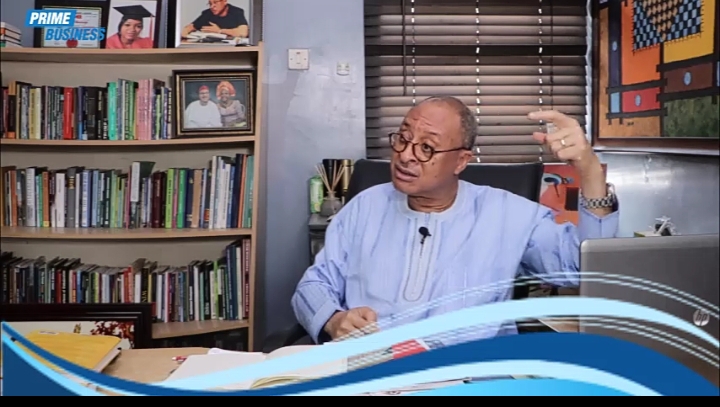

Defending the sustainability of Nigeria’s 2022 budget outlook by comparing the deficit ratio with that of economically advanced countries amounts to turning economic principles upside down, says the founder of Centre for Values in Leadership (CVL) Prof. Pat Utomi.

In an exclusive interview with Prime Business Africa, Utomi, a renowned Professor of Political Economy said defending sustainability of budget deficits by comparing ratios with those of other countries, especially the advanced ones considered sustainable, is a total miscalculation. he said Nigeria’s budget is ‘utterly unsustainable.’

He explained that the United States has the highest deficit in the world, but has a highly productive economy unlike Nigeria which mainly depends on importation. He added that, with high production capacity, US is able to absorb it’s deficit ratio.

Join our WhatsApp Channel“People read economics upside down many times. They will give you deficit ratios from some part of the world that others have considered as sustainable, but those guys know they are producing. They know they can project where the production will lead them to,” he said..

“The ultimate deficit country is America, but it’s the ultimate production machine. So, to say America has this deficit and so our own is not so bad show you are mental, you don’t understand economics. America can afford that deficit, but we cannot. Even America gets hurt by that deficit but they can afford it because their production machine would rev up.”

A budget is considered deficit when the estimated expenditure outweighs projected revenue.

In Nigeria’s 2022 budget of N17.13 trillion, 18 percent higher than the 2021 budget, revenue projection is N10.71 trillion while the deficit hovers around N6.4 trillion.

Minister of Finance, Budget, and National Planning, Mrs. Zainab Shamsuna Ahmed, had said that the deficit, which represents 3.46 percent of the Gross Domestic Product (GDP), would be funded mainly by borrowings, thereby increasing the country’s debt stock.

In the heat of mounting criticisms, the government made spirited efforts to justify the amount for the deficit appropriated in the budget. Ahmed said, “The debt level of the Federal Government is still within sustainable limits. Borrowings are essentially for Capital Expenditure and Human Development, as specified in Section 41(1)a of the Fiscal Responsibility Act 2007.” As at September 2021, Nigeria’s debt stock has risen to N38 trillion, raising concerns of how the country is going to continue managing such.

The budget summary shows that allocation for recurrent expenditure (N6.9 trillion) is more than the Capital expenditure (N5.93 trillion). The debt service provision is N3.61 trillion, which is 21 per cent of total expenditure, and 34 percent of total revenues.

Utomi speaking on borrowing and Nigeria’s rising debt profile, said with the country’s history of debt, and behaviour of political leaders, he has no conviction that borrowed money would be judiciously used to improve the economy.

“Ours is not sustainable. Those days when you talk about IMF conditionalities, we want to borrow, and borrow, citing that things are difficult. Have you watched the behaviour of Nigerian politicians, is there any suggestions that they are ready to do anything like tightening belt. I won’t trust people who behave like that with borrowed money. They would just squash the future of people who would pay back that debt. We have made this mistake again and again,” Utomi observed.

Economic experts have said government can resort to borrowing when its public spending surpasses the revenue, provided that the borrowed funds are invested in productive assets to boost domestic production and stimulate demand and supply of goods and services which improves the economy. Just like Utomi said, the worry with Nigeria is how the borrowed fund is spent.

Commenting on the fuel fuel subsidy removal saga, Utomi observed that the country is in dilemma, stating that if the government continues to spend on subsidy, it takes a big toll on the economy and if it is removed without adequate provisions for availability of the product domestically, the citizens would suffer.

He added that with the nature of characters in leadership, there is no guarantee that the money will be invested in productive ventures.

His words, “These are very nuanced conversation. Not as simple as remove, take, don’t remove. If you remove this subsidy -by the way subsidies don’t make sense you are just shortchanging yourself. But if you remove them with the kind of politicians that I have just described, who will just see new cash to spend, you would probably do more damage than anything else.

“I have said repeatedly that when you are a lame duck government, when your time is about to expire and you may be suspected to have ambition of taking some monies away before you go, you usually make very few decisions. I have seen lame duck governments around the world, but I have never seen one worse than the present one in Nigeria. Buhari’s government became a lame duck two and half years ahead of his time because of the way they have managed the country. And so there is no trust for it, there is a huge trust deficit between the Nigerian people and the government. To make that kind of policy decision, is crazy because people can’t trust them to use those resources well. And to then go and borrow in the stead of that removal is even doubly dangerous. This is the dilemma of where Nigeria is.

“So what we rightly need now is a government of national unity that will determine how the country would function because Buhari’s government has actually ran out of legitimacy on the one hand, and there is much time still left,” he advised.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.