Economic reconstruction is defined as “a process for creating a proactive vision of economic change.’’ The need for economic reconstruction arises from the existing fundamental problems of the economy, such as it is presently in the Nigerian economy.

In assessing the challenges of the economy, Professor Doyin Salami of the Lagos Business School and former member, Monetary Policy Committee, Central Bank of Nigeria (CBN), had once noted that “Nigeria has an economic challenge that is significant and potentially severe, and the federal government alone lack the firepower and would need huge private investments to move the needle of the economy.’’

Join our WhatsApp ChannelThe challenges of the economy are diverse and demand critical and surgical interventions for reconstruction, reformation and redirection. Some of the notable and fundamental challenges include import-dependency, and over-leakage, according to the “leaky-bucket’’ model of economic growth and development propounded by Avik Basu.

According to Basu,”money circulates within the region when money that is earned locally is also spent locally. And the “leak’’ in the bucket that allows money to escape from the country is created when goods and services from outside the region are purchased with local money.’’

He further noted that typically, a robust economy required both the availability of capital and its circulation in the region. The leakage in the economy arose from the consumption of foreign goods and services which translates to building up foreign economies at the expense of the local economy.

Another major challenge of the economy is the rapacious and wasteful political class who indulge in conspicuous consumption at the expense of the masses and whose rapacious propensity further aggravates the leakage in the economy, and also a major reason why current expenditure has always been skewed over capital expenditure.

Capital expenditure should be channeled into the economy for production and not consumption. As noted by Demirigue-Kunt and Levine, the “mobilization of resources for economic growth is the primary target for development.’’

Other challenges of the economy include epileptic power supply which disrupts production and fires inflation, insecurity, economic sabotage, smuggling, criminal syndicates who vandalize state infrastructure, some banks and privileged individuals who engage in forex round tripping and exacerbate the forex conundrum.

Others include the under-utilization of the capital market mechanism, infrastructure deficit, pervasive corruption, population growth rate that outstrips economic growth rate, exchange rate distortion and volatility, high interest rate and spiking inflation, etc.

As the apex monetary policy authority, the Central Bank of Nigeria (CBN) plays a central role in piloting the economy for stability, growth, and development. CBN determines interest rate and directs money supply to achieve stability, formulates and implements monetary policy, manages foreign reserves and ensures stability of financial markets, and regulates and supervises the banking and financial system.

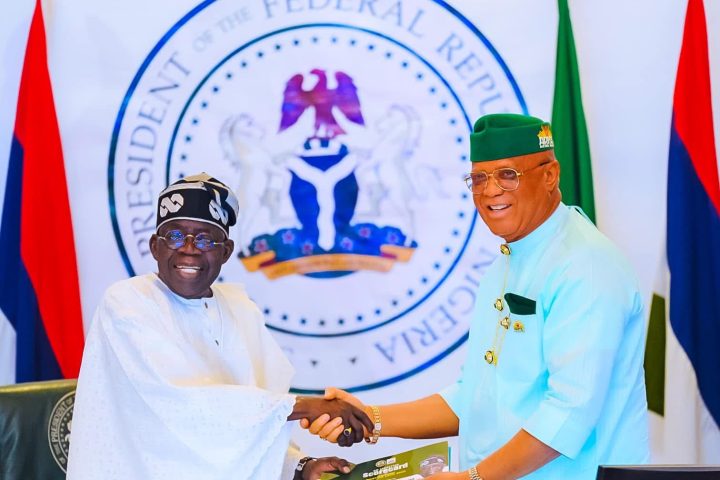

Before the assumption of office by the new CBN management, President Bola Tinubu noted in an address, that the financial system was “rotten’’ and was worrisome in view of the pivotal role of the financial system in driving the economy. There was chaos and a crisis of confidence in the economy as a hangover of the flopped demonetization (currency /naira redesign) policy.

Currency redesign is a drastic intervention to remove the legal tender status of a currency and is used to curb a surplus and cyclonic flow of illegal currency, fight inflation, stabilize the currency and boost the formal economy. But it is risky and can be chaotic and plunge the economy into crisis if things go awry, as it went with the naira redesign policy in 2023.

Sequel to the crisis of the naira redesign, President Tinubu removed fuel subsidies and CBN also adopted a unified and floating exchange rate regime. Fuel subsidy removal escalated inflation which had earlier started soaring due to other variables including the increased money supply due to government’s debt stock including Ways and Means.

There also arose a drastic exchange rate volatility which depreciated the naira to a record level.

READ ALSO:

- CBN Slashes Loan-to-Deposit Ratio To 50%, Mandates Banks To Adjust Operations

- CBN Drops Interest Rates On 1-year Treasury Bills By 42.4 bps To 20.7% Amidst Robust Investor Confidence

- CBN Releases Another Round Of $10,000 FX To Each BDC, Mandates Them To Sell At N1,117/$1

The exchange rate is a major economic variable that determines trade and capital flow and the health of the economy, thus, with escalating inflation which is now at 31.79 per cent and a volatile exchange rate/depreciated naira, the economy got a double whammy.

With strategic agility, CBN recalibrated its policy toolkits and evolved policies aimed at controlling the two major challenges of spiking inflation and exchange rate gyration.

The Bank adopted an explicit inflation targeting framework to enhance the effectiveness of monetary policy and the Monetary Policy Committee (MPR) increased the Monetary Policy Rate (MPR) drastically from 18.75 per cent to a record 22.75 per cent and subsequently to 24.75 per cent.

CBN also started using regular Open Market Operations (OMO) to mop up the excess liquidity from the banking system and offering Treasury Bills with three tenors to the investing public.

The Bank also took critical steps to stabilize the exchange rate, it introduced new forex laws and guidelines to address the devaluation of the naira and achieve exchange rate stability and holistically, CBN focused on its core mandates which also include providing economic and financial advice to the federal government and evolved other strategic policies within its mandate, including the pending recapitalization of banks, towards economic reconstruction.

As noted by CBN Governor, Yemi Cardoso, “at the end of our tenure, we want to look back and see that our policies have impacted people’s lives.’’

Nwobu, a Chartered Stockbroker and Business Journalist wrote from Lagos.

Tel: 08033021230

Follow Us