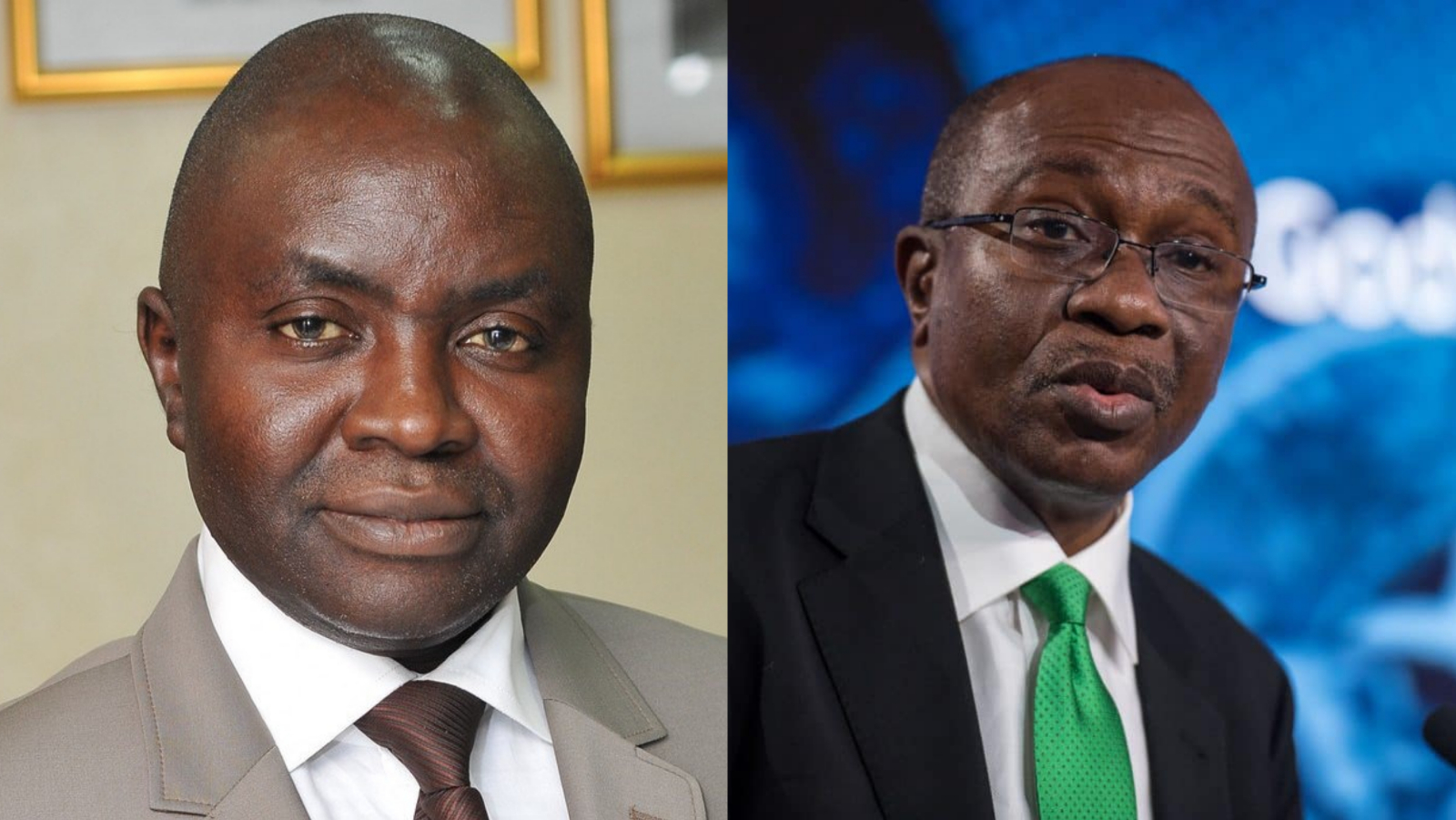

The founder of the Centre for the Promotion of Private Enterprise (CPPE), Muda Yusuf, has revealed that contrary to the statement of the Central Bank of Nigeria (CBN), cash is not supposed to be inside commercial banks.

Recall that the CBN Governor, Godwin Emefiele, had complained that 85 per cent of cash in circulation was outside the country’s banks’ vaults.

Join our WhatsApp ChannelAccording to the central bank head, about N2.7 billion out of N3.3 trillion cash in circulation is hoarded by Nigerians, and this is dangerous to the banking system.

In October 2022, he said this is one of the factors that motivated the apex bank to redesign the Naira notes in order to mop up the cash outside the bank.

However, Yusuf, on Monday, 30 January 2023, during a Twitter space organised by Prime Business Africa, disagreed with Emefiele’s assertion, stating that the currency is not meant to be sitting idle inside a bank’s vault, rather, it should be spread into the economy.

The economist said the cash Emefiele is bothered about is just five per cent of the total money supply, which he said was N52 trillion.

He said the CBN is painting the wrong picture on the impact of cash not being inside the bank, arguing that 95 per cent of the money is still within the banking system as money is not limited to just cash.

Yusuf cited the richest man in Africa, Aliko Dangote, stating he is worth billions, but where are the billions located? – inside the banking system.

According to him, Emefiele’s concern that cash is not inside the bank is like worrying that cash loaded into the Auto Teller Machines (ATM) are no longer inside the ATMs, or that bank chequebooks are no longer inside the banks.

He said the purpose of cash is to be taken from the bank to conduct business, but Nigerians are being punished by the CBN for doing the right thing.

Recall that in order to recover the N2.7 trillion, Emefiele said all old Naira notes will stop being legal tender by 31 January 2023 – giving just two months for Nigerians to swap the old banknotes for the new currencies of N200, N500 and N1,000 – before extending the deadline to 10 February 2023.

The short period to transition from old Naira notes to the redesigned banknotes has caused chaos in banks across Nigeria.

During the Twitter space, Yusuf said: “Then the CBN talked about monetary policy effectiveness. Cash as a percentage of money supply in the economy today is just about five per cent. Monetary policy effectiveness is about money supply, it is not about cash.

“If all the cash you have, the cash is just about N2.6 trillion, total money supply is N52 trillion as of December last year.

“So how much will you achieve in terms of materiality if you begin to flicker with only 5 per cent of money supply. And the reality from data is that 95 per cent of money is still within the banking system because it is not all money that is cash, but cash is part of money.”

The economist also stated that: “95 per cent of money is still in the banking system, so I don’t understand when they go about saying that 85 per cent of currency is outside the banking system.

“Total currency notes as a percentage of money supply is only five per cent, and cash is not meant to be inside the bank, cash is meant to be outside the bank.

“So, it’s not a bid deal that you have 85 per cent of your cash outside the system. This is an economic literacy issue. It is just like saying that 85 per cent of your ATM cards are outside the system, where are the ATM cash supposed to be?

“Is it not for people to do transactions? Or you say 85 per cent of your cheque books are outside the bank, are they supposed to be within the bank?

“So we should be about to interpret properly. So the impression that is being given is that 85 per cent of money is outside the banking system, that is not correct.

“95 per cent of money, that is talking of money supply, is within the banking system. Cash is only 5 per cent of money, so I need to correct that.”

Follow Us