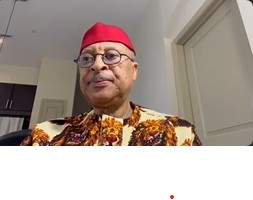

Presidential candidate of the Labour Party in the 2023 general election, Mr Peter Obi, has criticised the latest decision of the Nigerian government to impose a cybersecurity level on electronic transactions, saying it amounts to milking a dying economy.

The CBN had in a circular released on Monday, 6 May 2024, directed commercial banks, mobile money operators and other financial institutions to commence the deduction of 0.5 per cent value of every electronic transaction made by customers and remit to the National Cybersecurity Fund (NCF) which shall be administered by the Office of the National Security Adviser (ONSA).

Join our WhatsApp ChannelThe CBN said the levy is in compliance with the Cybercrimes (Prohibition, Prevention, etc.) Act 2015 and directed all commercial, and other financial institutions to begin implementation of the directive in the next two weeks from the date the circular was issued.

Reacting to that, Mr Obi in a statement on Wednesday said that imposing the cybersecurity levy which is another form of tax on Nigerians who are already suffering severe economic distress “is further proof that the government is more interested in milking a dying economy instead of nurturing it to recovery and growth.”

READ ALSO: 4 Electronic Transaction Levies Nigerians Pay As CBN Introduces Cybersecurity Levy

Obi argued that the levy amounts to multiple taxation on banking transactions as there are other existing taxes including stamp duties, adding that the policy runs contrary to the government’s avowed commitment to reducing the number of taxes and streamlining the tax system.

The former Anambra State governor pointed out that the tax (cybersecurity levy) is being imposed on the trading capital of businesses, not on their profit, and would, unfortunately, further erode whatever is left of their remaining capital, after the impact of the Naira devaluation and high inflation rate in the economy.

“It is inconceivable to expect the suffering citizens of Nigeria to separately fund all activities of the government. Policies such as this not only impoverish the citizens but make the country’s economic environment less competitive.”

He further asserted that given the current economic hardship, the government is expected to reduce taxes to curb inflation not introduce new ones.

“At a time when the government should be reducing taxes to curb inflation, the government is instead introducing new taxes. And when did the office of the NSA become a revenue-collecting centre? And why should that purely national security office receive returns on a specific tax as stated in the new cybersecurity law?” Obi queried.

READ ALSO: CBN’s Cybersecurity Levy Sparks Reactions From Nigerians

The Cybersecurity Levy has continued to generate reactions from Nigerians. Organised labour has also kicked against the policy saying it would create more burdens for Nigerians already facing other economic challenges.

In separate statements, the Nigeria Labour Congress (NLC) and the Trade Union Congress (TUC) said the levy threatens to exacerbate the financial strain of hardworking Nigerians. They said the levy discourages efforts at mainstreaming cashless policy which people are already keying into through increasing adoption of electronic channels for banking transactions.

The NLC stated that although there are some electronic transactions exempted from the levy including interbank transfers and loan transactions, “the broader impact on everyday transactions cannot be overlooked. Such deductions directly affect the disposable income of workers and further diminish the purchasing power of the common citizen.”

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Follow Us