The decision of the Central Bank of Nigeria (CBN) to increase the Monetary Policy Rate (MPR), which serves as a benchmark for commercial banks’ loan interest rates, has come under scrutiny.

On Tuesday, 21 March 2023, Prime Business Africa reported that the CBN raised the MPR by 50 basis points to 18 per cent, from the previous level of 17.5 per cent.

Join our WhatsApp ChannelThe raise came as a shock for some market analysts and economists who had expected that the central bank will hold the MPR at 17.5 per cent due to what the continuous increase in interest rate has caused in markets like the United States.

This publication previously reported that Silicon Valley Bank and Signature Bank collapsed in the U.S due to a hike in MPR, and fear of contagion in the global banking system has led to speculations that the Monetary Policy Committee (MPC) of the CBN will hold the rate to observe the current fear of a financial crisis.

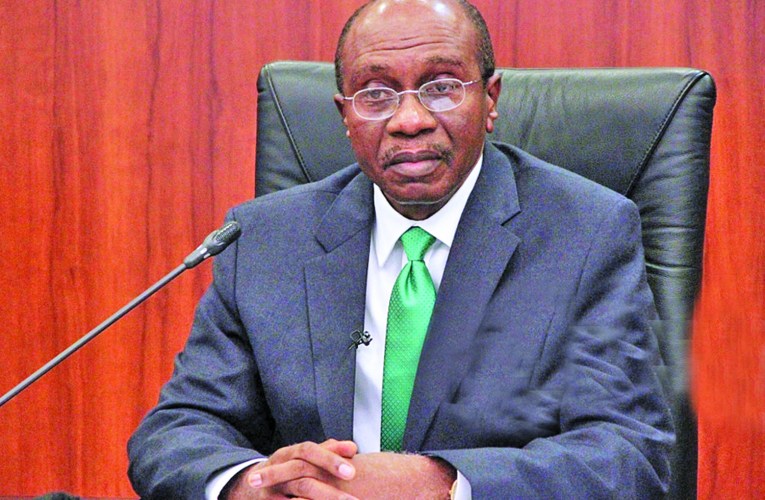

However, the Governor of the CBN, Godwin Emefiele, shocked many as he discloses the new interest rate that the CBN will lend to the banks.

Emefiele said pushing up the MPR for the sixth time will rein in inflation which soared to 21.91 per cent in February 2023, from 21.82 per cent the month before.

The decision of the MPC wasn’t well received by analysts and economists who said the CBN is using the wrong tool to tackle inflation.

Dr Muda Yusuf, the Chief Executive Officer, Centre for the Promotion of Private Enterprise (CPPE), who spoke to Prime Business Africa on Tuesday, during a Twitter space, said he was also expecting a hold: “I was expecting that we are going to have a hold on the rate, having regard MPR was already at a very high level of 17.5 per cent, and because our CRR is one of the highest in the world, 32.5 per cent.”

Victims of CBN’s MPR hike

Yusuf said the increase in MPR will result in a higher cost of credit for businesses, entrepreneurs and persons that have obtained loans before the announcement.

He explained that the rate hike will be an additional burden to Nigerians who are already facing some challenges that are negatively affecting their businesses.

“I thought that the CBN was going to hold, but here we are, that they further increased, and the immediate implication of this for businesses and entrepreneurs is that the cost of credit will go up.

“It is even more disturbing for those who are already indebted to the bank. You know, when you have taken a loan from the bank, it’s not easy to just work away anymore because you are already in the net.

“And because most of these loan terms are flexible, so once there is a review in MPR, what happens often is that the following day, within 24 hours, the banks should be writing to their debtors, reviewing interest rates upwards.

“You know what that means for businesses, especially when you situate it within the contest of the prevailing economic conditions, the cost of energy, forex (foreign exchange) issues, challenges with the ports and the customs, weakening purchasing power, uncertainty in the economy.

“You know, there’s a whole lot that many of these businesses are going through already. So this is an additional burden if you ask me, and it is even more disturbing for me because, there’s no proof that this hiking interest is actually helping to moderate inflation,” he said.

CBN using monetary tools to fight fiscal issues driving inflation

Yusuf said the majority of the factors driving inflation are outside the purview of the CBN, as they are more of fiscal issues than monetary concerns.

In his explanation, Yusuf stated: “I think the bigger factors driving inflation are outside what the CBN has been trying to do. The bigger factors are the cost of energy and factors of exchange rate depreciation and liquidity in the forex market.

“And of course, you have structural issues, security, like that that are affecting the supply side and affecting productivity. And these are fiscal policy issues.

“Another major issue which is within the purview of the CBN is the ways and means finances. The part of the challenges that you have with that are a lot of money still coming from the CBN to the Federal Government to finance deficits.

“So, these are the critical factors as far as I’m concerned. So the victims of these are actually the entrepreneurs, those in the real economy, either those willing to borrow or those who have already borrowed – those are the victims of this.”

He feared that the continuous rate hikes might affect banks and considering the cash reserve ratio (CRR) is 32.5 per cent, the capacity of the Deposit Money Banks (DMBs) to do business will be limited.

“The bank failure that we are seeing around the world now have been triggered by largely high-interest rate, which affected the quality of loan assets, which led to the run of some of these banks.

“So even abroad where we tend to take a cue from, people are (being) conscious in Europe and America that they need to moderate the rate at which they push, hike interest rate because of the larger implication of the financial system stability.

“The CBN governor alluded to that, but I don’t think he’s really, he was giving assurance, but nonetheless, we need to be extremely careful, especially when you already put CRR to 32.5 per cent. You have already squeezed the banks, and that is affecting their capacity to do business, it is affecting their capacity to play their role of financial intermediation,” he said.

Fiscal, not CBN’s monetary policy, can rein inflation?

An Investment Analyst at Zrock Investment Management, Carl Temiloluwa Macaulay, said it is not clear to him if the CBN really understands how inflation works in Nigeria.

Macaulay argued that when MPR is raised, economic theory says it will reduce money supply which will reduce inflation, “but that is not the case, because the way our markets are structured in Nigeria, MPR is not connected to the market the way it is connected in say the U.S. Europe,” he said.

The analyst stated that inflation is more of a supply-side issue, which means the CBN can do little or nothing about inflation, as it is in the jurisdiction of the President, minister of finance and other ministers, “These are things that needs to be fixed at a national level, not through monetary policy.”

“The benefit we are expecting to get from the hike are not likely to come. And on the flip side, the pain that you expect to receive from the hike of the MPR, we are likely to get,” Macaulay said.

On his own part, Daniel Olunloyo, an Economist and Fixed Income Analyst at Kosk Partners echoed Macaulay’s view, adding: “In my opinion, I think the CBN might not be able to curtail this (inflation) using the tool they are using at the moment, which is hiking interest rate.”

He asserted that during the COVID period, many governments pumped money into the economy through palliatives and other measures. This, coupled with the ongoing Russia-Ukraine crisis which has impacted and disrupted global wheat and oil trading, resulted in soaring inflation.

Olunloyo said trying to hike the MPR to fight the inflation caused by too much money pumped into the system and other factors, especially in Nigeria where inflation is imported, might not work.

“What can be done is probably more of a fiscal policy than just using CBN tools. The CRR is also high, and this is really affecting banks.

“What banks make their money on is based on interest. Banks are different from normal businesses, so when you are taking out 32.5 per cent as a kind of cash reserve ratio, that’s too much, and it is even impeding how far the economy can grow,” he told this publication.

Follow Us