The naira to dollar rate traded flat in the official market on Monday, as the value of foreign currency exchanged fell, nearing a low last recorded on April 4, 2022, while the Nigerian currency appreciated in the black market.

Report from the official market, which is the Investors & Exporters window, the naira stood at $421.33 to one dollar, mirroring the same rate both currencies traded in the previous session, last week Friday.

Join our WhatsApp ChannelAlthough, during trading, one dollar was sold for as high as N444/$1 due to rise in intra-day session, and at some point, traders were willing to let go of $1 for as low as N413/$1, before the value of the foreign legal tender settled at $421.33.

The stalemate was accompanied by a dip in volume of forex traded on Monday, as about $46.07 million were sold. This is the lowest in over two months on the Investors & Exporters window situated on the FMDQ Exchange.

The stability of the naira extended into the parallel market, as it depreciated to N606/$1, in contrast to the N607/$1 reported on Friday. The growth of the local currency shows demand of the United States greenback is slightly dwindling.

Meanwhile, Prime Business Africa understands that Nigeria’s external reserves grew slightly from $38.66 billion recorded on June 16, to $38.69 billion the next day. It reflects the country having more foreign exchange to spend for the importation of goods into Africa’s largest economy.

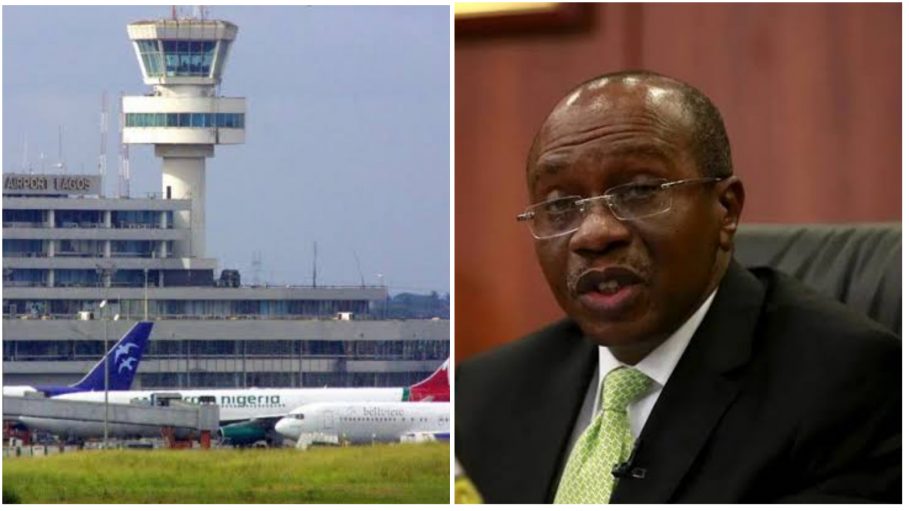

Recall that it was earlier reported that the Central Bank of Nigeria (CBN), had seized $450 million revenue of foreign airlines, in a bid to boost its foreign reserves, and meet rising demands from traders unable to finance the cost of forex in the black market.

The financial regulator had blocked the airlines from repatriating some of their earnings, as Nigeria is low on forex, at a period turnover from the oil industry is not at par with the demand level.