The Central Bank of Nigeria (CBN) is reportedly planning to sell Polaris Bank at the cost of N40 billion to Auwal Lawan Abdullahi, a commercial farmer and the Sarkin Sudan of Gombe State.

Polaris Bank has been under the management of debt recovery agency, Asset Management Corporation of Nigeria (AMCON), since it was renamed from Skye Bank and nationalised in 2018.

Join our WhatsApp ChannelSkype Bank became bankrupt in 2016, and was unable to meet the recapitalisation requirements, leading to the intervention of the CBN. The top executives at the firm, Chairman, Tunde Ayeni; and the Managing Director, Timothy Oguntayo, were prosecuted for money laundering.

The Economic and Financial Crimes Commission (EFCC) had filed a N25.4 billion lawsuit against Ayeni and Oguntayo in 2019, but it was withdrawn in July 2022, after an alleged settlement that led to the forfeiture of cash and assets worth N15 billion.

Since the takeover of Skye Bank, now known as Polaris Bank, AMCON have been unable to sell the lender to new investors, with AMCON and CBN pumping about N848 billion of tax payers’ money as at December 2020 into the firm.

READ ALSO: Double Whammy In NDIC, AMCON Travesty For Banks

Reports, however say that an extra N350 billion has been invested into the commercial bank by the two government agencies in the last one and a half year. This means about 96% of the investment by AMCON will be lost if Polaris Bank is sold at N40 billion, when pegged at the N848 billion, and 97% loss based on the total sum of N1.2 trillion reportedly invested by the government agencies.

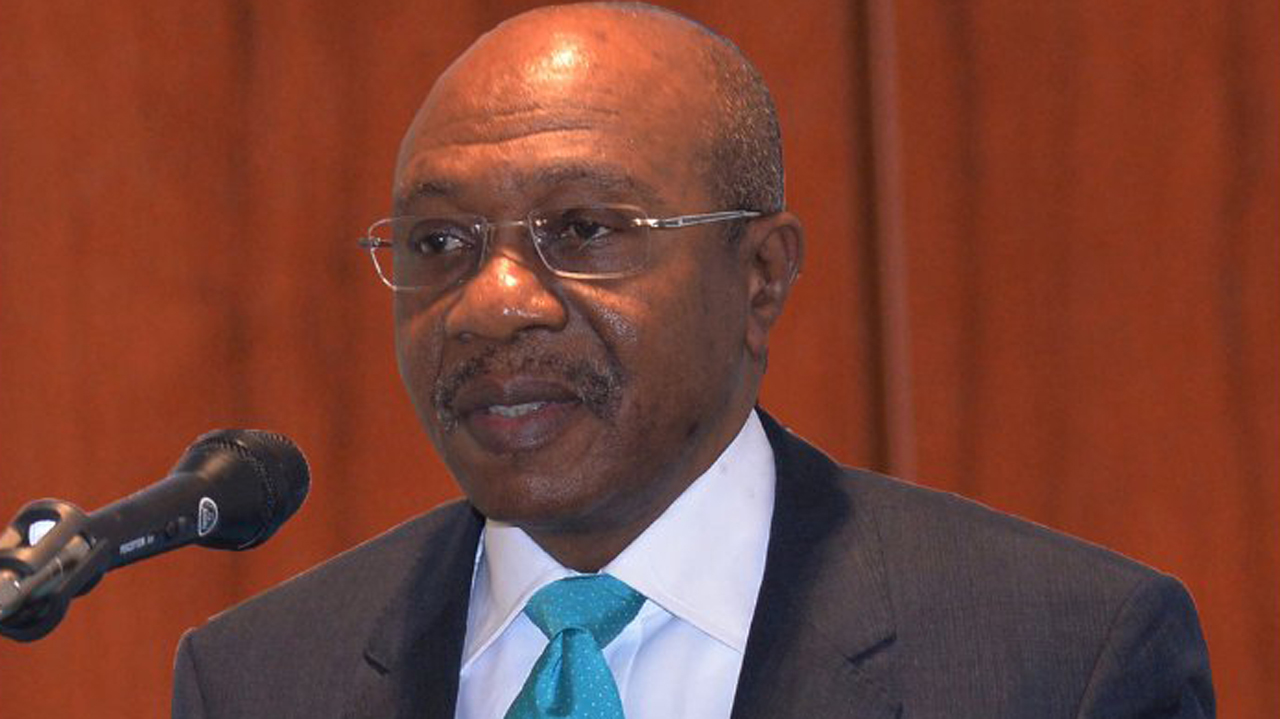

It was gathered that the governor of the Central Bank, Godwin Emefiele, is pushing for a prompt sell-off, and has received the backing of AMCON’s managing director and chief executive officer, Ahmed Kuru, Peoples Gazette alleged.

READ ALSO: Double Whammy In NDIC, AMCON Travesty For Banks

Prime Business Africa understands that before the sale of a company under AMCON, the entity must be publicly placed for sale. Efforts by this correspondent to confirm the impending sale proved abortive, as calls and email to AMCON were not immediately responded to.

Follow Us