burden on Nigeria’s economy, especially when the fund is not channeled to productive ventures.

Obi, who accused the current administration of President Bola Tinubu of borrowing to spend lavishly on “nonessential procurements,” pointed out that the procedure didn’t adhere to the principle of public accountability.

Join our WhatsApp ChannelIn a statement titled “Debt and Waste as Economic Policy,” Obi questioned the rationale behind securitization of the N22.7 trillion Ways and Means borrowing from the Central Bank of Nigeria (CBN).

He said the CBN ways and means advances to the federal government has risen to 2700 per cent in seven years in violation of the CBN Act. According to Obi, this is a “flagrant violation of the CBN Act.”

He expressed dismay that given the illegality of the excessive CBN ways and means borrowing, the National Assembly still went ahead to approve the new Tinubu administration’s request for an N7.3 trillion securitization of the existing ways and means facility just before considering the 2024 budget proposal.

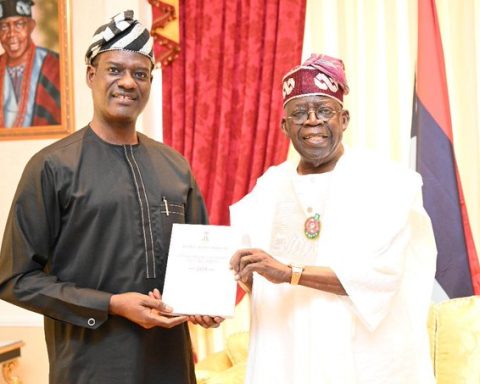

Apart from the securitization of CBN borrowing, President Tinubu also recently got the approval of the National Assembly to borrow another $7.8 billion and €100 million.

“No questions asked. No explanations were sought as to the precise purpose of these borrowings all within the seven-month tenure of this government,” Obi observed.

“Ordinarily,” he continued, “minimum public accountability should require that the president and his administration offer more specific explanations about the purpose of these borrowings. But so far, all we have been told is that these borrowings are meant to fund ‘capital’ expenditure.”

He argued that, the continuous securitization of Ways and Means borrowing from the CBN is against the law, adding that converting it to debt breaches the provisions of the apex bank rules.

He added that such measure portends danger for the future of the economy as it would increase the debt burden of the country.

“Specifically, the continuous securitization of Ways and Means borrowing from the CBN is against the law and against the CBN Act which stipulates the limit of the Federal Government’s borrowing from the CBN not to exceed 5% of the previous year’s revenue.

“The law also requires the liquidation of the outstanding borrowing before any new advancement can be made. More importantly, the CBN Act expressly states that all borrowings under the Ways and Means cannot be converted to debt or securitized if the CBN is the underwriter.

“It needs to be pointed out that the idea of securitization of illegal borrowings from the CBN and transferring the same into our debt stock portends danger to the future of our economy. It increases the debt burden of the nation. It is even more worrisome because these accumulations of debts are not being transparently and productively utilized or accounted for.”

The former Anambra State governor further stated that even as the new debt of N7.3 trillion has been “hurriedly approved without scrutiny by the National Assembly,” the principle of public accountability places responsibility on the Federal Government to explain to Nigerians what the fund was used for.

Following the outcry that by stakeholders tshg trailed the securitization of the CBN ways and means facility, the Debt Management Office in defence of the Federal Government’s decision listed what it termed as the benefits.

According to DMO, the securitization will achieve the following:

“Improve debt transparency as the securitized Ways and Means Advances will now be included in the public debt statistics.

“It will reduce the Debt Service Cost as the new Interest Rate is 9% p.a. compared to the Monetary Policy Rate plus 3% which translates to 21.0% p.a. (MPR – 18.0% + 3%) currently being charged on the Ways and Means Advances.

“The large savings arising from the much lower Interest Rate will help reduce the deficit in the Budget and expectedly, the level of New Borrowings.”

While countering the claim by the Federal Government that all borrowing are for capital project, the Labour Party presidential standard bearer in the last election asked “can we know the capital or productive projects this huge borrowing is being applied to?”

“What is emerging is a disturbing pattern of huge borrowing and profligate spending on nonessential procurements which are being termed ‘capital’ expenditure and are being funded with an accumulation of debts,” Obi added.

He observed that a good number of what is termed ‘capital expenditure’ items in the 2024 budget are more of procurement and luxury projects. “This trend of lavish spending backed only by equally lavish borrowing is unsustainable and would wreck the economy in due course,” Obi warned, adding that the trend should be halted to avoid plunging the country into grave economic woes in the near future.

He said this is the time to go beyond partisan politics to address fundamental issue of rational economic management.

“I am afraid that the current administration is not paying sufficient attention to issues of rational economic management.

“Instead, an unsustainable level of debt is being piled upon the economy thereby further burdening our already distressed populace who are bearing the burden of harsh economic policies not backed by compassionate cushioning policies,” Obi stated.