The Senate’s approval to restructure the N22.7 trillion ways and means advances from the Central Bank of Nigeria (CBN) into bonds has sparked criticism from economic analyst and the Trade Union Congress of Nigeria (TUC).

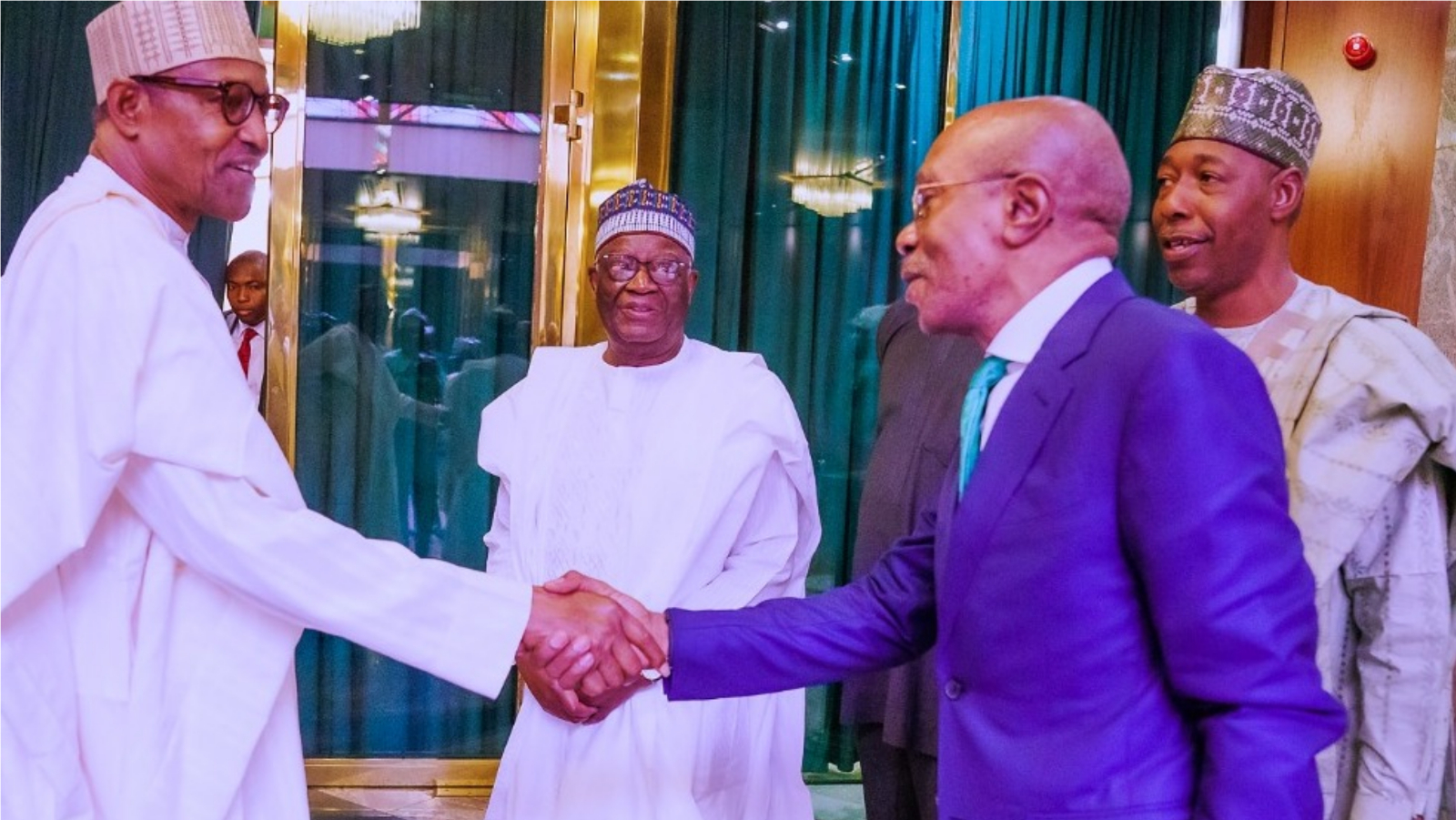

On Wednesday, 3 May, the Senate gave the approval, with the Senate Leader, Ibrahim Gobir, stating that the N22.7 trillion, which was obtained without legislative approval, was used for budget shortfalls to support projects.

Join our WhatsApp Channel“The monies received by the Federal Government were actually used for funding critical projects across the country.

“That due to the serious shortfall in Government Revenue, the Federal Government in order for the economy not to collapse, was compelled to borrow repeatedly from the CBN, exceeding the 5 per cent threshold of the prior year’s revenue as stipulated by the CBN Act, 2007.

“That the Federal Government through the Ministry of Finance, Budget, and National Planning has concluded plans to convert the CBN loans to tradable securities such as treasury bills and bond issuance,” Gobir said.

He said both the Federal Government and State Government accessed the funds that Prime Business Africa reported exceeded the five per cent threshold of FG’s annual revenue as stipulated by the CBN Act, 2007.

The CBN Act had stated that the ways and means advances (loans) should be a last resort for FG in case there is no alternative to borrowing funds. The loan obtained from the CBN shouldn’t be more than five per cent of the previous year’s annual revenue and should be repaid the next year.

However, FG has obtained more than five per cent and also failed to pay back as when due, leading to the loan hitting N22.7 trillion and compelling the government to request approval to restructure the loan to bonds, which will give FG more time (14 years) to pay back, at a nine per cent interest.

Last year, the Senate and House of Representatives had rejected the request, accusing the government of obtaining the ways and means advances without legislative approval.

Criticism trails approval of CBN’s N22.7 trillion ways and means advances to FG

Following the approval, the Senate has been under fire from Nigerians because there is not enough evidence to show the loan from the CBN was adequately utilised.

The N22.7 trillion loan increases Nigeria’s domestic and external debt to about N69 trillion from N46.25 trillion reported at the end of 31 December 2022.

Economic analyst, Kelvin, said the decision of the Senate is criminal and irresponsible: “The records I have seen from NBET as statutory grants to cover tariff shortfall from DISCO so far does not justify the claims that some part of ways and means was used to pay GENCOs,

“It is irresponsible and criminal to transfer 22.7trillion in CBN overdrafts to Nigerians,” he wrote on Twitter.

In a separate tweet, he said: “the Central Bank gave #15trn to the Federal Government as advances to cover budget deficits and fund direct intervention programs, that both the CBN & Ministry of Finance cannot account for today.

“Now Overdrafts attract annual interests of 21% and according to the 2023 budget, the FG is due to pay #4.2trn as interest on that 24.5trillion in loans, So what they’ve done with this is transfer the responbility of payment to Nigerians through a 40-Year government bond that attracts 9% interest per annum, with a grace period of 3-Years (moratorium) before they start paying interest.”

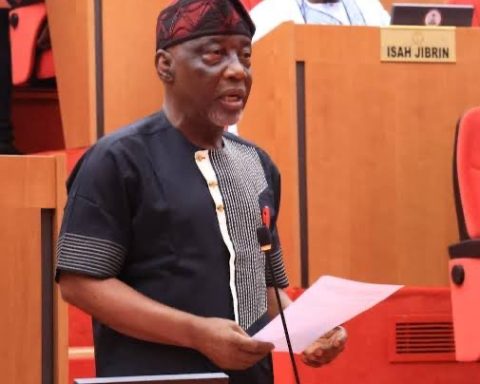

The TUC also condemned the Senate, with the union’s Secretary General, Nuhu Toro, describing the approval as ridiculous, because a new administration is coming in on 29 May 2023.

“It is ridiculous and creates room for suspicion. We don’t think this is necessary, especially on the eve of this administration’s departure. This leaves us with the question of whether governance is a continuous exercise or not,” Vanguard quoted Toro.