China Exim Bank, a government-owned bank which provides infrastructural capital for developing countries, rejected the Nigerian government’s request for a $22.79 billion loan.

Nigeria made the request after the National Assembly approved it in 2020 after the Federal Government submitted the 2016–2018 Federal Government External Borrowing (Rolling) Plan.

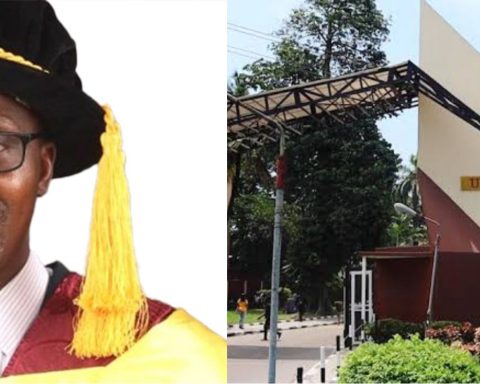

Join our WhatsApp ChannelAccording to a Punch report on Wednesday, 29 March 2023, the loan rejection was revealed by the Chairman of the House of Representatives Committee on Rules and Business, Abubakar Fulata, on Tuesday 28 March 2023, when he moved a motion titled ‘Rescission of the 2016–2018 Federal Government External Borrowing (Rolling) Plan.’

Fulata said the $22.79 trillion was meant for the financing of the Kaduna–Kano segment under the Nigerian Railway Modernisation Project.

He said the government is now in talks with another Chinese bank, China Development Bank, to obtain the funds, which have been reduced to N973.47 million.

“The House notes that the 2016–2018 Federal Government External Borrowing (Rolling) Plan was approved by the Senate and the House of Representatives on March 5, 2020, and June 2, 2020, respectively.

“The House recalls that the National Assembly approved the sum of $22,798,446,773 only under the 2016–2018 Medium Term External Borrowing (Rolling) plan.

“The House is aware of the communications from the Federal Ministry of Finance requesting approval of modifications to the financing proposal for the Nigerian Railway Modernisation Project (Kaduna–Kano segment) occasioned by the COVID–19 pandemic, whereof China Exim Bank withdrew its support to finance the project,” the lawmaker said.

Fulata further stated: “The House is also aware that to secure funds for the project, the contractor (CCECC Nigeria Limited), in collaboration with the Federal Ministry of Transportation, engaged China Development Bank as the new financier in the sum of $973,474,971.38 only.”

The request to obtain the new funding from China Development Bank was approved by the House. The terms of the commercial loan, which will be provided in Euro currency, state; the maturity is 15 years; the interest rate is put at 2.7 per cent + 6 months Euribor.

It was learnt that the commitment fee is 0.4 per cent, while the upfront fee is 0.5 per cent.

Follow Us