As we noted in our last article, Africa is still on the way to making (digital) instant payment systems (rIPS) on the continent to compete with the standards in developed countries. This is with regard to becoming a fully operational digital public infrastructure. There is work to be done in terms of system sustainability, value for customers, higher promise of value for payment providers, and a strong, operational policy framework. But there is considerable progress, beginning with the ever expanding reach of IPS across Africa.

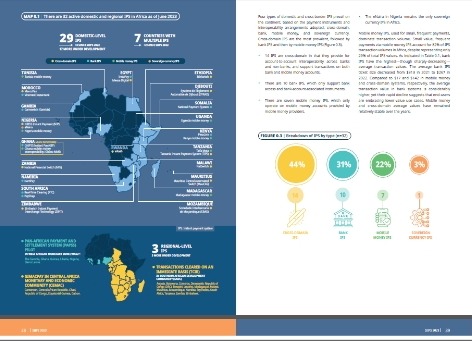

By late 2022, the IPS landscape in Africa had evolved extensively as shown in Figure 1. According to the 2023 SIIPS reports, “There are 29 live domestic systems across 21 countries and three live regional systems. Despite this wide spread in the number of systems, a few IPS are in operation due to the long time it takes for IPS to take off in countries, which already have the systems in place.

Join our WhatsApp ChannelREAD ALSO:

A lot of time is spent in consultations between payment providers such as banks and the regulators. IPS implementation also requires extensive technical expertise. The report indicates that “Three new systems, EthSwitch (Ethiopia), Virement Instantané (Morocco) and PayShap (South Africa) went live. Three systems, Meeza Digital (Egypt), MauCAS (Mauritius), and eKash (Rwanda), have been reclassified as cross-domain IPS. Meeza Digital and eKash had been classified previously as mobile money IPS and MauCAS was a bank IPS in SIIPS 2022. Seven countries (Egypt, Ghana, Kenya, Morocco, Nigeria, South Africa, Tanzania) have multiple IPS; only in Ghana are these systems interoperable with one another.”

Types of Domestic IPS

The report identifies four types of domestic and cross-border IPS in Africa based on the payment instruments and interoperability arrangements adopted. They are crossdomain, bank, mobile money, and sovereign currency. Crossdomain IPS are the most prevalent, followed by bank IPS and then by mobile money IPS (Figure 2).

Figure 2: Average value per transactions per IPS type (US$)

The report further notes as follows:

- 14 IPS are cross-domain, meaning that they provide for account-to-account interoperability across banks and non-banks, and support transactions on both bank and mobile money accounts.

- There are 10 bank IPS, which only support bank access and bank-account-associated instruments.

- There are seven mobile money IPS, which only operate on mobile money accounts provided by mobile money providers.

- The eNaira in Nigeria remains the only sovereign currency IPS in Africa.

Mobile money predominates

In terms of transaction volume, mobile money predominates (82%), because it is used for small and more frequent payments. This volume notwithstanding, mobile money transactions account for only 29% of total IPS. Banks are in the lead in the mobile money transactions.

It is expected that regional IPS will cover over half of Africa’s population when the three new regional IPS, still in construction, go into full use. As of June 2023, Botswana, Cape Verde, Democratic Republic of the Congo (DRC), Eritrea, Libya, the Seychelles, and South Sudan were the seven countries in Africa, which have yet to indicate any interest developing functional domestic IPS.

The countries using regional IPS have work to do to scale through the hurdle posed by overlaps in regional IPS such the Common Market for Eastern and Southern Africa (COMESA), and East African Community (ESA), which serve Burundi, Kenya, Rwanda, Tanzania, and Uganda. There is also a cross boarder arrangement in which Algeria, Mauritania and Morocco can access Buna, a crossborder payment system supported by the Arab central banks, and spanning the Middle East, South Asia, and North Africa.

These overlaps can affect the ability of countries to achieve scale in the operation of IPS in terms of the functionality of the key instruments such as e-money, persontoperson (P2P) and person-to-business (P2B) use cases, and unstructured supplementary service data (USSD). The functionality of the systems have swiveled around these instruments, and they still hold the key to achieving inclusivity and meeting the payment needs of endusers.

Dr Mbamalu, a Jefferson Fellow, is an Editor, Publisher and Communications Consultant. Follow on X: @marcelmbamalu

Dr. Marcel Mbamalu is a distinguished communication scholar, journalist, and entrepreneur with three decades of experience in the media industry. He holds a Ph.D. in Mass Communication from the University of Nigeria, Nsukka, and serves as the publisher of Prime Business Africa, a renowned multimedia news platform catering to Nigeria and Africa's socio-economic needs.

Dr. Mbamalu's journalism career spans over two decades, during which he honed his skills at The Guardian Newspaper, rising to the position of senior editor. Notably, between 2018 and 2023, he collaborated with the World Health Organization (WHO) in Northeast Nigeria, training senior journalists on conflict reporting and health journalism.

Dr. Mbamalu's expertise has earned him international recognition. He was the sole African representative at the 2023 Jefferson Fellowship program, participating in a study tour of the United States and Asia (Japan and Hong Kong) on inclusion, income gaps, and migration issues.

In 2020, he was part of a global media team that covered the United States presidential election.

Dr. Mbamalu has attended prestigious media trainings, including the Bloomberg Financial Journalism Training and the Reuters/AfDB Training on "Effective Coverage of Infrastructural Development in Africa."

As a columnist for The Punch Newspaper, with insightful articles published in other prominent Nigerian dailies, including ThisDay, Leadership, The Sun, and The Guardian, Dr. Mbamalu regularly provides in-depth analysis on socio-political and economic issues.