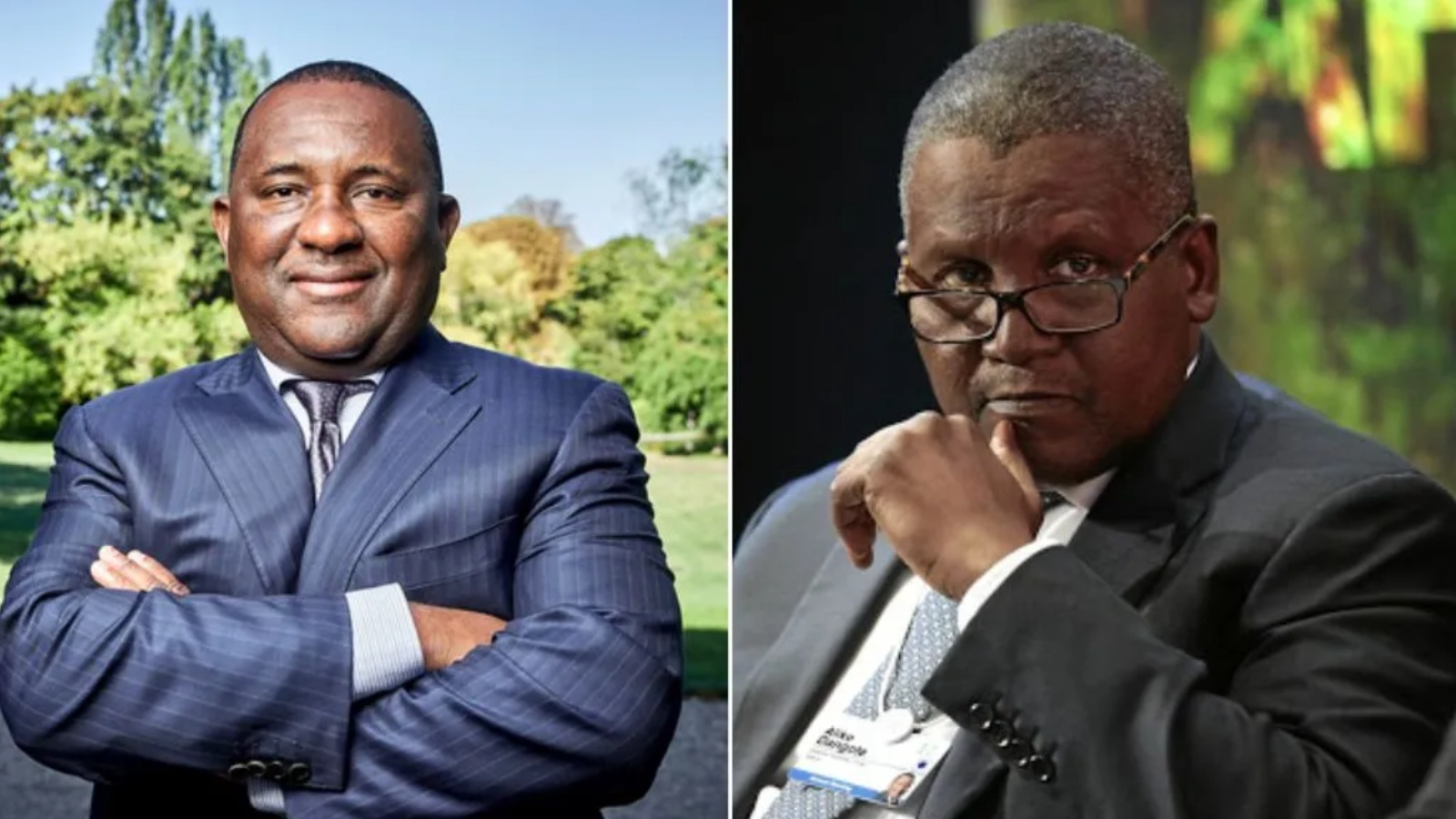

Africa’s richest man, Aliko Dangote, and Nigerian billionaire, Abdulsamad Rabiu, lost $5.85 billion from their total net worth on Thursday, as the naira devaluation bites the businessmen.

Dangote lost $3.12 billion and Rabiu’s fortune dropped by $2.73 billion, data obtained from Bloomberg Billionaire Index disclosed.

Join our WhatsApp ChannelAt the end of business hour on Thursday, Dangote’s wealth was estimated to have dropped from $20.92 billion on Wednesday, to $17.8 billion.

On the same day, Rabiu, the founder of BUA Cement and BUA Foods, suffered a significant decline in his net worth, which fell to $5.54 billion from $8.27 billion.

Both Dangote and Rabiu are the only Nigerian billionaires on the Bloomberg Billionaire Index at the time this report was filed.

What you need to know

Dangote is the founder of Dangote Group, a substantial investor in Dangote Cement and Dangote Sugar. The majority of the firm’s revenue-generating businesses are situated in Nigeria, likewise that of BUA Cement and BUA Foods.

As a result, Dangote and Rabiu’s fortunes took a hit, Prime Business Africa noted, as their companies’ turnover and market valuation are naira-driven.

Note that following the naira devaluation, the value of the naira fell by 40.7% in the official market, with the cost of one dollar rising by N192.37 kobo to N664.04/$1 on Wednesday.

The next day, the value of the naira further depreciated by N38.15 kobo, with authorised dealers selling the United States Dollar (USD) at the rate of N702.19/$1 at the close of Thursday’s trading.

Recall that the naira devaluation was approved on Wednesday as President Bola Tinubu took the step to unify the multiple exchange rates in Nigeria.

Meanwhile, aside from the naira devaluation affecting the wealth of billionaires in Nigeria, it is also expected to drop the Corporate tax collection, according to the Fiscal Policy Partner and Africa Tax Leader at PwC, Taiwo Oyedele.

“Corporate tax collection may however decline as many businesses crystallize forex losses due to the higher exchange rate,” he revealed, adding that there are benefits as well, “The country will attract fx inflows especially from portfolio investors, FDI and exporters proceeds. Impact on diaspora remittances would be marginal,” he said.

Follow Us